Page 66 - Stock Exchange Handbook 2020 - Issue 3

P. 66

JSE Sector Table Profile’s Stock Exchange Handbook: 2020 – Issue 3

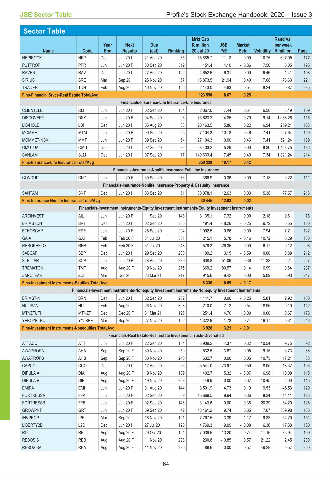

Sector Table

Mrkt Cap Rand Val

Year Next Due R million JSE Market per week

Name Code End Results (est) Ranking 20 Jul 20 P/E Beta Volatility R million Page

NEPIROCK NRP Dec Jun 20 I 21 Aug 20 35 55 885.7 11.18 0.00 10.75 607.95 177

PUTPROP PPR Jun Jun 20 F 30 Sep 20 312 151.4 4.10 - 0.36 7.56 0.05 195

RAVEN RAV Dec Jun 20 I 27 Aug 20 122 4 652.6 6.31 0.00 6.46 1.41 198

SIRIUS SRE Mar Sep 20 I 25 Nov 20 67 16 873.5 21.94 0.40 7.68 73.63 221

TRADEH TDH Feb Aug 20 I 16 Nov 20 166 2 143.0 4.63 0.54 8.24 0.87 235

Fins-Financial Srvcs-Real Estate Total/Avg 123 550 8.67 0.25

Financials-Insurance-Life Insurance-Life Insurance

CLIENTELE CLI Jun Jun 20 F 02 Sep 20 154 2 867.0 7.44 0.54 6.50 3.19 109

DISCOVERY DSY Jun Jun 20 F 04 Sep 20 26 73 623.2 14.85 0.79 9.14 1 038.26 116

LIB-HOLD LBH Dec Jun 20 I 05 Aug 20 63 20 463.5 5.86 0.22 6.94 259.21 158

MOMMET MTM Jun Jun 20 F 09 Sep 20 55 27 104.3 10.18 0.46 7.41 257.64 169

MOMMET-NSX MMT Jun Jun 20 F 09 Sep 20 54 27 104.3 0.00 0.46 7.41 521.24 169

OMUTUAL OMU Dec Jun 20 I 02 Sep 20 32 58 433.2 5.26 0.00 8.36 1 428.75 186

SANLAM SLM Dec Jun 20 I 07 Sep 20 17 140 633.4 17.45 0.49 7.34 1 821.24 214

Fins-Insurance-Life Insurance Total/Avg 350 229 10.17 0.42

Financials-Insurance-Nonlife Insurance-Full Line Insurance

CONDUIT CND Jun Jun 20 F 30 Sep 20 276 366.9 - 0.36 0.00 17.18 0.22 111

Financials-Insurance-Nonlife Insurance-Property & Casualty Insurance

SANTAM SNT Dec Jun 20 I 03 Sep 20 51 30 078.1 12.63 0.03 5.38 77.57 216

Fins-Insurance-Nonlife Insurance Total/Avg 30 445 12.63 0.02

Financials-Investment Instruments-Equity Investment Instruments-Equity Investment Instruments

ARCINVEST AIL Jun Jun 20 F 11 Sep 20 148 3 135.1 7.32 0.00 12.18 9.61 78

BRIMSTON BRT Dec Jun 20 I 02 Sep 20 306 191.4 - 8.26 - 0.25 9.72 0.55 100

ETHOSCAP EPE Jun Jun 20 F 28 Sep 20 204 1 092.5 10.86 0.00 7.94 7.21 122

GAIA GAI Feb Feb 20 F 31 Jul 20 301 215.1 5.78 - 0.46 10.72 0.29 130

RHBOPHELO RHB Feb Feb 20 F 31 Jul 20 243 579.3 26.35 0.00 6.17 0.12 208

SABCAP SBP Dec Jun 20 I 29 Sep 20 200 1 199.2 3.15 - 0.59 0.00 0.89 212

STELLAR SCP Jun Jun 20 F 28 Aug 20 239 638.8 - 51.09 - 0.36 11.33 6.24 227

TREMATON TMT Aug Aug 20 F 19 Nov 20 275 369.2 80.57 0.14 6.99 0.64 237

ZARCLEAR ZCL Mar Dec 20 I 23 Mar 21 217 915.6 - 9.42 0.00 5.09 5.93 247

Fins-Investment Instruments-Equities Total/Avg 8 336 10.69 - 0.17

Financials-Investment Instruments-Nonequity Investment Instruments-Nonequity Investment Instruments

BRIMST-N BRN Dec Jun 20 I 02 Sep 20 202 1 141.7 0.00 - 0.25 5.81 2.92 100

HULISANI HUL Feb Aug 20 I 26 Nov 20 303 210.0 - 7.12 - 0.54 18.96 0.10 142

MTNZFUTHI MTNZF Dec Dec 20 F 31 Mar 21 196 1 251.4 4.70 0.00 0.00 0.67 173

YEBOYETHU YYLBEE Mar Sep 20 I 27 Nov 20 192 1 322.9 1.73 0.74 16.17 0.31 246

Fins-Investment Instruments-Nonequities Total/Avg 3 926 3.21 - 0.01

Financials-Real Estate-Real Estate Investment Trusts-Diversified

ATTACQ ATT Jun Jun 20 F 22 Sep 20 134 3 909.2 4.37 0.32 10.54 59.75 92

AWAPROPA AHA Sep Sep 20 F 30 Nov 20 250 532.5 - 13.67 0.05 9.15 3.73 88

AWAPROPB AHB Sep Sep 20 F 30 Nov 20 240 632.7 0.00 0.05 10.75 17.21 88

CAPCO CCO Dec Jun 20 I 12 Aug 20 56 25 541.0 - 73.97 0.59 8.05 218.37 103

DIPULA A DIA Aug Aug 20 F 19 Nov 20 189 1 402.7 5.32 - 0.07 6.98 10.09 115

DIPULA B DIB Aug Aug 20 F 19 Nov 20 258 449.9 0.00 - 0.07 10.45 2.00 115

EMIRA EMI Jun Jun 20 F 31 Aug 20 144 3 501.9 4.73 0.19 9.53 45.53 120

FORTRESSA FFA Jun Jun 20 F 02 Sep 20 69 15 669.5 9.64 0.36 8.34 311.11 128

FORTRESSB FFB Jun Jun 20 F 02 Sep 20 146 3 143.6 0.00 0.36 20.39 84.29 128

GROWPNT GRT Jun Jun 20 F 09 Sep 20 42 43 161.2 9.74 0.35 7.07 889.98 135

INVPROP IPF Mar Sep 20 I 16 Nov 20 101 7 767.5 3.39 1.17 9.33 54.20 151

LIBERTY2D L2D Dec Jun 20 I 27 Jul 20 120 4 769.3 9.09 - 0.08 6.36 17.33 160

RDI RPL Aug Aug 20 F 29 Oct 20 104 7 039.6 13.20 0.74 11.16 35.94 199

REBOSIS REB Aug Aug 20 F 11 Nov 20 298 230.8 - 0.85 0.57 21.22 2.45 200

REBOSISA REA Aug Aug 20 F 11 Nov 20 326 88.6 0.00 0.57 49.28 0.57 200

64