Page 106 - Stock Exchange Handbook 2020 - Issue 3

P. 106

JSE – CAP Profile’s Stock Exchange Handbook: 2020 – Issue 3

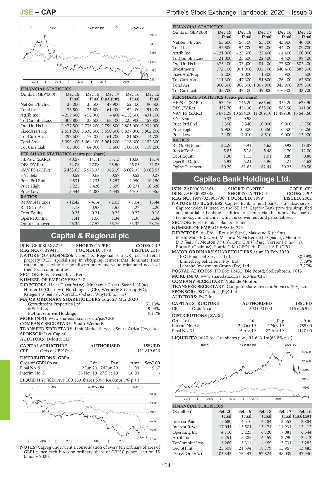

FINA 40 Week MA CAPCO FINANCIAL STATISTICS

(Amts in GBP’000)

10348 Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

Final Final Final Final Final

NetRent/InvInc 53 600 56 100 55 700 43 800 40 800

8857

Total Inc 52 500 54 700 57 200 44 200 109 700

7365 Attrib Inc - 121 000 - 25 600 22 400 - 4 400 100 000

TotCompIncLoss - 121 000 - 25 600 22 400 - 4 400 98 400

5874

Ord UntHs Int 375 100 433 000 481 400 477 600 503 200

Investments 772 100 901 000 932 700 840 400 883 300

4382

FixedAss/Prop 2 200 2 000 1 800 900 600

2891 Tot Curr Ass 111 300 47 300 51 800 76 400 63 600

2015 | 2016 | 2017 | 2018 | 2019 |

Total Ass 900 300 966 800 1 007 900 945 900 979 300

FINANCIAL STATISTICS Tot Curr Liab 35 700 37 100 39 000 376 300 33 700

(Amts in GBP’000) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

PER SHARE STATISTICS (cents per share)

Final Final Final(rst) Final Final

NetRent/InvInc 36 000 35 500 48 900 52 100 90 500 HEPS-C (ZARc) 534.76 746.20 685.60 359.20 623.90

Total Inc 36 500 35 800 61 400 52 400 91 200 DPS (ZARc) 432.70 454.30 638.00 588.50 341.90

Attrib Inc - 253 600 - 56 900 - 400 - 118 600 431 100 NAV PS (ZARc) 6 671.28 10 584.00 11 209.10 11 489.30 16 545.60

TotCompIncLoss - 307 800 - 123 600 - 63 100 - 225 900 457 800 3 Yr Beta 0.33 0.58 - - -

Ord UntHs Int 2 477 500 2 736 200 2 799 800 2 805 000 2 934 000 Price Prd End 5 350 5 540 10 000 9 000 15 750

FixedAss/Prop 2 551 200 3 338 600 3 650 300 3 827 000 3 862 200 Price High 9 900 10 800 10 850 16 500 16 250

Tot Curr Ass 292 500 79 200 61 700 81 600 114 700 Price Low 2 480 4 010 8 510 9 000 13 900

Total Ass 3 099 400 3 664 100 3 961 200 4 118 600 4 152 300 RATIOS

Tot Curr Liab 63 000 64 000 73 600 100 100 119 200 RetOnSH Funds - 32.26 - 5.91 4.65 - 0.92 19.87

RetOnTotAss 5.83 5.18 5.48 4.70 12.00

Debt:Equity 1.30 1.15 1.01 0.89 0.88

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 40.57 - 14.11 53.13 - 10.00 18.74 OperRetOnInv 6.92 6.21 5.96 5.21 4.62

DPS (ZARc) 32.08 27.88 25.50 26.85 31.85 OpInc:Turnover 60.29 61.65 62.44 50.23 50.56

NAV PS (ZARc) 5 433.62 5 973.33 365.19 5 602.35 8 008.53

3 Yr Beta 0.59 0.68 0.57 0.52 0.27

Price Prd End 4 831 4 235 5 257 4 950 10 250 Capitec Bank Holdings Ltd.

Price High 5 225 5 420 5 699 10 271 10 620 ISIN: ZAE000035861 SHORT: CAPITEC CODE: CPI

CAP

Price Low 3 344 4 088 4 342 4 510 6 355

ISIN: ZAE000083838 SHORT: CAPITEC-P CODE: CPIP

REG NO: 1999/025903/06 FOUNDED: 1999 LISTED: 2002

RATIOS

RetOnSH Funds - 12.42 - 4.14 - 2.03 - 7.04 13.44 NATURE OF BUSINESS: Capitec Bank, a retail bank, is a subsidiary of

RetOnTotAss 1.18 0.98 1.55 1.27 2.20 Capitec which is listed on the JSE Ltd. Capitec Bank provides simplified

Debt:Equity 0.23 0.21 0.25 0.27 0.18 and affordable banking facilities to clients via the innovative use of

OperRetOnInv 1.41 1.06 1.34 1.36 2.34 technology in a manner which is convenient and personalised.

OpInc:Turnover 45.34 47.52 55.76 55.37 78.76 SECTOR: Fins—Banks—Banks—Banks

NUMBER OF EMPLOYEES: 13 774

DIRECTORS: du Pré le RouxMS(ne), Makwane K (ind ne),

Capital & Regional plc Mashilwane E (ind ne), Mashiya N, McKenzieJD(ind ne), Meintjes

CAP DP(ind ne), MoutonPJ(ne), OttoCA(ind ne), VersterJP(ind ne),

ISIN: GB00BL6XZ716 SHORT: CAPREG CODE: CRP Botha S (Chair, ne), Fourie G M (CEO), du Plessis A P (CFO)

REG NO: 01399411 FOUNDED: 1978 LISTED: 2015

NATURE OF BUSINESS: Capital & Regional is a UK focused retail MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 30.69%

PSG Financial Services Ltd.

property REIT specialising in shopping centres that dominate their Limietberg Sekuriteit (Pty) Ltd. 7.39%

catchment, serving the nondiscretionary and value orientated needs of Lebashe Investment Group (Pty) Ltd. 7.27%

their local communities. POSTAL ADDRESS: PO Box 12451, Die Boord, Stellenbosch, 7613

SECTOR: Fins—Rest—Inv—Ret MORE INFO: www.sharedata.co.za/sdo/jse/CPI

NUMBER OF EMPLOYEES: 248 COMPANY SECRETARY: Yolandé Mouton

DIRECTORS: Hales T (snr ind ne), Muchanya G (ne), SasseLN(ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Hunter D (Chair, ne), Hutchings L (CE), Wetherly S (Group FD), SPONSOR: PSG Capital (Pty) Ltd.

KriegerIS(ind ne), Norval L (ind ne), Whyte L (ind ne)

AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020

Growthpoint Properties Ltd. 51.13% CAPITAL STRUCTURE AUTHORISED ISSUED

MStead Ltd. 9.94% CPI Ords 1c ea 500 000 000 115 626 991

PDI Investment Holdings 9.11%

MORE INFO: www.sharedata.co.za/sdo/jse/CRP DISTRIBUTIONS [ZARc]

Pay

Amt

Ldt

COMPANY SECRETARY: Stuart Wetherly Ords 1c ea 29 Oct 19 4 Nov 19 755.00

Interim No 32

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Final No 31 15 Apr 19 23 Apr 19 1120.00

SPONSOR: Java Capital

AUDITORS: Deloitte LLP LIQUIDITY: Jul20 Ave 1m shares p.w., R1 643.1m(63.8% p.a.)

BANK 40 Week MA CAPITEC

CAPITAL STRUCTURE AUTHORISED ISSUED

CRP Ords of GBP10p ea - 111 819 626 145500

DISTRIBUTIONS [GBPp]

120550

Ords of GBP10p ea Ldt Pay Amt Scr/100

Final No 9 2 Jun 20 24 Jun 20 11.00 9.67

95599

Interim No 8 26 Nov 19 27 Dec 19 10.00 -

LIQUIDITY: Jul20 Ave 100 169 shares p.w., R4.0m(4.7% p.a.) 70649

SAPY 40 Week MA CAPREG 45699

16300

20748

2015 | 2016 | 2017 | 2018 | 2019 |

13385

FINANCIAL STATISTICS

10470 (R million) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final Final Final Final(rst)

7555 Interest Paid 5 680 4 510 4 184 3 552 2 884

Interest Rcvd 17 041 15 501 15 474 14 934 13 412

4640

Operating Inc 4 710 5 223 6 720 7 081 6 544

Attrib Inc 6 251 5 285 4 459 3 790 3 213

1725

| 2016 | 2017 | 2018 | 2019 |

TotCompIncLoss 6 260 5 314 4 459 3 731 3 285

NOTES: Capreg underwent a consolidation of every ten ordinary Shares of Ord SH Int 25 508 21 594 18 779 15 967 13 485

GBP1 pence each into one ordinary share of GBP10 pence each on 15 Dep & OtherAcc 103 343 76 443 57 824 48 039 47 940

January 2020.

104