Page 89 - SHBe20.vp

P. 89

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – ALP

CAPITAL STRUCTURE AUTHORISED ISSUED

Alphamin Resources Corp. AVV Ords 1c ea 300 000 000 143 421 787

ALP

ISIN: MU0456S00006 SHORT: ALPHAMIN CODE: APH DISTRIBUTIONS [ZARc]

REG NO: C125884 C1/GBL FOUNDED: 1981 LISTED: 2017 Ords 1c ea Ldt Pay Amt

NATURE OF BUSINESS: Alphamin, a Mauritian-domiciled company, is a Final No 13 12 Nov 19 18 Nov 19 30.00

pioneering tin exploration and development company with the vision to be Final No 12 13 Nov 18 19 Nov 18 27.00

a key player in the international tin mining sector. The company holds, as LIQUIDITY: Apr20 Ave 721 343 shares p.w., R10.4m(26.2% p.a.)

its principal investment, a controlling interest (80.75%) in Alphamin Bisie

Mining SA (“ABM”). ABM owns, as its principal asset, a world-class tin TECH 40 Week MA ALVIVA

mining project (“Bisie tin project”) which is based in the North Kivu

province of the Democratic Republic of Congo (“DRC”). 2251

SECTOR: AltX

1893

NUMBER OF EMPLOYEES: 0

DIRECTORS: BaloyiPC(ind ne), Jones B (ind ne), Kamstra B, 1535

Pretorius R (ind ne), NeedhamCDS (Chair, ne), Smith M (CEO),

O’Driscoll E (CFO) 1176

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=APH

COMPANY SECRETARY: Adansonia Management Services Ltd. 818

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 460

DESIGNATED ADVISOR: Nedbank Ltd. 2015 | 2016 | 2017 | 2018 | 2019 |

AUDITORS: PwC Inc. NOTES: Pinnacle HoldingsLtd. renamed to Alviva HoldingsLtd. on8 March

2017.

CAPITAL STRUCTURE AUTHORISED ISSUED

APH Ords no par value - 866 033 993 FINANCIAL STATISTICS

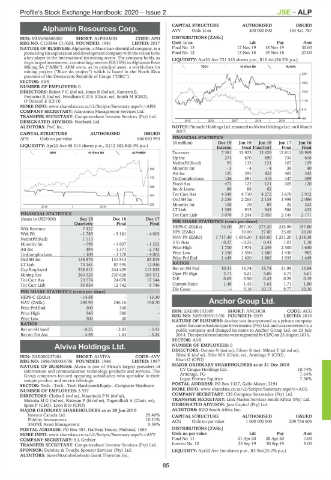

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

LIQUIDITY: Apr20 Ave 68 314 shares p.w., R212 382.8(0.4% p.a.)

Interim Final Final(rst) Final Final

MINI 40 Week MA ALPHAMIN Turnover 7 381 15 923 13 629 12 811 10 969

Op Inc 274 670 690 734 616

NetIntPd(Rcvd) 95 133 121 107 109

556 Minority Int - 3 - 4 - 4 39 40

Att Inc 125 395 422 405 342

472 TotCompIncLoss 126 391 418 447 389

Fixed Ass 472 122 121 105 120

388

Inv & Loans 80 88 62 - -

304 Tot Curr Ass 4 549 4 710 4 272 3 670 3 912

Ord SH Int 2 256 2 265 2 138 1 998 2 086

220 Minority Int 108 70 89 22 323

2018 | 2019 |

LT Liab 1 389 915 943 586 433

FINANCIAL STATISTICS Tot Curr Liab 3 078 3 244 2 656 2 144 2 171

(Amts in USD’000) Sep 19 Dec 18 Dec 17 PER SHARE STATISTICS (cents per share)

Quarterly Final Final

Wrk Revenue 7 427 - - HEPS-C (ZARc) 94.00 297.10 273.20 243.90 197.80

Wrk Pft - 1 785 - 3 181 - 4 005 DPS (ZARc) - 30.00 27.00 25.00 20.00

NetIntPd(Rcd) 1 513 - - NAV PS (ZARc) 1 717.40 1 658.20 1 453.60 1 251.20 1 218.38

Minority Int - 598 - 1 807 - 1 262 3 Yr Beta - 0.27 - 0.25 0.41 1.01 1.18

Att Inc 494 - 1 371 - 2 743 Price High 1 700 1 974 2 249 2 300 1 630

TotCompIncLoss - 104 - 3 178 - 4 005 Price Low 1 350 1 550 1 600 1 430 982

Ord SH Int 135 876 131 913 83 819 Price Prd End 1 449 1 620 1 800 1 935 1 449

LT Liab 75 161 87 595 12 046 RATIOS

Cap Employed 238 811 244 429 113 835 Ret on SH Fnd 10.31 16.74 18.74 21.98 15.84

Mining Ass 263 526 230 626 103 572 Oper Pft Mgn 3.71 4.21 5.06 5.73 5.61

Tot Curr Ass 23 574 24 078 17 344 D:E 0.65 0.50 0.43 0.29 0.19

Tot Curr Liab 50 854 12 742 9 746 Current Ratio 1.48 1.45 1.61 1.71 1.80

Div Cover - 9.18 10.13 9.77 10.36

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 14.68 - - 13.30

NAV (ZARc) 245.90 246.16 198.70 Anchor Group Ltd.

Price Prd End 300 340 - ANC

CODE: ACG

Price High 345 380 - ISIN: ZAE000193389 SHORT: ANCHOR LISTED: 2014

REG NO: 2009/005413/06 FOUNDED: 2009

Price Low 300 20 - NATURE OF BUSINESS: Anchor was incorporated as a private company

RATIOS under the name Andotorque Investments(Pty) Ltd. and was converted to a

Ret on SH fund - 0.25 - 2.03 - 3.93 public company and changed its name to Anchor Group Ltd. on 23 July

Ret on Tot Ass - 4.55 - 1.24 - 3.24 2014. ThespecialresolutionswereregisteredbyCIPCon25August2014.

SECTOR: AltX

Alviva Holdings Ltd. NUMBER OF EMPLOYEES: 0

DIRECTORS: Dennis N (ind ne), Fihrer R (ne), Mhlari T (ld ind ne),

ALV

ISIN: ZAE000227484 SHORT: ALVIVA CODE: AVV Sibisi K (ind ne), Teke M S (Chair, ne), Armitage P (CEO),

REG NO: 1986/000334/06 FOUNDED: 1986 LISTED: 1987 Khan O (CFO)

NATURE OF BUSINESS: Alviva is one of Africa’s largest providers of MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

information and communication technology products and services. The CV Cinque Holdings Ltd. 10.74%

Group comprises focused operating subsidiaries who specialise in their Armitage, PG 7.64%

unique product and service offerings. Legae Peresec Equities 7.38%

SECTOR: Tech—Tech—Tech Hardware&Equip—Computer Hardware POSTAL ADDRESS: PO Box 1337, Gallo Manor, 2191

NUMBER OF EMPLOYEES: 3 597 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ACG

DIRECTORS: Chaba S (ind ne), MasemolaPN(ind ne), COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

MokokaMG(ind ne), Natesan P (ld ind ne), Tugendhaft A (Chair, ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Spies P (CEO), Lyon R D (CFO) DESIGNATED ADVISOR: Java Capital (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 AUDITORS: BDO South Africa Inc.

Invesco Canada Ltd. 29.40% CAPITAL STRUCTURE AUTHORISED ISSUED

Fidelity Investments 10.21% ACG Ords no par value 1 000 000 000 209 756 605

36ONE Asset Management 5.39%

POSTAL ADDRESS: PO Box 483, Halfway House, Midrand, 1685 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AVV Ords no par value Ldt Pay Amt

COMPANY SECRETARY: S L Grobler Final No 11 21 Apr 20 28 Apr 20 7.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 10 23 Sep 19 30 Sep 19 9.00

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. LIQUIDITY: Apr20 Ave 1m shares p.w., R3.9m(25.0% p.a.)

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

85