Page 94 - SHBe20.vp

P. 94

JSE – ARG Profile’s Stock Exchange Handbook: 2020 – Issue 2

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ACZ

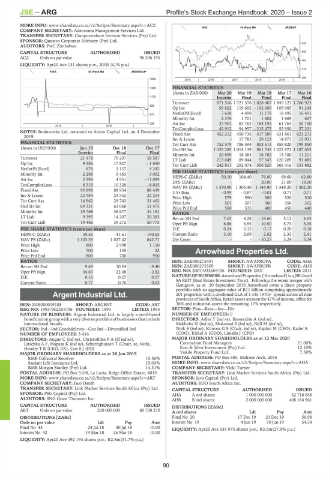

IIND 40 Week MA ARGENT

COMPANY SECRETARY: Adansonia Management Services Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

AUDITORS: PwC Zimbabwe 635

CAPITAL STRUCTURE AUTHORISED ISSUED 550

ACZ Ords no par value - 96 306 195

464

LIQUIDITY: Apr20 Ave 131 shares p.w., R935.3(-% p.a.)

378

FINA 40 Week MA ARDENCAP

292

1800 2015 | 2016 | 2017 | 2018 | 2019 |

1485 FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

1170 Interim Final Final Final Final

Turnover 871 516 1 721 578 1 828 407 1 849 127 1 706 923

856

Op Inc 59 822 119 692 - 192 069 105 985 91 245

NetIntPd(Rcvd) 7 618 4 498 11 178 18 495 16 491

541

Minority Int 2 376 1 701 1 602 1 669 637

226 Att Inc 37 901 83 763 - 184 192 61 764 55 100

2018 | 2019 |

TotCompIncLoss 42 912 94 957 - 215 475 55 950 57 231

NOTES: Brainworks Ltd. renamed to Arden Capital Ltd. on 4 December Fixed Ass 452 212 450 736 417 589 631 861 621 273

2019.

Inv & Loans - 17 785 29 123 14 971 15 931

FINANCIAL STATISTICS Tot Curr Ass 752 579 786 594 803 613 858 820 799 850

(Amts in USD’000) Jun 19 Dec 18 Dec 17 Ord SH Int 1 035 285 1 014 139 961 745 1 222 972 1 187 652

Interim Final Final Minority Int 20 859 18 483 16 782 15 180 11 211

Turnover 21 478 79 297 58 587 LT Liab 213 049 89 044 57 345 120 209 91 885

Op Inc 9 586 17 827 - 1 650 Tot Curr Liab 242 811 292 074 306 820 368 416 331 882

NetIntPd(Rcvd) 876 3 157 4 242

Minority Int 2 288 5 463 3 052 PER SHARE STATISTICS (cents per share) 76.80 69.60 62.80

HEPS-C (ZARc)

50.10

104.40

Att Inc 2 998 4 951 - 11 099

-

21.00

18.00

20.00

-

TotCompIncLoss 8 315 10 328 - 8 015 DPS (ZARc) 1 370.90 1 305.40 1 144.90 1 349.20 1 302.20

NAV PS (ZARc)

Fixed Ass 90 898 88 954 88 439

3 Yr Beta - 0.99 - 0.87 - 0.01 0.71 0.71

Inv & Loans 22 984 23 552 22 254 Price High 579 590 500 520 510

Tot Curr Ass 14 962 29 742 31 462 Price Low 501 307 360 356 302

Ord SH Int 69 331 63 068 51 475 Price Prd End 560 535 400 450 440

Minority Int 39 768 38 677 34 151 RATIOS

LT Liab 9 395 14 207 20 383 Ret on SH Fnd 7.63 8.28 - 18.66 5.12 4.65

Tot Curr Liab 19 466 39 272 50 775 Oper Pft Mgn 6.86 6.95 - 10.50 5.73 5.35

PER SHARE STATISTICS (cents per share) D:E 0.24 0.15 0.17 0.20 0.18

HEPS-C (ZARc) 59.36 - 41.61 - 190.55 Current Ratio 3.10 2.69 2.62 2.33 2.41

NAV PS (ZARc) 1 103.39 1 027.42 842.71 Div Cover - - - 10.27 3.24 3.34

Price High 800 2 998 1 150

Price Low 700 135 22 Arrowhead Properties Ltd.

Price Prd End 800 700 950

ARR

RATIOS ISIN: ZAE000275491 SHORT: AWAPROPA CODE: AHA

Ret on SH Fnd 9.69 10.24 - 9.40 ISIN: ZAE000275509 SHORT: AWAPROPB CODE: AHB

Oper Pft Mgn 44.63 22.48 - 2.82 REG NO: 2007/032604/06 FOUNDED: 2007 LISTED: 2011

D:E 0.16 0.27 0.57 NATURE OF BUSINESS: Arrowhead Properties (‘Arrowhead’) is a JSE-listed

Current Ratio 0.77 0.76 0.62 SA REIT (Real Estate Investment Trust). Following the recent merger with

Gemgrow, as at 30 September 2019 Arrowhead owns a direct property

portfolio with an aggregate value of R11 billion comprising approximately

Argent Industrial Ltd. 201 properties with a combined GLA of 1 335 197m² spread across all nine

provinces of South Africa. Retail assets account for 47% of income, office for

ARG

ISIN: ZAE000019188 SHORT: ARGENT CODE: ART 36% and industrial assets the remaining 17% respectively.

REG NO: 1993/002054/06 FOUNDED: 1994 LISTED: 1994 SECTOR: Fins—Rest—Inv—Div

NATURE OF BUSINESS: Argent Industrial Ltd. is largely a steel-based NUMBER OF EMPLOYEES: 0

beneficiation group with a very diverse portfolio of businesses that include DIRECTORS: Adler T (ind ne), Basserabie A (ind ne),

international brands. Makhoba N (ind ne), Mokorosi S (ind ne), Nell M (ind ne),

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind Noik S (ind ne), Kinross G S (Chair, ind ne), Kaplan M (CEO), Kader R

NUMBER OF EMPLOYEES: 3 416 (COO), Kirkel A (COO), Limalia J (CFO)

DIRECTORS: Angus C (ind ne), ChristofidesPA(ld ind ne), MAJOR ORDINARY SHAREHOLDERS as at 12 Mar 2020

Litschka A F, Mapasa K (ind ne), Scharrighuisen T (Chair, ne, Neth), Coronation Fund Managers 21.00%

Hendry T R (CEO, UK), Cox S J (FD) East & West Investment (Pty) Ltd. 12.10%

MAJOR ORDINARY SHAREHOLDERS as at 26 Jun 2019 Vukile Property Fund Ltd. 7.50%

RMB Collateral Receiver 15.56% POSTAL ADDRESS: PO Box 685, Melrose Arch, 2076

Sanlam Life Insurance Ltd. 15.03% MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AHA

RMB Morgan Stanley (Pty) Ltd. 14.31% COMPANY SECRETARY: Vicki Turner

POSTAL ADDRESS: PO Box 5108, La Lucia, Ridge Office Estate, 4019 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ART SPONSOR: Java Capital (Pty) Ltd.

COMPANY SECRETARY: Jaco Dauth AUDITORS: BDO South Africa Inc.

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: PSG Capital (Pty) Ltd. AHA A ord shares 1 000 000 000 62 718 658

AUDITORS: SNG Grant Thornton Inc. AHB B ord shares 2 000 000 000 408 184 961

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ART Ords no par value 200 000 000 80 708 270 A ord shares Ldt Pay Amt

DISTRIBUTIONS [ZARc] Final No 20 17 Dec 19 23 Dec 19 56.98

Ords no par value Ldt Pay Amt Interim No 19 4 Jun 19 10 Jun 19 54.54

Final No 43 24 Jul 18 30 Jul 18 10.00 LIQUIDITY: Apr20 Ave 335 975 shares p.w., R3.5m(27.9% p.a.)

Interim No 42 19 Mar 18 26 Mar 18 10.00

LIQUIDITY: Apr20 Ave 492 194 shares p.w., R2.8m(31.7% p.a.)

90