Page 85 - SHBe20.vp

P. 85

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – AFR

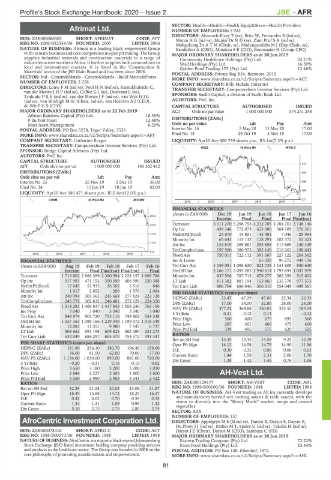

SECTOR: Health—Health—Health Equip&Srvcs—Health Providers

Afrimat Ltd. NUMBER OF EMPLOYEES: 5 923

AFR DIRECTORS: Alsworth-Elvey T (ne), Britz W, Fernandes B (ind ne),

ISIN: ZAE000086302 SHORT: AFRIMAT CODE: AFT MotauHG(ind ne), Munisi DrND(ne), Zinn ProfSA(ind ne),

REG NO: 2006/022534/06 FOUNDED: 2005 LISTED: 2006 Mokgokong DrATM (Chair, ne), Madungandaba M J (Dep Chair, ne),

NATURE OF BUSINESS: Afrimat is a leading black empowered Group Banderker A (CEO), Mmakau S E (CIO), Boonzaaier H (Group CFO)

with its main business andcore competence in open pit mining. The Group MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

supplies industrial minerals and construction materials to a range of Community Healthcare Holdings (Pty) Ltd. 22.21%

industries across southern Africa. It further supplies bulk commodities to Wad Holdings (Pty) Ltd. 16.39%

local and international markets. It is listed in the ‘Construction & Golden Pond Trading 175 (Pty) Ltd. 12.46%

Materials’ sector of the JSE Main Board and has been since 2006. POSTAL ADDRESS: Private Bag X34, Benmore, 2010

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ACT

NUMBER OF EMPLOYEES: 2 258 COMPANY SECRETARY: Billy Mokale (Interim)

DIRECTORS: LouwFM(ind ne), PoolHN(ind ne), Ramukhubathi C, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

van der MerweJHP(ind ne), CoffeeGJ(ne), Dotwana L (ne), SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

TsukuduPRE(ind ne), van der MerweJF(ind ne), van WykHJE

(ind ne), von Wielligh M W (Chair, ind ne), van Heerden A J (CEO), AUDITORS: PwC Inc.

de WitPGS (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 22 Feb 2019 ACT Ords no par value 1 000 000 000 574 241 248

African Rainbow Capital (Pty) Ltd. 18.35%

F du Toit Trust 12.48% DISTRIBUTIONS [ZARc]

Mazi Asset Management 6.29% Ords no par value Ldt Pay Amt

POSTAL ADDRESS: PO Box 5278, Tyger Valley, 7536 Interim No 16 5 May 20 11 May 20 17.00

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AFT Final No 15 29 Oct 19 4 Nov 19 17.00

COMPANY SECRETARY: Catharine Burger LIQUIDITY: Apr20 Ave 800 759 shares p.w., R3.1m(7.3% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

HEES 40 Week MA AFRO-C

SPONSOR: Bridge Capital Advisors (Pty) Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

572

AFT Ords shrs no par val 1 000 000 000 143 262 412

DISTRIBUTIONS [ZARc] 484

Ords shrs no par val Ldt Pay Amt

Interim No 25 26 Nov 19 2 Dec 19 36.00 396

Final No 24 11 Jun 19 18 Jun 19 62.00

309

LIQUIDITY: Apr20 Ave 346 471 shares p.w., R10.6m(12.6% p.a.)

CONM 40 Week MA AFRIMAT 221

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

2914

Interim Final Final Final Final(rst)

2314 Turnover 3 111 270 5 296 793 4 212 705 3 784 701 3 148 146

Op Inc 439 346 772 073 623 086 564 109 376 361

1714 NetIntPd(Rcvd) 24 070 14 891 - 43 481 7 046 - 29 964

Minority Int 65 643 115 132 128 291 102 372 53 323

1114

Att Inc 134 819 269 881 253 858 117 669 140 349

TotCompIncLoss 197 900 380 973 382 149 216 263 198 643

514

2015 | 2016 | 2017 | 2018 | 2019 |

Fixed Ass 750 011 722 112 391 067 227 122 204 362

FINANCIAL STATISTICS Inv & Loans - - 65 028 96 272 449 116

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Tot Curr Ass 1 159 081 1 085 620 823 735 1 141 608 850 640

Interim Final Final(rst) Final(rst) Final Ord SH Int 2 166 171 2 095 282 1 940 614 1 793 694 1 047 979

Turnover 1 719 802 2 966 399 2 380 994 2 228 157 1 969 786 Minority Int 837 506 787 713 679 277 585 359 515 603

Op Inc 317 993 471 152 350 399 406 595 320 388 LT Liab 811 382 881 194 153 860 135 778 977 573

NetIntPd(Rcvd) 17 645 51 935 26 502 5 516 846 Tot Curr Liab 806 704 686 046 356 310 554 049 499 561

Minority Int 1 917 2 852 - 290 1 570 2 064 PER SHARE STATISTICS (cents per share)

Att Inc 248 994 301 363 245 668 277 824 222 128 HEPS-C (ZARc) 23.47 47.29 47.06 22.34 26.33

TotCompIncLoss 245 779 302 812 246 481 272 129 224 350 DPS (ZARc) 17.00 34.00 32.00 28.00 24.00

Fixed Ass 1 514 283 1 469 837 1 417 845 1 058 240 763 156 NAV PS (ZARc) 377.22 364.88 350.05 323.55 189.04

Inv Prop 3 040 3 040 3 040 3 040 3 040 3 Yr Beta 0.21 - 0.12 0.13 - - 0.12

Tot Curr Ass 848 974 901 720 755 116 749 802 554 338 Price High 500 600 675 695 560

Ord SH Int 1 537 163 1 398 166 1 219 340 1 199 372 1 018 349

Minority Int 12 083 11 351 9 980 7 547 6 737 Price Low 287 301 466 475 400

LT Liab 504 662 591 198 609 825 362 490 231 273 Price Prd End 339 495 575 620 525

Tot Curr Liab 632 049 686 297 695 570 754 372 391 347 RATIOS

Ret on SH Fnd 13.35 13.35 14.59 9.25 12.39

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 14.12 14.58 14.79 14.90 11.96

HEPS-C (ZARc) 181.90 234.10 180.70 196.40 156.60 D:E 0.30 0.35 0.06 0.06 0.63

DPS (ZARc) 36.00 81.00 62.00 70.00 57.00 Current Ratio 1.44 1.58 2.31 2.06 1.70

NAV PS (ZARc) 1 134.00 1 030.00 893.00 881.00 720.00 Div Cover 1.38 1.42 1.45 0.76 1.06

3 Yr Beta - 0.20 - 0.31 0.16 0.15 0.62

Price High 3 650 3 180 3 200 3 200 3 030

Price Low 2 844 2 227 2 305 1 800 1 600 AH-Vest Ltd.

Price Prd End 3 050 2 980 2 903 3 041 2 422 AHV

RATIOS ISIN: ZAE000129177 SHORT: AH-VEST CODE: AHL

Ret on SH Fnd 32.39 21.58 20.03 23.06 21.87 REG NO: 1989/000100/06 FOUNDED: 1988 LISTED: 1998

Oper Pft Mgn 18.49 15.88 14.72 18.25 16.27 NATURE OF BUSINESS: AH-Vest trading as All Joy currently develops

D:E 0.42 0.62 0.70 0.59 0.33 and manufactures bottled wet cooking sauces & table sauces, with the

Current Ratio 1.34 1.31 1.09 0.99 1.42 vision to diversify into the “Ready Meals” market, soups and canned

vegetables.

Div Cover 5.10 2.73 2.75 2.80 2.74

SECTOR: AltX

NUMBER OF EMPLOYEES: 157

AfroCentric Investment Corporation Ltd. DIRECTORS: AppelgrynMS(ld ind ne), Darsot B, Darsot S, Darsot R,

Du PlooyJJ(ind ne), Pather M T, Speirs U (ind ne), Takolia H (ind ne),

AFR

ISIN: ZAE000078416 SHORT: AFRO-C CODE: ACT Darsot I E (Chair), Darsot M (CEO), Sambaza C (FD)

REG NO: 1988/000570/06 FOUNDED: 1988 LISTED: 1988 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

NATURE OF BUSINESS: AfroCentric is a majority black-owned Johannesburg Eastern Trading Company (Pty) Ltd. 72.22%

Stock Exchange (JSE) listed investment holding company providing services Farm Food Holdings (Pty) Ltd. 23.34%

and products to the healthcare sector. The Group was founded in 2008 on the POSTAL ADDRESS: PO Box 100, Eikenhof, 1872

core philosophy of promoting transformation and empowerment. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AHL

81