Page 74 - SHBe20.vp

P. 74

JSE – ABS Profile’s Stock Exchange Handbook: 2020 – Issue 2

EMAIL: ir@absa.africa

Absa Group Ltd. WEBSITE: www.absa.africa/absaafrica

ABS TELEPHONE: 011-350-4000

COMPANY SECRETARY: Nadine R Drutman

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSORS: Absa Bank Ltd., JP Morgan Equities

South Africa (Pty) Ltd.

Scan the QR code to AUDITORS: Ernst & Young Inc.

visit our Investor BANKERS: Absa Bank Ltd.

Centre

CALENDAR Expected Status

Annual General Meeting 4 Jun 2020 Confirmed

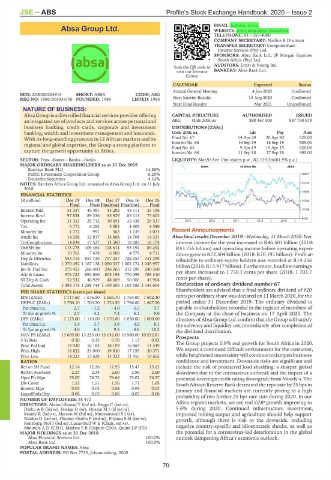

ISIN: ZAE000255915 SHORT: ABSA CODE: ABG

REG NO: 1986/003934/06 FOUNDED: 1986 LISTED: 1986 Next Interim Results 12 Aug 2020 Confirmed

Next Final Results Mar 2021 Unconfirmed

NATURE OF BUSINESS:

Absa Group is a diversified financial services provider offering CAPITAL STRUCTURE AUTHORISED ISSUED

an integrated set of products and services across personal and ABG Ords 200c ea 880 467 500 847 750 679

business banking, credit cards, corporate and investment DISTRIBUTIONS [ZARc]

banking, wealth and investment management and insurance. Ords 200c ea Ldt Pay Amt

With its long-standing presence in 12 African markets and its Final No 67 14 Apr 20 20 Apr 20 620.00

regional and global expertise, the Group a strong platform to Interim No 66 10 Sep 19 16 Sep 19 505.00

15 Apr 19

620.00

Final No 65

9 Apr 19

capture the growth opportunity in Africa. Interim No 64 11 Sep 18 17 Sep 18 490.00

SECTOR: Fins—Banks—Banks—Banks LIQUIDITY: Mar20 Ave 13m shares p.w., R2 139.3m(81.9% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 BANK 40 Week MA ABSA

Barclays Bank PLC 14.88%

Public Investment Corporation Group 6.29% 26803

Deutsche Securities 4.32%

NOTES: Barclays Africa Group Ltd. renamed to Absa Group Ltd. on 11 July 23129

2018

19456

FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 15782

Final Final Final(rst) Final(rst) Final

Interest Paid 51 337 45 481 43 285 43 111 35 196 12109

Interest Rcvd 97 838 89 236 85 929 85 114 73 603

8435

Operating Inc 31 353 29 712 30 091 32 438 29 537 2015 | 2016 | 2017 | 2018 | 2019 |

Tax 5 772 6 282 5 882 4 405 4 540

Minority Int 1 372 991 362 1 139 1 073 Recent Announcements

Attrib Inc 14 256 13 917 13 888 14 708 14 331 Absa final results December 2019 - Wednesday, 11 March 2020: Net

TotCompIncLoss 14 834 17 527 13 580 12 685 16 174 interest income for the year increased to R46.501 billion (2018:

Ord SH Int 113 278 109 484 108 614 93 191 89 292 R43.755 billion) and operating income before operating expen-

Minority Int 10 761 7 478 6 000 4 579 4 711 diture grew to R72.304 billion (2018: R70.191 billion). Profit at-

Dep & OtherAcc 943 716 857 726 757 257 728 057 751 399 tributable to ordinary equity holders was recorded at R14.256

Liabilities 1 270 492 1 167 138 1 050 337 1 001 174 1 045 957 billion(2018: R13.917billion).Furthermore, headlineearnings

Inv & Trad Sec 278 453 266 400 246 265 212 296 240 360 per share increased to 1 750.1 cents per share (2018: 1 703.7

Adv & Loans 976 723 894 860 805 198 770 098 789 310

ST Dep & Cash 52 532 46 929 48 669 50 006 45 904 cents per share).

Total Assets 1 399 175 1 288 744 1 169 595 1 103 588 1 144 604 Declaration of ordinary dividend number 67

Shareholders are advised that a final ordinary dividend of 620

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 1 717.60 1 676.50 1 665.70 1 764.00 1 692.40 cents per ordinary share was declared on 11 March 2020, for the

HEPS-C (ZARc) 1 750.10 1 703.70 1 724.50 1 796.60 1 687.20 period ended 31 December 2019. The ordinary dividend is

Pct chng p.a. 2.7 - 1.2 - 4.0 6.5 9.7 payable to shareholders recorded in the register of members of

Tr 5yr av grwth % 2.7 4.2 7.2 6.1 9.0 the Company at the close of business on 17 April 2020. The

DPS (ZARc) 1 125.00 1 110.00 1 070.00 1 030.00 1 000.00 directors of Absa Group Ltd. confirm that the Group will satisfy

Pct chng p.a. 1.4 3.7 3.9 3.0 8.1 the solvency and liquidity test immediately after completion of

Tr 5yr av grwth % 4.0 6.3 9.5 8.8 18.2 the dividend distribution.

NAV PS (ZARc) 13 669.00 13 233.00 13 042.00 10 980.00 10 532.81 Prospects

3 Yr Beta 0.50 0.35 0.70 1.13 0.92

Price Prd End 14 930 16 182 18 199 16 869 14 349 The Group projects 0.9% real growth for South Africa in 2020.

Price High 18 822 21 000 19 830 17 155 20 371 We expect a continued difficult environment for the consumer,

Price Low 14 223 13 628 13 322 11 955 10 662 while heightened uncertainty will continue to dampen business

RATIOS confidence and investment. Downside risks are significant and

Ret on SH Fund 12.14 12.26 11.95 15.47 15.62 include the risk of protracted load shedding, a sharper global

RetOn AveAsset 2.27 2.34 2.60 2.96 2.60 slowdown due to the coronavirus outbreak and the impact of a

Oper Pft Mgn 75.07 78.72 76.66 73.02 76.57 potential sovereign credit rating downgrade from Moody’s. The

Div Cover 1.53 1.51 1.56 1.71 1.69 South African Reserve Bank decreased the repo rate by 25 bps in

Interest Mgn 0.03 0.03 0.04 0.04 0.03 January and financial markets are currently pricing in a high

LiquidFnds:Dep 0.06 0.05 0.06 0.07 0.06

probability of two further 25 bps rate cuts during 2020. In our

NUMBER OF EMPLOYEES: 38 472

DIRECTORS: Abdool-Samad T (ind ne), Beggs C (ind ne), Africa regions markets, we see real GDP growth improving to

DarkoAB(ind ne), Hodge D (ne), HusainMJ(ld ind ne), 5.6% during 2020. Continued infrastructure investment,

Keanly R (ind ne), Merson M (ind ne), MunyantwaliSJ(ne), improved mining output and agriculture should help support

Naidoo D (ind ne), Okomo-Okello F (ind ne), PityanaSM(ind ne), growth, although there is risk to the downside, including

Rensburg Prof I (ind ne), Lucas-Bull W E (Chair, ind ne),

Mminele A D (CEO), Matlare P B (Deputy CEO), Quinn J P (FD) negative country-specific and idiosyncratic shocks, as well as

MAJOR HOLDINGS as at 31 Dec 2018 the potential for a coronavirus-led deterioration in the global

Absa Financial Services Ltd. 100.0% outlook dampening Africa’s economic outlook.

Absa Bank Ltd. 100.0%

POPULAR BRAND NAMES: Absa

POSTAL ADDRESS: PO Box 7735, Johannesburg, 2000

70