Page 77 - SHBe20.vp

P. 77

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – ADC

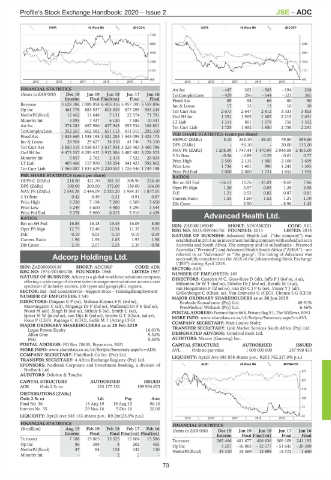

PHAR 40 Week MA ADCOCK SUPS 40 Week MA ADCORP

7126

5882 3285

4639 2564

3395 1842

2152 1121

908 400

2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS Att Inc - 447 262 - 563 - 194 208

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 TotCompIncLoss - 429 296 - 644 - 321 385

Interim Final Final(rst) Final Final Fixed Ass 89 58 66 80 90

Revenue 3 628 386 7 089 058 6 405 316 5 957 700 5 559 896 Inv & Loans 17 15 13 10 10

Op Inc 461 776 883 537 803 049 677 295 553 245 Tot Curr Ass 2 673 2 647 2 812 3 333 3 805

NetIntPd(Rcvd) 12 462 11 648 7 131 22 574 71 781 Ord SH Int 1 351 1 905 1 603 2 215 2 631

Minority Int 3 095 7 437 6 130 7 586 10 341 LT Liab 1 314 801 1 078 756 1 502

Att Inc 374 283 687 986 637 943 553 534 168 801 Tot Curr Liab 1 725 1 652 1 850 2 758 2 241

TotCompIncLoss 352 267 662 582 651 113 411 015 292 350

Fixed Ass 1 835 665 1 538 198 1 521 255 1 445 095 1 423 173 PER SHARE STATISTICS (cents per share)

Inv & Loans 28 904 29 627 34 010 41 746 74 310 HEPS-C (ZARc) 5.10 245.10 - 86.40 79.80 299.60

96.10

135.00

-

20.00

-

Tot Curr Ass 3 850 319 3 558 617 3 617 934 3 326 463 3 460 786 DPS (ZARc) 1 208.39 1 747.44 1 470.99 2 044.06 2 455.00

NAV PS (ZARc)

Ord SH Int 4 473 557 4 295 432 3 912 506 3 487 482 3 228 573

0.77

Minority Int 5 857 2 762 2 413 7 522 26 024 3 Yr Beta - 0.56 - 0.89 - 0.39 - 0.01 3 699

2 100

2 135

2 500

1 900

Price High

LT Liab 405 466 117 970 135 254 341 423 592 862

Tot Curr Liab 1 966 087 1 834 629 2 220 552 1 726 546 1 749 148 Price Low 1 736 1 401 990 1 245 1 395

Price Prd End 2 000 2 000 1 731 1 652 1 495

PER SHARE STATISTICS (cents per share)

RATIOS

HEPS-C (ZARc) 218.50 421.70 381.30 308.90 226.10 Ret on SH Fnd - 66.13 13.76 - 35.01 - 8.69 7.86

DPS (ZARc) 100.00 200.00 172.00 139.00 104.00 Oper Pft Mgn 1.20 2.57 0.05 1.28 2.98

NAV PS (ZARc) 2 545.28 2 444.09 2 226.20 1 984.37 1 837.05 D:E 1.21 0.52 0.82 0.87 0.81

3 Yr Beta 0.42 0.49 0.31 0.91 0.87 Current Ratio 1.55 1.60 1.52 1.21 1.70

Price High 6 250 7 198 7 200 6 500 5 650 Div Cover - 2.50 - - 8.96 1.42

Price Low 5 249 5 600 4 900 4 295 3 544

Price Prd End 5 378 5 960 6 015 5 910 4 429

RATIOS Advanced Health Ltd.

Ret on SH Fnd 16.85 16.18 16.45 16.05 5.50 ISIN: ZAE000189049 SHORT: ADVANCED CODE: AVL

ADV

Oper Pft Mgn 12.73 12.46 12.54 11.37 9.95 REG NO: 2013/059246/06 FOUNDED: 2013 LISTED: 2014

D:E 0.10 0.03 0.10 0.10 0.19 NATURE OF BUSINESS: Advanced Health Ltd. (“the company”) was

Current Ratio 1.96 1.94 1.63 1.93 1.98 established in2013 asaninvestmentholding company with subsidiaries in

Div Cover 2.19 2.07 2.23 2.39 0.98 Australia and South Africa. The company and its subsidiaries - Presmed

Australia (“Presmed”) and Advanced Health South Africa (“AHSA”) – are

Adcorp Holdings Ltd. referred to as “Advanced” or “the group”. The listing of Advanced was

successfully completed on the AltX of the Johannesburg Stock Exchange

ADC (“JSE”) during April 2014.

ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR SECTOR: AltX

REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987 NUMBER OF EMPLOYEES: 189

NATURE OF BUSINESS: Adcorp is a global workforce solutions company, DIRECTORS: Castelyn M C, Goss-Ross D (alt), JaffePJ(ind ne, Aus),

offering a wide range of diverse talent management solutions across a vast

spectrum of industry sectors, job types and geographic regions. Mthembu DrWT(ind ne), Oelofse Dr J (ind ne), Resnik M (Aus),

van Hoogstraten F (ld ind ne), van ZylCJPG(ne), VisserYJ(alt),

SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Training&Employment Grillenberger C (Chair, ne), Van Emmenis G (CEO), Chonco S G (CFO)

NUMBER OF EMPLOYEES: 2 543 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

DIRECTORS: DingaanGP(ne), Mabaso-KoyanaSN(ind ne), Eenhede Konsultante (Pty) Ltd. 49.91%

Maswanganyi C (alt), Mnganga Dr P (ind ne), Mufamadi DrFS(ind ne), PresMedical Witbank (Pty) Ltd. 6.56%

Nkosi M (alt), Singh H (ind ne), Sithole S (ne), Smith C (ne), POSTAL ADDRESS:PostnetSuite668, PrivateBagX1,TheWillows,0041

SpicerMW(ld ind ne), van Dijk R (ind ne), Serobe G T (Chair, ind ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=AVL

Roux P (CEO), Kujenga C (CFO), Sadik M T (Acting CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 COMPANY SECRETARY: Mari-Louise Stoltz

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Legae Perese Equity 16.01%

Allan Gray 9.32% DESIGNATED ADVISOR: Grindrod Bank Ltd.

PSG 9.30% AUDITORS: Mazars (Gauteng) Inc.

POSTAL ADDRESS: PO Box 70635, Bryanston, 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ADR AVL Ords no par value 1 000 000 000 287 988 433

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd. LIQUIDITY: Apr20 Ave 386 858 shares p.w., R205 762.2(7.0% p.a.)

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

SPONSORS: Nedbank Corporate and Investment Banking, a division of ALSH 40 Week MA ADVANCED

Nedbank Ltd.

271

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 221

ADR Ords 2.5c ea 183 177 151 109 954 675

172

DISTRIBUTIONS [ZARc]

Ords 2.5c ea Ldt Pay Amt 122

Final No 36 13 Aug 19 19 Aug 19 96.10

73

Interim No 35 29 Nov 16 5 Dec 16 20.00

LIQUIDITY: Apr20 Ave 548 143 shares p.w., R9.2m(25.9% p.a.) 23

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 (Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final Final(rst) Final(rst) Interim Final Final(rst) Final Final

Turnover 7 188 15 065 15 325 15 804 15 586 Turnover 265 466 481 677 406 636 309 109 241 192

Op Inc 86 388 8 202 465 Op Inc 3 207 - 16 883 - 32 577 - 51 645 - 20 580

NetIntPd(Rcvd) 47 84 124 142 110 NetIntPd(Rcvd) 35 410 15 469 13 895 14 372 1 650

Minority Int - - 2 2 -

73