Page 220 - SHBe20.vp

P. 220

JSE – SAN Profile’s Stock Exchange Handbook: 2020 – Issue 2

Def Tax Asset 1 872 2 249 2 083 1 880 368

Sanlam Ltd. Tot Curr Ass 87 627 82 403 62 314 65 350 70 292

SH Funds 67 317 69 506 57 420 53 390 53 621

SAN

Minority Int 12 043 12 111 6 017 5 696 6 571

LT Liab 718 625 641 630 603 035 550 220 545 722

Tot Curr Liab 102 244 92 329 67 111 63 253 68 594

PER SHARE STATISTICS (cents per share)

Core EPS(ZARc) 345.80 565.40 544.40 481.10 468.90

HEPS-C (ZARc) 361.80 445.60 486.30 493.00 464.40

Pct chng p.a. - 18.8 - 8.4 - 1.4 6.2 11.5

Tr 5yr av grwth % - 2.2 1.6 11.1 14.5 13.2

ISIN: ZAE000070660 SHORT: SANLAM CODE: SLM DPS (ZARc) 334.00 312.00 290.00 268.00 245.00

REG NO: 1959/001562/06 FOUNDED: 1918 LISTED: 1998 Pct chng p.a. 7.1 7.6 8.2 9.4 8.9

Tr 5yr av grwth % 8.2 9.3 6.4 17.8 18.6

NATURE OF BUSINESS: NAV PS (ZARc) 2 895.60 3 137.12 2 650.36 2 464.34 2 475.01

Sanlam is a leading financial services group in South Africa 3 Yr Beta 0.49 0.82 1.08 1.39 0.88

with its head office in Bellville. Price High 8 525 9 849 9 474 7 149 8 217

Established in 1918, the group demutualised in 1998 and Price Low 6 886 6 540 6 100 5 116 4 405

6 054

7 980

6 290

7 910

Price Prd End

8 700

Sanlam Ltd. then listed on the JSE Ltd. in Johannesburg and RATIOS

the Namibian Stock Exchange. Ret on SH Fnd 11.10 15.69 18.90 17.90 18.13

The Sanlam group conducts its business through Sanlam Ltd., Ret On Tot Ass 1.65 2.14 2.24 2.04 2.20

the corporate head office and five business clusters. The Oper Pft Mgn 8.84 19.80 12.61 13.81 16.46

corporate head officeis responsible for the group’s centralised D:E 1.61 1.20 1.24 1.13 1.08

functions such as strategic direction, financial and risk man- Int Cover 8.71 18.19 20.83 26.02 24.21

agement, marketing and communications, group human Current Ratio 0.86 0.89 0.93 1.03 1.02

1.80

1.04

1.91

1.81

Div Cover

1.88

resources and corporate social investment. NUMBER OF EMPLOYEES: 21 267

The Sanlam Personal Finance (SPF) cluster is responsible for DIRECTORS: Birrell A S (ind ne),

Sanlam’s retail business in South Africa. It provides clients BothaAD(ind ne), Hanratty P (ind ne, Ire),

across all market segments (entry-level, middle and affluent) Masilela E (ind ne), Modise M J,

with a comprehensive range of appropriate and competitive Mokoka M G (ind ne), Moller J P (ind ne),

Mvusi T I, Nkosi S A (ld ind ne),

financial solutions. Designed to facilitate long-term wealth NondumoKT(ind ne), Simelane Dr R V (ne),

creation, protection and niche financing, these solutions are Swanepoel C G (ind ne), Zinn Prof S A (ind ne),

engineered around client needs. The SPF cluster consists of Kirk IM(GroupCE, Ire), van Zyl Dr J (Chair, ne),

Motsepe Dr P T (Dep Chair, ne), Werth H C

Sanlam Sky Solutions, Sanlam Individual Life and Segment Scan the QR code to POSTAL ADDRESS: PO Box 1, Sanlamhof, 7532

Solutions; and Glacier. visit our website EMAIL: webmaster@sanlam.co.za

The Sanlam Emerging Markets (SEM) cluster is responsible WEBSITE: www.sanlam.co.za

for Sanlam’s financial services offering in emerging markets TELEPHONE: 021-947-9111 FAX: 021-947-3670

outside South Africa with the aim of ensuring sustainable COMPANY SECRETARY: Sana-Ullah Bray

delivery and growth across the various businesses that make TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Standard Bank of South Africa Ltd.

up this cluster. AUDITORS: Ernst & Young Inc., KPMG Inc.

The SanlamInvestmentGroup clusterprovides individual and

BANKERS: Absa Bank Ltd.

institutional clients in South Africa, the UK and elsewhere in CALENDAR Expected Status

Europe, the United States and Australia access to a compre- Annual General Meeting Jun 2020 Unconfirmed

hensive range of specialised investment and risk management Next Interim Results Sep 2020 Unconfirmed

expertise. Next Final Results Mar 2021 Unconfirmed

The General Insurance cluster, Santam, is the leading general

CAPITAL STRUCTURE AUTHORISED ISSUED

insurer in South Africa with a market share of 23%. Santam SLM Ords 1c ea 4 000 000 000 2 069 106 282

specialises in general insurance products for a diversified DISTRIBUTIONS [ZARc]

market in South Africa and, in collaboration with Sanlam Ords 1c ea Ldt Pay Amt

Emerging Markets, elsewhere in Africa and India. These Final No 22 14 Apr 20 20 Apr 20 334.00

products are offered through broker networks and direct sales Final No 21 9 Apr 19 15 Apr 19 312.00

Final No 20 3 Apr 18 9 Apr 18 290.00

channels and include personal, commercial, agricultural and Final No 19 4 Apr 17 10 Apr 17 268.00

specialised insurance products. LIQUIDITY: Mar20 Ave 23m shares p.w., R1 812.2m(58.8% p.a.)

Sanlam Corporate is a newly formed business, targeting

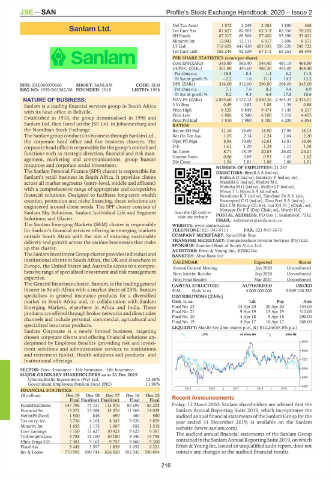

LIFE 40 Week MA SANLAM

chosen corporate clients and offering financial solutions un-

derpinned by Employee Benefits (providing risk and invest- 9570

ment solutions and administration services to institutions 8549

and retirement funds), Health solutions and products and

Institutional offerings. 7527

SECTOR: Fins—Insurance—Life Insurance—Life Insurance 6506

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Ubuntu-Botho Investments (Pty) Ltd. 12.48% 5484

Government Employees Pension Fund (PIC) 11.96%

4463

2015 | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Recent Announcements

Final Final(rst) Final(rst) Final Final

FundsFmClients 147 796 77 721 113 976 86 695 85 293 Friday, 13 March 2020: Sanlam shareholders are advised that the

Financial Ser 13 072 15 388 14 376 11 969 14 039 Sanlam Annual Reporting Suite 2019, which incorporates the

NetIntPd(Rcvd) 1 500 846 690 460 580 audited annual financial statements of the Sanlam Group for the

Tax on op inc 5 756 4 164 4 342 3 026 3 859 year ended 31 December 2019, is available on the Sanlam

Minority Int 1 655 1 175 1 067 955 1 519 website (www.sanlam.com).

Core Earnings 7 150 11 627 10 923 9 623 9 391

TotCompIncLoss 3 788 15 100 10 180 5 440 14 798 The audited annual financial statements of the Sanlam Group

Hline Erngs-CO 7 481 9 162 9 757 9 860 9 300 containedinthe SanlamAnnualReportingSuite2019, onwhich

Fixed Ass 3 449 3 597 1 839 2 052 2 221 Ernst & Young Inc. issued an unqualified audit report, does not

Inv & Loans 770 995 690 744 656 020 592 945 590 894 contain any changes to the audited financial results.

216