Page 224 - SHBe20.vp

P. 224

JSE – SCH Profile’s Stock Exchange Handbook: 2020 – Issue 2

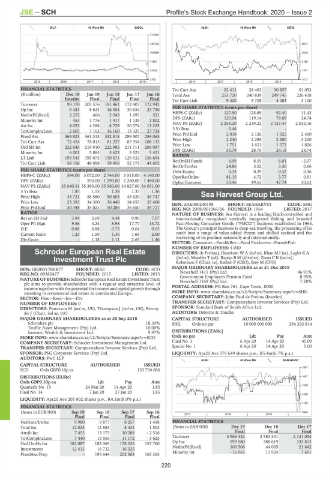

OILP 40 Week MA SASOL ALSH 40 Week MA SERE

174354

140122 2914

105889 2540

71657 2166

37424 1791

3192 1417

2015 | 2016 | 2017 | 2018 | 2019 | | 2016 | 2017 | 2018 | 2019 |

FINANCIAL STATISTICS Tot Curr Ass 22 411 28 463 30 857 61 053

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Total Ass 253 720 240 839 249 745 226 418

Interim Final Final Final Final Tot Curr Liab 9 420 5 708 4 483 3 100

Turnover 99 170 203 576 181 461 172 407 172 942

Op Inc 9 483 8 623 16 304 30 634 23 730 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 2 255 466 2 043 1 697 521 HEPS-C (ZARc) 127.90 125.89 92.40 11.43

119.14

24.74

120.04

79.09

Minority Int 453 1 776 1 417 1 139 1 802 DPS (ZARc) 2 258.20 2 239.22 2 127.47 2 032.16

NAV PS (ZARc)

Att Inc 4 053 4 298 8 729 20 374 13 225

TotCompIncLoss 2 605 7 162 16 160 13 325 27 734 3 Yr Beta 0.46 - - -

Fixed Ass 365 823 361 313 332 818 289 507 259 065 Price Prd End 2 038 2 126 1 925 2 400

Tot Curr Ass 72 454 78 015 81 257 87 954 108 133 Price High 2 240 2 295 2 300 3 200

Ord SH Int 222 645 219 910 222 985 211 711 206 997 Price Low 1 751 1 651 1 572 1 826

24.74

DPS (ZARc)

24.18

33.79

28.75

Minority Int 6 001 5 885 5 623 5 523 5 421

LT Liab 199 543 195 075 150 671 129 532 136 694 RATIOS 4.09 8.55 6.01 - 2.07

RetOnSH Funds

Tot Curr Liab 58 156 49 098 59 956 52 173 41 602

RetOnTotAss 24.86 5.52 3.30 0.66

PER SHARE STATISTICS (cents per share) Debt:Equity 0.33 0.29 0.32 0.36

HEPS-C (ZARc) 594.00 3 072.00 2 744.00 3 515.00 4 140.00

OperRetOnInv 81.15 4.72 3.77 0.91

DPS (ZARc) - 590.00 1 290.00 1 260.00 1 480.00 OpInc:Turnover 53.46 49.63 47.74 30.63

NAV PS (ZARc) 35 640.31 35 380.00 35 960.00 34 827.00 34 051.00

3 Yr Beta 1.85 1.53 1.38 1.37 1.36

Price High 35 721 58 580 50 603 43 620 49 747 Sea Harvest Group Ltd.

SEA

Price Low 23 393 34 300 36 440 34 655 35 400 ISIN: ZAE000240198 SHORT: SEAHARVST CODE: SHG

Price Prd End 30 348 35 021 50 286 36 650 39 717 REG NO: 2008/001066/06 FOUNDED: 1964 LISTED: 2017

RATIOS NATURE OF BUSINESS: Sea Harvest is a leading black-controlled and

Ret on SH Fnd 3.94 2.69 4.44 9.90 7.07 internationally recognised vertically integrated fishing and branded

Oper Pft Mgn 9.56 4.24 8.98 17.77 13.72 Fast-Moving Consumer Goods (“FMCG”) business established in 1964.

D:E 0.88 0.88 0.73 0.64 0.65 The Group’s principal business is deep-sea trawling, the processing of its

Current Ratio 1.25 1.59 1.36 1.69 2.60 catch into a range of value-added frozen and chilled seafood and the

Div Cover - 1.18 1.11 2.65 1.46 marketing of its produce nationally and internationally.

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

NUMBER OF EMPLOYEES: 4 040

Schroder European Real Estate DIRECTORS: de Freitas J, Hanekom W A (ind ne), Khan MI(ne), Lagler K A

Investment Trust Plc (ind ne), Moodley T (alt), Rapiya B M (ld ind ne), Zama C K (ind ne),

Robertson F (Chair, ne), Ratheb F (CEO), Brey M (CFO)

SCH MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

ISIN: GB00BY7R8K77 SHORT: SERE CODE: SCD

REG NO: 09382477 FOUNDED: 2015 LISTED: 2015 Newshelf 1411 (Pty) Ltd. 46.91%

NATUREOF BUSINESS:SchroderEuropeanRealEstateInvestmentTrust Government Employees Pension Fund 8.95%

Newshelf 1169 (Pty) Ltd.

7.28%

plc aims to provide shareholders with a regular and attractive level of

income together with the potential for income and capital growth through POSTAL ADDRESS: PO Box 761, Cape Town, 8000

investing in commercial real estate in continental Europe. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SHG

SECTOR: Fins—Rest—Inv—Div COMPANY SECRETARY: John Paul de Freitas (Interim)

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Patterson M (ind ne, UK), Thompson J (ind ne, UK), Berney SPONSOR: Standard Bank of South Africa Ltd.

Sir J (Chair, ind ne, UK) AUDITORS: Deloitte & Touche

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2018 CAPITAL STRUCTURE AUTHORISED ISSUED

Schroders plc 18.30% SHG Ords no par 10 000 000 000 294 293 814

Truffle Asset Management (Pty) Ltd. 10.00%

Investec Wealth & Investment Ltd. 9.97% DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SCD Ords no par Ldt Pay Amt

COMPANY SECRETARY: Schroder Investment Management Ltd. Final No 3 6 Apr 20 14 Apr 20 45.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Special No 1 6 Apr 20 14 Apr 20 5.00

SPONSOR: PSG Corporate Services (Pty) Ltd. LIQUIDITY: Apr20 Ave 379 649 shares p.w., R5.4m(6.7% p.a.)

AUDITORS: PwC LLP

ALSH 40 Week MA SEAHARVST

CAPITAL STRUCTURE AUTHORISED ISSUED

1597

SCD Ords GBP0.10p ea - 133 734 686

DISTRIBUTIONS [EURc] 1487

Ords GBP0.10p ea Ldt Pay Amt

Quarterly No 15 24 Mar 20 14 Apr 20 1.85 1376

Final No 14 7 Jan 20 27 Jan 20 1.85

1266

LIQUIDITY: Apr20 Ave 205 802 shares p.w., R4.1m(8.0% p.a.)

1155

FINANCIAL STATISTICS

(Amts in EUR’000) Sep 19 Sep 18 Sep 17 Sep 16 1044

Final Final Final Final 2017 | 2018 | 2019 |

NetRent/InvInc 9 980 9 877 8 257 1 498 FINANCIAL STATISTICS

Total Inc 12 025 12 883 8 431 1 503 (Amts in ZAR’000) Dec 19 Dec 18 Dec 17

Attrib Inc 7 455 13 175 10 288 - 2 516 Final Final Final

TotCompIncLoss 7 440 15 563 11 172 - 3 625 Turnover 3 966 452 2 583 341 2 131 054

Ord UntHs Int 182 087 182 069 178 326 157 760 Op Inc 599 580 388 619 333 813

Investments 12 413 16 732 16 325 - NetIntPd(Rcvd) 100 506 44 005 21 642

FixedAss/Prop - 195 644 202 563 165 365 Minority Int - 16 965 11 924 7 601

220