Page 215 - SHBe20.vp

P. 215

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – REU

POPULAR BRAND NAMES: African Cables,

Reunert Ltd. CBI-electric, ECN, Nashua, Reutech

Communications, Reutech Radar Systems,

REU

Reutech Solutions, Skywire

POSTAL ADDRESS: PO Box 784391, Sandton,

2146

EMAIL: invest@reunert.co.za

WEBSITE: www.reunert.com

TELEPHONE: 011-517-9000

Scan the QR code to COMPANY SECRETARY: Reunert Management

visit our website Services

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

ISIN: ZAE000057428 SHORT: REUNERT CODE: RLO SPONSOR: One Capital

REG NO: 1913/004355/06 FOUNDED: 1888 LISTED: 1948 AUDITORS: Deloitte & Touche

BANKERS: Investec, Nedbank Ltd., Standard Bank

NATURE OF BUSINESS: SEGMENTAL REPORTING as at 30 Sep 19 (asa%of Assets)

Reunert Ltd. is a South African-based industrial group in the Information Communication Technologies 45.00%

Electrical Engineering

27.00%

industrial goods and services sector. It manages a number of Applied Electronics 23.00%

businesses focused on electrical engineering, information and Other 5.00%

communication technologies and applied electronics. CALENDAR Expected Status

Reunert’s employees are highly qualified and experienced Next Interim Results May 2020 Unconfirmed

engineers, technicians, research and developmentexperts and Next Final Results Nov 2020 Unconfirmed

field support staff. Reunert owns well-known brands such as Annual General Meeting Feb 2021 Unconfirmed

Nashua, CBI-electric and Reutech. Reunert promotes a decen- CAPITAL STRUCTURE AUTHORISED ISSUED

tralised management style. While operating decisions are RLO Ords no par value 235 000 000 184 950 196

made by the businesses, the Reunert board and executive DISTRIBUTIONS [ZARc]

team define and monitor long-term strategic plans, risks, per- Ords no par value Ldt Pay Amt

formance and investment decisions. Final No 187 14 Jan 20 20 Jan 20 383.00

Interim No 186 18 Jun 19 24 Jun 19 130.00

SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip Final No 185 15 Jan 19 21 Jan 19 368.00

MAJOR ORDINARY SHAREHOLDERS as at 03 Feb 2020 Interim No 184 19 Jun 18 25 Jun 18 125.00

Public Investment Corporation Ltd. 11.20% LIQUIDITY: Mar20 Ave 1m shares p.w., R104.4m(41.8% p.a.)

Old Mutual Investment Group (SA) (Pty) Ltd. 10.21%

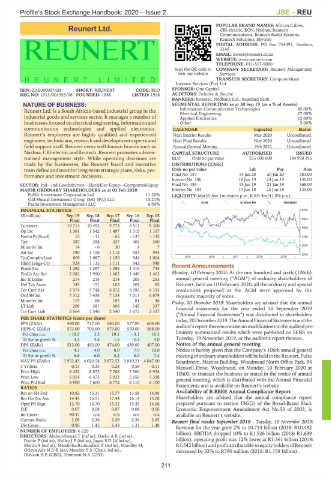

Pzena Investment Management LLC 6.00% ELEE 40 Week MA REUNERT

FINANCIAL STATISTICS 8200

(R million) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15

Final Final Final Final Final 7063

Turnover 10 714 10 492 9 773 8 511 8 300

5926

Op Inc 1 361 1 542 1 497 1 315 1 167

NetIntPd(Rcvd) 15 - 11 - 65 - 137 - 135 4790

Tax 387 358 437 404 360

3653

Minority Int 14 - 6 30 9 7

Att Inc 790 1 158 1 112 954 994 2516

TotCompIncLoss 809 1 087 1 150 944 1 004 2015 | 2016 | 2017 | 2018 | 2019 |

Hline Erngs-CO 924 1 135 1 111 942 948 Recent Announcements

Fixed Ass 1 292 1 297 1 095 1 019 745

FinCo Acc Rec 2 082 1 990 1 682 1 449 1 463 Monday, 10 February 2020: At the one hundred and sixth (106th)

Inv & Loans 214 214 214 205 253 annual general meeting (“AGM”) of ordinary shareholders of

Def Tax Asset 143 151 105 104 92 Reunert, held on 10 February 2020, all the ordinary and special

Tot Curr Ass 5 574 5 748 6 072 6 395 6 193 resolutions proposed at the AGM were approved by the

Ord SH Int 7 312 7 438 7 138 7 011 6 679 requisite majority of votes.

Minority Int 119 88 105 81 46 Friday, 20 December 2019: Shareholders are advised that the annual

LT Liab 209 381 306 145 337 financial statements for the year ended 30 September 2019

Tot Curr Liab 2 664 2 546 2 540 2 672 2 337

(“Annual Financial Statements”) was distributed to shareholders

PER SHARE STATISTICS (cents per share) today,20December2019.TheAnnualFinancialStatementsandthe

EPS (ZARc) 490.00 717.00 680.00 577.00 604.00 auditor’sreportthereoncontainnomodificationstotheauditedpre-

HEPS-C (ZARc) 573.00 703.00 679.00 570.00 588.00

Pct chng p.a. - 18.5 3.5 19.1 - 3.1 16.3 liminary summarised results which were published on SENS on

Tr 5yr av grwth % 3.5 4.5 1.5 - 0.3 4.0 Tuesday, 19 November 2019, or the auditor’s report thereon.

DPS (ZARc) 513.00 493.00 474.00 439.00 407.00 Notice of the annual general meeting

Pct chng p.a. 4.1 4.0 8.0 7.9 10.0 Notice is hereby given that the Company’s 106th annual general

Tr 5yr av grwth % 6.8 6.0 5.2 6.0 7.4 meetingofordinaryshareholderswillbeheldintheReunert,Pulse

NAV PS (ZARc) 3 952.43 4 020.54 3 872.52 3 810.21 4 047.00 Boardroom, Nashua Building, Woodmead North Office Park, 54

3 Yr Beta 0.13 0.35 0.24 0.58 - 0.11 Maxwell Drive, Woodmead, on Monday, 10 February 2020 at

Price High 8 422 8 875 7 768 7 560 6 924 10h00, to transact the business as stated in the notice of annual

Price Low 6 014 6 473 5 933 5 650 5 398

general meeting, which is distributed with the Annual Financial

Price Prd End 6 900 7 600 6 772 6 110 6 100

RATIOS Statements and is available on Reunert’s website

Ret on SH Fnd 10.82 15.31 15.77 13.58 14.88 Availability of B-BBEE Annual Compliance Report

Ret On Tot Ass 14.45 16.51 17.44 16.14 15.08 Shareholders are advised that the annual compliance report

Oper Pft Mgn 12.70 14.70 15.32 15.45 14.06 prepared pursuant to section 13G(2) of the Broad-Based Black

D:E 0.07 0.08 0.07 0.08 0.06 Economic Empowerment Amendment Act No.53 of 2003, is

Int Cover 80.47 n/a n/a n/a n/a available on Reunert’s website.

Current Ratio 2.09 2.26 2.39 2.39 2.65 Reunert final results September 2019 - Tuesday, 19 November 2019:

Div Cover 0.96 1.45 1.43 1.31 1.48 Revenue for the year grew 2% to 10.714 billion (2018: R10.492

NUMBER OF EMPLOYEES: 6 220 billion). EBITDA dropped 10% to R1.526 billion (2018: R1.699

DIRECTORS: Abdool-Samad T (ind ne), DarkoAB(ind ne),

Fourie P (ind ne), HulleyJP(ind ne), JagoeSD(ld ind ne), billion), operating profit was 12% lower at R1.361 billion (2018:

Martin S (ind ne), Matshoba-Ramuedzisi T (ind ne), Moodley M, R1.542billion)andprofitattributabletoequityholdersofReunert

Orleyn AdvNDB(ne), Munday T S (Chair, ind ne), decreased by 32% to R790 million (2018: R1.158 billion).

Dickson A E (CEO), Thomson N A (CFO)

211