Page 212 - SHBe20.vp

P. 212

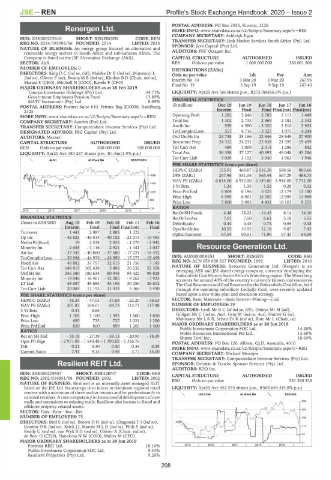

JSE – REN Profile’s Stock Exchange Handbook: 2020 – Issue 2

POSTAL ADDRESS: PO Box 2555, Rivonia, 2128

Renergen Ltd. MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RES

REN COMPANY SECRETARY: Ashleigh Egan

ISIN: ZAE000202610 SHORT: RENERGEN CODE: REN TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

REG NO: 2014/195093/06 FOUNDED: 2014 LISTED: 2015 SPONSOR: Java Capital (Pty) Ltd.

NATURE OF BUSINESS: An energy group focused on alternative and

renewable energy sectors in South Africa and sub-Saharan Africa. The AUDITORS: PKF Octagon Inc.

Company is listed on the JSE Alternative Exchange (AltX). CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: AltX RES Ords no par value 1 000 000 000 363 061 506

NUMBER OF EMPLOYEES: 0 DISTRIBUTIONS [ZARc]

DIRECTORS: KingDC(ind ne, UK), Maleke Dr B (ind ne), Matteucci L Ords no par value Ldt Pay Amt

(ind ne), Olivier F (ne), SwanaMB(ind ne), Kimber B D (Chair, ind ne), Interim No 34 3 Mar 20 9 Mar 20 267.96

Marani S (CEO), Mitchell N (COO), Ravele F (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019 Final No 33 3 Sep 19 9 Sep 19 267.40

Tamryn Investment Holdings (Pty) Ltd. 34.71% LIQUIDITY: Apr20 Ave 5m shares p.w., R272.9m(66.6% p.a.)

Government Employees Pension Fund 13.89%

MATC Investment (Pty) Ltd. 8.69% FINANCIAL STATISTICS

POSTAL ADDRESS: Postnet Suite 610, Private Bag X10030, Randburg, (R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

2125 Interim Final Final Final(rst) Final(rst)

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=REN Operatng Proft 1 282 2 646 2 783 2 113 1 449

COMPANY SECRETARY: Acorim (Pty) Ltd. Total Inc 1 302 2 733 2 869 2 183 2 342

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Attrib Inc 539 4 590 - 3 320 2 510 3 923

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. TotCompIncLoss 557 4 716 - 3 327 1 975 4 244

AUDITORS: Mazars Ord UntHs Int 24 738 25 166 22 846 28 649 27 900

CAPITAL STRUCTURE AUTHORISED ISSUED Investmnt Prop 24 312 24 231 22 838 21 395 19 499

REN Ords no par value 500 000 000 500 000 000 Tot Curr Ass 489 1 009 2 014 1 286 842

LIQUIDITY: Apr20 Ave 180 287 shares p.w., R1.8m(1.9% p.a.) Total Ass 36 398 37 127 40 693 49 048 43 286

Tot Curr Liab 3 039 3 192 3 040 1 963 1 946

ALSH 40 Week MA RENERGEN

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 155.91 468.87 - 2 016.38 588.56 869.66

1686 DPS (ZARc) 267.96 531.06 565.44 567.29 488.73

NAV PS (ZARc) 6 814.00 6 932.00 6 149.00 8 944.00 7 731.00

1446

3 Yr Beta 1.24 1.35 1.52 0.28 0.32

1205 Price Prd End 6 804 6 196 5 625 12 174 13 180

Price High 6 999 6 901 15 350 13 999 13 969

965

Price Low 5 800 5 095 4 431 10 101 9 255

725 RATIOS

2015 | 2016 | 2017 | 2018 | 2019 |

RetOnSH Funds 4.48 18.22 - 14.43 8.14 14.10

FINANCIAL STATISTICS RetOnTotAss 7.01 7.50 6.61 5.18 5.55

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16 Debt:Equity 0.44 0.45 0.74 0.65 0.48

Interim Final Final Final(rst) Final OperRetOnInv 10.55 10.92 12.18 9.87 7.43

Turnover 1 441 2 987 2 885 1 722 - OpInc:Turnover 67.54 69.51 71.96 67.43 64.58

Op Inc - 42 825 - 46 014 - 40 102 - 23 019 - 19 495

NetIntPd(Rcvd) 19 2 534 2 935 - 1 279 - 2 942

Minority Int - 2 645 - 4 116 - 2 921 - 1 441 - 1 047 Resource Generation Ltd.

Att Inc - 37 343 - 40 860 - 37 680 - 17 221 - 18 452 RES

TotCompIncLoss - 39 988 - 44 976 - 43 990 - 15 273 - 19 499 ISIN: AU000000RES1 SHORT: RESGEN CODE: RSG

Fixed Ass 46 882 37 757 32 615 21 756 7 145 REG NO: ACN 059 950 337 FOUNDED: 1993 LISTED: 2010

Tot Curr Ass 148 815 102 438 5 496 20 232 52 358 NATURE OF BUSINESS: Resource Generation Ltd. (Resgen) is an

emerging ASX and JSE-listed energy company, currently developing the

Ord SH Int 246 380 180 634 80 948 98 423 98 828 Boikarabelo Coal Mine in South Africa’s Waterberg region. The Waterberg

Minority Int - 19 046 - 16 401 - 12 285 - 9 262 - 7 923 accounts for around 40% of the country’s currently known coal resources.

LT Liab 48 687 49 684 34 156 30 250 26 612 The Coal Resources and Coal Reserves for the Boikarabelo Coal Mine, held

Tot Curr Liab 20 084 11 193 11 433 5 366 3 490 through the operating subsidiary Ledjadja Coal, were recently updated

PER SHARE STATISTICS (cents per share) based upon a new mine plan and execution strategy.

HEPS-C (ZARc) - 35.24 - 47.03 - 37.68 - 22.20 - 36.53 SECTOR: Basic Materials—Basic Resrcs—Mining—Coal

NAV PS (ZARc) 201.83 164.01 84.73 113.71 117.48 NUMBER OF EMPLOYEES: 29

3 Yr Beta 0.31 0.64 - - - DIRECTORS: Croll MrRC(ld ind ne, UK), Dahiya Mr M (alt),

Price High 1 105 1 100 1 395 1 600 1 850 Gilligan Mr C (ind ne, Aus), Gray M (ind ne, Aus), Hunter G (ne),

Price Low 695 725 727 1 021 1 250 Molotsane MrLRR, Sebati Dr K (ind ne), Xate Mr L (Chair, ne)

Price Prd End 850 800 899 1 265 1 400 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 14.28%

Public Investment Corporation SOC Ltd.

RATIOS Noble Resources International Pte Ltd. 13.69%

Ret on SH Fnd - 35.18 - 27.39 - 59.13 - 20.93 - 18.39 Shinto Torii Inc. 10.69%

Oper Pft Mgn - 2 971.89 - 1 540.48 - 1 390.02 - 1 336.76 - POSTAL ADDRESS: PO Box 126, Albion, QLD, Australia, 4010

D:E 0.21 0.30 0.50 0.34 0.29 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=RSG

Current Ratio 7.41 9.15 0.48 3.77 15.00

COMPANY SECRETARY: Michael Meintjes

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Resilient REIT Ltd. SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

AUDITORS: BDO Inc.

RES

ISIN: ZAE000209557 SHORT: RESILIENT CODE: RES CAPITAL STRUCTURE AUTHORISED ISSUED

REG NO: 2002/016851/06 FOUNDED: 2002 LISTED: 2002 RSG Ords no par value - 581 380 338

NATURE OF BUSINESS: Resilient is an internally asset managed REIT

listed on the JSE Ltd. Its strategy is to invest in dominant regional retail LIQUIDITY: Apr20 Ave 452 535 shares p.w., R508 664.3(4.0% p.a.)

centres with a minimum of three anchor tenants and let predominantly to

JSE-COAL 40 Week MA RESGEN

nationalretailers. A core competency is the successful development of new

malls and extensions to existing malls. Resilient also invests in listed and 250

offshore property-related assets.

204

SECTOR: Fins—Rest—Inv—Ret

NUMBER OF EMPLOYEES: 75 158

DIRECTORS: Bird S (ind ne), BrownDH(ind ne), ChagondaTI(ind ne),

GordonDK(ind ne), Kriek J J, MaroleMLD(ind ne), Phili P (ind ne), 112

Reddy U (ind ne), van WykBD(ind ne), Olivier A (Chair, ind ne),

de Beer D (CEO), Hanekom N W (COO), Muller M (CFO) 67

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 21

Fortress REIT Ltd. 10.10% 2015 | 2016 | 2017 | 2018 | 2019 |

Public Investment Corporation SOC Ltd. 9.43%

Resilient Properties (Pty) Ltd. 9.26%

208