Page 51 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 51

Basic Concepts

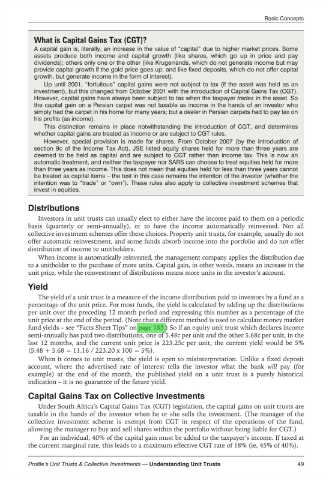

What is Capital Gains Tax (CGT)?

A capital gain is, literally, an increase in the value of “capital” due to higher market prices. Some

assets produce both income and capital growth (like shares, which go up in price and pay

dividends); others only one or the other (like Krugerrands, which do not generate income but may

provide capital growth if the gold price goes up; and like fixed deposits, which do not offer capital

growth, but generate income in the form of interest).

Up until 2001, “fortuitous” capital gains were not subject to tax (if the asset was held as an

investment), but this changed from October 2001 with the introduction of Capital Gains Tax (CGT).

However, capital gains have always been subject to tax when the taxpayer trades in the asset. So

the capital gain on a Persian carpet was not taxable as income in the hands of an investor who

simply had the carpet in his home for many years; but a dealer in Persian carpets had to pay tax on

his profits (as income).

This distinction remains in place notwithstanding the introduction of CGT, and determines

whether capital gains are treated as income or are subject to CGT rules.

However, special provision is made for shares. From October 2007 (by the introduction of

section 9c of the Income Tax Act), JSE listed equity shares held for more than three years are

deemed to be held as capital and are subject to CGT rather than income tax. This is now an

automatic treatment, and neither the taxpayer nor SARS can choose to treat equities held for more

than three years as income. This does not mean that equities held for less than three years cannot

be treated as capital items – the test in this case remains the intention of the investor (whether the

intention was to “trade” or “own”). These rules also apply to collective investment schemes that

invest in equities.

Distributions

Investors in unit trusts can usually elect to either have the income paid to them on a periodic

basis (quarterly or semi-annually), or to have the income automatically reinvested. Not all

collective investment schemes offer these choices. Property unit trusts, for example, usually do not

offer automatic reinvestment, and some funds absorb income into the portfolio and do not offer

distribution of income to unitholders.

When income is automatically reinvested, the management company applies the distribution due

to a unitholder to the purchase of more units. Capital gain, in other words, means an increase in the

unit price, while the reinvestment of distributions means more units in the investor’s account.

Yield

The yield of a unit trust is a measure of the income distribution paid to investors by a fund as a

percentage of the unit price. For most funds, the yield is calculated by adding up the distributions

per unit over the preceding 12 month period and expressing this number as a percentage of the

unit price at the end of the period. (Note that a different method is used to calculate money market

fund yields – see “Facts Sheet Tips” on page 183.) So if an equity unit trust which declares income

semi-annually has paid two distributions, one of 5.48c per unit and the other 5.68c per unit, in the

last 12 months, and the current unit price is 223.25c per unit, the current yield would be 5%

(5.48 + 5.68 = 11.16 / 223.20 x 100 = 5%).

When it comes to unit trusts, the yield is open to misinterpretation. Unlike a fixed deposit

account, where the advertised rate of interest tells the investor what the bank will pay (for

example) at the end of the month, the published yield on a unit trust is a purely historical

indication – it is no guarantee of the future yield.

Capital Gains Tax on Collective Investments

Under South Africa’s Capital Gains Tax (CGT) legislation, the capital gains on unit trusts are

taxable in the hands of the investor when he or she sells the investment. (The manager of the

collective investment scheme is exempt from CGT in respect of the operations of the fund,

allowing the manager to buy and sell shares within the portfolio without being liable for CGT.)

For an individual, 40% of the capital gain must be added to the taxpayer’s income. If taxed at

the current marginal rate, this leads to a maximum effective CGT rate of 18% (ie, 45% of 40%).

49

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts