Page 215 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 215

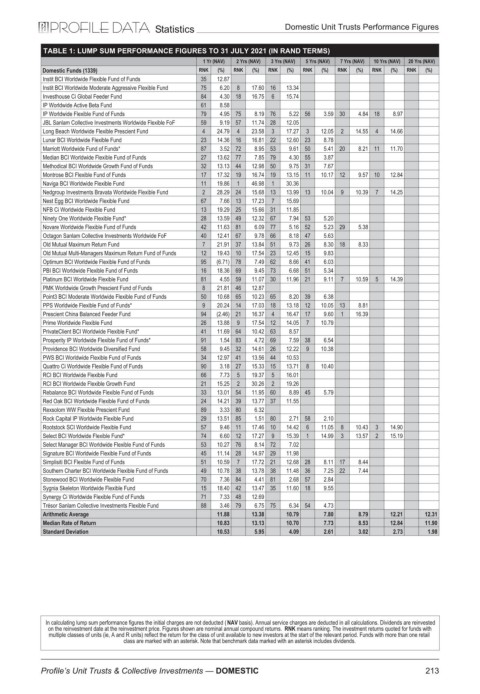

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Instit BCI Worldwide Flexible Fund of Funds 35 12.87

Instit BCI Worldwide Moderate Aggressive Flexible Fund 75 6.20 8 17.60 16 13.34

Investhouse Ci Global Feeder Fund 84 4.30 18 16.75 6 15.74

IP Worldwide Active Beta Fund 61 8.58

IP Worldwide Flexible Fund of Funds 79 4.95 75 8.19 76 5.22 56 3.59 30 4.84 18 8.97

JBL Sanlam Collective Investments Worldwide Flexible FoF 59 9.19 57 11.74 28 12.05

Long Beach Worldwide Flexible Prescient Fund 4 24.79 4 23.58 3 17.27 3 12.05 2 14.55 4 14.66

Lunar BCI Worldwide Flexible Fund 23 14.36 16 16.81 22 12.60 23 8.78

Marriott Worldwide Fund of Funds* 87 3.52 72 8.95 53 9.61 50 5.41 20 8.21 11 11.70

Median BCI Worldwide Flexible Fund of Funds 27 13.62 77 7.85 79 4.30 55 3.87

Methodical BCI Worldwide Growth Fund of Funds 32 13.13 44 12.98 50 9.75 31 7.67

Montrose BCI Flexible Fund of Funds 17 17.32 19 16.74 19 13.15 11 10.17 12 9.57 10 12.84

Naviga BCI Worldwide Flexible Fund 11 19.86 1 46.98 1 30.36

Nedgroup Investments Bravata Worldwide Flexible Fund 2 28.29 24 15.68 13 13.99 13 10.04 9 10.39 7 14.25

Nest Egg BCI Worldwide Flexible Fund 67 7.66 13 17.23 7 15.69

NFB Ci Worldwide Flexible Fund 13 19.29 25 15.66 31 11.85

Ninety One Worldwide Flexible Fund* 28 13.59 49 12.32 67 7.94 53 5.20

Novare Worldwide Flexible Fund of Funds 42 11.63 81 6.09 77 5.16 52 5.23 29 5.38

Octagon Sanlam Collective Investments Worldwide FoF 40 12.41 67 9.78 66 8.18 47 5.63

Old Mutual Maximum Return Fund 7 21.91 37 13.84 51 9.73 26 8.30 18 8.33

Old Mutual Multi-Managers Maximum Return Fund of Funds 12 19.43 10 17.54 23 12.45 15 9.83

Optimum BCI Worldwide Flexible Fund of Funds 95 (6.71) 78 7.49 62 8.66 41 6.03

PBI BCI Worldwide Flexible Fund of Funds 16 18.36 69 9.45 73 6.68 51 5.34

Platinum BCI Worldwide Flexible Fund 81 4.55 59 11.07 30 11.96 21 9.11 7 10.59 5 14.39

PMK Worldwide Growth Prescient Fund of Funds 8 21.81 46 12.87

Point3 BCI Moderate Worldwide Flexible Fund of Funds 50 10.68 65 10.23 65 8.20 39 6.38

PPS Worldwide Flexible Fund of Funds* 9 20.24 14 17.03 18 13.18 12 10.05 13 8.81

Prescient China Balanced Feeder Fund 94 (2.46) 21 16.37 4 16.47 17 9.60 1 16.39

Prime Worldwide Flexible Fund 26 13.88 9 17.54 12 14.05 7 10.79

PrivateClient BCI Worldwide Flexible Fund* 41 11.69 64 10.42 63 8.57

Prosperity IP Worldwide Flexible Fund of Funds* 91 1.54 83 4.72 69 7.59 38 6.54

Providence BCI Worldwide Diversified Fund 58 9.45 32 14.61 26 12.22 9 10.38

PWS BCI Worldwide Flexible Fund of Funds 34 12.97 41 13.56 44 10.53

Quattro Ci Worldwide Flexible Fund of Funds 90 3.18 27 15.33 15 13.71 8 10.40

RCI BCI Worldwide Flexible Fund 66 7.73 5 19.37 5 16.01

RCI BCI Worldwide Flexible Growth Fund 21 15.25 2 30.26 2 19.26

Rebalance BCI Worldwide Flexible Fund of Funds 33 13.01 54 11.95 60 8.89 45 5.79

Red Oak BCI Worldwide Flexible Fund of Funds 24 14.21 39 13.77 37 11.55

Rexsolom WW Flexible Prescient Fund 89 3.33 80 6.32

Rock Capital IP Worldwide Flexible Fund 29 13.51 85 1.51 80 2.71 58 2.10

Rootstock SCI Worldwide Flexible Fund 57 9.46 11 17.46 10 14.42 6 11.05 8 10.43 3 14.90

Select BCI Worldwide Flexible Fund* 74 6.60 12 17.27 9 15.39 1 14.99 3 13.57 2 15.19

Select Manager BCI Worldwide Flexible Fund of Funds 53 10.27 76 8.14 72 7.02

Signature BCI Worldwide Flexible Fund of Funds 45 11.14 28 14.97 29 11.98

Simplisiti BCI Flexible Fund of Funds 51 10.59 7 17.72 21 12.68 28 8.11 17 8.44

Southern Charter BCI Worldwide Flexible Fund of Funds 49 10.78 38 13.78 38 11.48 36 7.25 22 7.44

Stonewood BCI Worldwide Flexible Fund 70 7.36 84 4.41 81 2.68 57 2.84

Sygnia Skeleton Worldwide Flexible Fund 15 18.40 42 13.47 35 11.60 18 9.55

Synergy Ci Worldwide Flexible Fund of Funds 71 7.33 48 12.69

Trésor Sanlam Collective Investments Flexible Fund 88 3.46 79 6.75 75 6.34 54 4.73

Arithmetic Average 11.88 13.38 10.79 7.80 8.79 12.21 12.31

Median Rate of Return 10.83 13.13 10.70 7.73 8.53 12.84 11.90

Standard Deviation 10.53 5.95 4.09 2.61 3.02 2.73 1.98

In calculating lump sum performance figures the initial charges are not deducted (NAV basis). Annual service charges are deducted in all calculations. Dividends are reinvested

on the reinvestment date at the reinvestment price. Figures shown are nominal annual compound returns. RNK means ranking. The investment returns quoted for funds with

multiple classes of units (ie, A and R units) reflect the return for the class of unit available to new investors at the start of the relevant period. Funds with more than one retail

class are marked with an asterisk. Note that benchmark data marked with an asterisk includes dividends.

213

Profile’s Unit Trusts & Collective Investments — DOMESTIC