Page 214 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 214

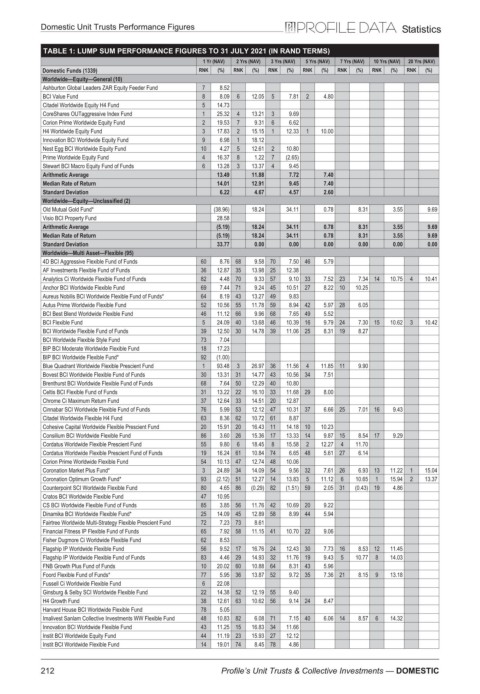

Domestic Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Worldwide—Equity—General (10)

Ashburton Global Leaders ZAR Equity Feeder Fund 7 8.52

BCI Value Fund 8 8.09 6 12.05 5 7.81 2 4.80

Citadel Worldwide Equity H4 Fund 5 14.73

CoreShares OUTaggressive Index Fund 1 25.32 4 13.21 3 9.69

Corion Prime Worldwide Equity Fund 2 19.53 7 9.31 6 6.62

H4 Worldwide Equity Fund 3 17.83 2 15.15 1 12.33 1 10.00

Innovation BCI Worldwide Equity Fund 9 6.98 1 18.12

Nest Egg BCI Worldwide Equity Fund 10 4.27 5 12.61 2 10.80

Prime Worldwide Equity Fund 4 16.37 8 1.22 7 (2.65)

Stewart BCI Macro Equity Fund of Funds 6 13.28 3 13.37 4 9.45

Arithmetic Average 13.49 11.88 7.72 7.40

Median Rate of Return 14.01 12.91 9.45 7.40

Standard Deviation 6.22 4.67 4.57 2.60

Worldwide—Equity—Unclassified (2)

Old Mutual Gold Fund* (38.96) 18.24 34.11 0.78 8.31 3.55 9.69

Visio BCI Property Fund 28.58

Arithmetic Average (5.19) 18.24 34.11 0.78 8.31 3.55 9.69

Median Rate of Return (5.19) 18.24 34.11 0.78 8.31 3.55 9.69

Standard Deviation 33.77 0.00 0.00 0.00 0.00 0.00 0.00

Worldwide—Multi Asset—Flexible (95)

4D BCI Aggressive Flexible Fund of Funds 60 8.76 68 9.58 70 7.50 46 5.79

AF Investments Flexible Fund of Funds 36 12.87 35 13.98 25 12.38

Analytics Ci Worldwide Flexible Fund of Funds 82 4.48 70 9.33 57 9.10 33 7.52 23 7.34 14 10.75 4 10.41

Anchor BCI Worldwide Flexible Fund 69 7.44 71 9.24 45 10.51 27 8.22 10 10.25

Aureus Nobilis BCI Worldwide Flexible Fund of Funds* 64 8.19 43 13.27 49 9.83

Autus Prime Worldwide Flexible Fund 52 10.56 55 11.78 59 8.94 42 5.97 28 6.05

BCI Best Blend Worldwide Flexible Fund 46 11.12 66 9.96 68 7.65 49 5.52

BCI Flexible Fund 5 24.09 40 13.68 46 10.39 16 9.79 24 7.30 15 10.62 3 10.42

BCI Worldwide Flexible Fund of Funds 39 12.50 30 14.78 39 11.06 25 8.31 19 8.27

BCI Worldwide Flexible Style Fund 73 7.04

BIP BCI Moderate Worldwide Flexible Fund 18 17.23

BIP BCI Worldwide Flexible Fund* 92 (1.00)

Blue Quadrant Worldwide Flexible Prescient Fund 1 93.48 3 26.97 36 11.56 4 11.85 11 9.90

Bovest BCI Worldwide Flexible Fund of Funds 30 13.31 31 14.77 43 10.56 34 7.51

Brenthurst BCI Worldwide Flexible Fund of Funds 68 7.64 50 12.29 40 10.80

Celtis BCI Flexible Fund of Funds 31 13.22 22 16.10 33 11.68 29 8.00

Chrome Ci Maximum Return Fund 37 12.64 33 14.51 20 12.87

Cinnabar SCI Worldwide Flexible Fund of Funds 76 5.99 53 12.12 47 10.31 37 6.66 25 7.01 16 9.43

Citadel Worldwide Flexible H4 Fund 63 8.36 62 10.72 61 8.87

Cohesive Capital Worldwide Flexible Prescient Fund 20 15.91 20 16.43 11 14.18 10 10.23

Consilium BCI Worldwide Flexible Fund 86 3.60 26 15.36 17 13.33 14 9.87 15 8.54 17 9.29

Cordatus Worldwide Flexible Prescient Fund 55 9.80 6 18.45 8 15.58 2 12.27 4 11.70

Cordatus Worldwide Flexible Prescient Fund of Funds 19 16.24 61 10.84 74 6.65 48 5.61 27 6.14

Corion Prime Worldwide Flexible Fund 54 10.13 47 12.74 48 10.06

Coronation Market Plus Fund* 3 24.89 34 14.09 54 9.56 32 7.61 26 6.93 13 11.22 1 15.04

Coronation Optimum Growth Fund* 93 (2.12) 51 12.27 14 13.83 5 11.12 6 10.65 1 15.94 2 13.37

Counterpoint SCI Worldwide Flexible Fund 80 4.65 86 (0.29) 82 (1.51) 59 2.05 31 (0.43) 19 4.86

Cratos BCI Worldwide Flexible Fund 47 10.95

CS BCI Worldwide Flexible Fund of Funds 85 3.85 56 11.76 42 10.69 20 9.22

Dinamika BCI Worldwide Flexible Fund* 25 14.09 45 12.89 58 8.99 44 5.94

Fairtree Worldwide Multi-Strategy Flexible Prescient Fund 72 7.23 73 8.61

Financial Fitness IP Flexible Fund of Funds 65 7.92 58 11.15 41 10.70 22 9.06

Fisher Dugmore Ci Worldwide Flexible Fund 62 8.53

Flagship IP Worldwide Flexible Fund 56 9.52 17 16.76 24 12.43 30 7.73 16 8.53 12 11.45

Flagship IP Worldwide Flexible Fund of Funds 83 4.46 29 14.93 32 11.76 19 9.43 5 10.77 8 14.03

FNB Growth Plus Fund of Funds 10 20.02 60 10.88 64 8.31 43 5.96

Foord Flexible Fund of Funds* 77 5.95 36 13.87 52 9.72 35 7.36 21 8.15 9 13.18

Fussell Ci Worldwide Flexible Fund 6 22.08

Ginsburg & Selby SCI Worldwide Flexible Fund 22 14.38 52 12.19 55 9.40

H4 Growth Fund 38 12.61 63 10.62 56 9.14 24 8.47

Harvard House BCI Worldwide Flexible Fund 78 5.05

Imalivest Sanlam Collective Investments WW Flexible Fund 48 10.83 82 6.08 71 7.15 40 6.06 14 8.57 6 14.32

Innovation BCI Worldwide Flexible Fund 43 11.25 15 16.83 34 11.66

Instit BCI Worldwide Equity Fund 44 11.19 23 15.93 27 12.12

Instit BCI Worldwide Flexible Fund 14 19.01 74 8.45 78 4.86

212 Profile’s Unit Trusts & Collective Investments — DOMESTIC