Page 156 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 156

CHAPTER 8

Performance fee hurdles affect the impact of performance fees on an investor’s net return. A

fund levying performance fees on all positive returns will take a larger share of profits that

one using inflation or an interest rate as a fee hurdle.

The high watermark principle is applied by some funds but not others.

How often the manager collects the performance fee can also impact fund returns. Most

funds extract fees quarterly or annually. A minority take performance fees monthly or

bi-annually.

Unlike unit trusts, which typically pay out repurchases within a few days, hedge funds

usually require a month’s notice from investors for withdrawal of funds.

Lock-ups (periods of time during which new investors may not withdraw capital) are

relatively uncommon in South Africa but are found amongst the more illiquid strategies

used by credit and structured finance funds.

The risk profiles of hedge funds vary significantly across strategies and are often very

different to those of other collective investments – investors and advisors need to be sure

they understand the risk implications before investing in hedge funds.

Classification of Hedge Funds

The ASISA Hedge Fund Classification Standard was published in September 2019 and was

effective from January 2020.

The Standard provides for four tiers of classification.

The first tier splits hedge fund portfolios into either Retail Investor or Qualified Investor

portfolios.

The second tier classifies hedge fund portfolios according to geographic exposure:

South African portfolios invest at least 60% of their assets in local markets.

Worldwide portfolios invest in both SA and foreign markets. There are no limits set for

either domestic or foreign assets.

Global portfolios invest at least 80% of their assets outside South Africa, with no

restriction on geographical concentration.

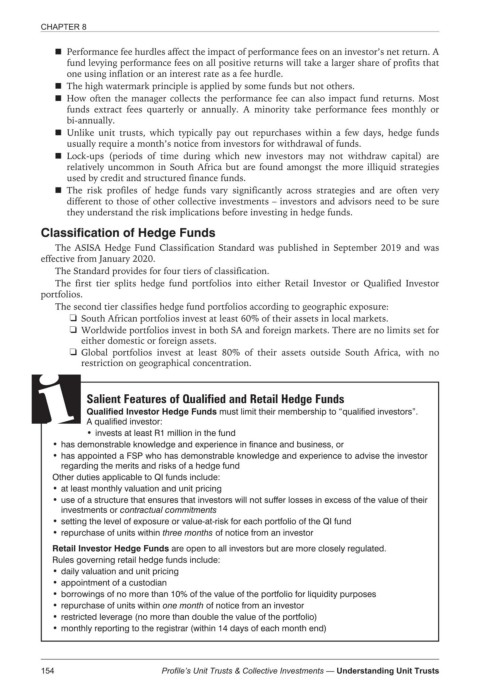

Salient Features of Qualified and Retail Hedge Funds

Qualified Investor Hedge Funds must limit their membership to “qualified investors”.

A qualified investor:

• invests at least R1 million in the fund

• has demonstrable knowledge and experience in finance and business, or

• has appointed a FSP who has demonstrable knowledge and experience to advise the investor

regarding the merits and risks of a hedge fund

Other duties applicable to QI funds include:

• at least monthly valuation and unit pricing

• use of a structure that ensures that investors will not suffer losses in excess of the value of their

investments or contractual commitments

• setting the level of exposure or value-at-risk for each portfolio of the QI fund

• repurchase of units within three months of notice from an investor

Retail Investor Hedge Funds are open to all investors but are more closely regulated.

Rules governing retail hedge funds include:

• daily valuation and unit pricing

• appointment of a custodian

• borrowings of no more than 10% of the value of the portfolio for liquidity purposes

• repurchase of units within one month of notice from an investor

• restricted leverage (no more than double the value of the portfolio)

• monthly reporting to the registrar (within 14 days of each month end)

154 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts