Page 51 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 51

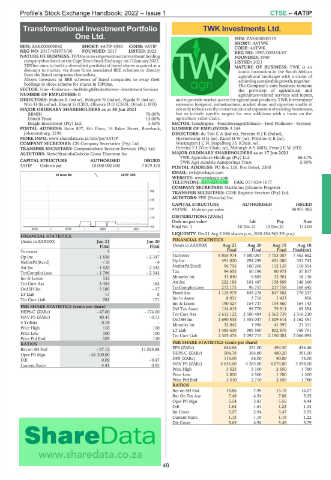

Profile’s Stock Exchange Handbook: 2022 – Issue 1 CTSE – 4ATIP

Transformational Investment Portfolio TWK Investments Ltd.

One Ltd. 4ATWK ISIN: ZAE400000119

4ATIP SHORT: 4ATWK

ISIN: ZAEZ00000042 SHORT: 4ATIP ONE CODE: 4ATIP CODE: 4ATWK

REG NO: 2017/458073/06 FOUNDED: 2017 LISTED: 2022 REG NO: 1997/003334/07

NATURE OF BUSINESS: TIPOne is an empowerment investment holding FOUNDED: 1940

companythatlistedontheCapeTownStockExchange on17January2022. LISTED: 2021

TIPOne aims to build a diversified portfolio of listed shares acquired at a NATURE OF BUSINESS: TWK is an

discount to market, via those firms associated BEE schemes or directly iconic institution in the South African

from the listed companies themselves. agricultural landscape with a vision of

Allows investors in BEE schemes of listed companies to swap their achieving sustainablegrowth,together.

holdings in those scheme for shares in TIPOne. The Company’s core business remains

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services the provision of agricultural and

NUMBER OF EMPLOYEES: 0 agriculture-related services and inputs,

DIRECTORS: Mahura K (ind ne), Mokgele N (ind ne), Ngada N (ind ne), and to provide market access for agricultural products. TWK Investments’

Ntoi H (ld ind ne), Blount G (CIO), Oliveira D D (CEO), Ditodi L (FD) extensive footprint, infrastructure, market share and expertise enable it

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 not only to focus on the conservation and expansion of existing businesses,

BBMIH 70.00% but to include specific targets for new additions with a focus on the

Ditodi Trust 13.00% agriculture value chain.

Beagle Investment (Pty) Ltd. 3.50% SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

POSTAL ADDRESS: Suite 807, 8th Floor, 16 Baker Street, Rosebank, NUMBER OF EMPLOYEES: 3 184

Johannesburg, 2196 DIRECTORS: du ToitCA(ind ne), FerreiraHJK(ind ne),

MORE INFO: www.sharedata.co.za/sdo/jse/4ATIP HiestermannHG(ne), KuselHW(ne), PrinslooGB(ne),

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. WartingtonJCN, Stapelberg J S (Chair, ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ferreira T I (Vice Chair, ne), Myburgh A S (MD), FivazJEW (FD)

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc. MAJOR ORDINARY SHAREHOLDERS as at 17 Jun 2021

TWK Agriculture Holdings (Pty) Ltd. 66.41%

CAPITAL STRUCTURE AUTHORISED ISSUED TWK Agri Aandele Aansporings Trust 5.95%

4ATIP Ords no par 10 000 000 000 7 879 370 POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

EMAIL: twk@twkagri.com

40 Week MA ZXTIP ONE

WEBSITE: www.twkagri.com

TELEPHONE: 017-824-1000 FAX: 017-824-1077

COMPANY SECRETARY: Marthinus Johannes Potgieter

162

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: PFK (Pretoria) Inc.

146

CAPITAL STRUCTURE AUTHORISED ISSUED

131 4ATWK Ords no par value - 38 951 986

DISTRIBUTIONS [ZARc]

115

Ords no par value Ldt Pay Amt

100 Final No 1 10 Dec 21 13 Dec 21 114.00

2018 | 2019 | 2020 | 2021

LIQUIDITY: Dec21 Avg 2 086 shares p.w., R80 454.9(0.3% p.a.)

FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 FINANCIAL STATISTICS

Final Final (Amts in ZAR'000) Aug 21 Aug 20 Aug 19 Aug 18

Turnover 3 - Final Final Final Final(rst)

Op Inc - 1 836 - 2 347 Turnover 8 855 974 7 680 067 7 753 007 7 463 662

NetIntPd(Rcvd) - 16 - 4 Op Inc 491 020 294 299 431 080 331 743

AttInc -1820 -2343 NetIntPd(Rcvd) 96 756 100 206 112 139 110 554

TotCompIncLoss - 1 796 - 2 343 Tax 94 655 50 196 80 973 57 817

Inv & Loans 532 - Minority Int 33 840 6 885 32 901 18 136

Att Inc 222 183 101 487 158 899 140 360

Tot Curr Ass 3 454 162

Ord SH Int 3 186 - 17 TotCompIncLoss 272 175 96 757 217 758 169 645

LT Liab 17 8 Fixed Ass 1 115 979 845 276 847 382 770 237

Tot Curr Liab 783 171 Inv in Assoc 8 031 3 716 1 433 856

Inv & Loans 190 527 154 737 154 860 164 143

PER SHARE STATISTICS (cents per share)

Def Tax Asset 114 615 98 770 79 911 63 354

HEPS-C (ZARc) - 47.00 - 174.00 Tot Curr Ass 2 612 122 2 500 484 2 562 739 2 516 230

NAV PS (ZARc) 40.43 - 0.73 Ord SH Int 1 690 533 1 354 047 1 309 614 1 162 451

3 Yr Beta 0.18 - Minority Int 32 045 1 996 41 995 21 331

Price High 110 110 LT Liab 1 485 630 989 560 802 876 768 791

Price Low 100 100 Tot Curr Liab 2 305 476 2 092 715 2 150 081 2 066 095

Price Prd End 105 110

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH Fnd - 57.12 11 025.88 EPS (ZARc) 644.66 321.00 494.30 434.46

Oper Pft Mgn - 61 200.00 - HEPS-C (ZARc) 504.78 384.80 480.20 391.00

D:E 0.09 - 0.47 DPS (ZARc) 114.00 65.00 90.00 75.00

Current Ratio 4.41 0.95 NAV PS (ZARc) 4 636.00 4 283.00 4 074.00 3 598.00

Price High 3 525 3 100 2 650 1 780

Price Low 2 850 2 500 1 780 1 300

Price Prd End 3 510 2 710 2 650 1 780

RATIOS

Ret on SH Fnd 14.86 7.99 14.19 12.07

Ret On Tot Ass 7.48 4.54 7.88 5.35

Oper Pft Mgn 5.54 3.83 5.56 4.44

D:E 1.64 1.61 1.23 1.33

Int Cover 5.07 2.94 3.47 2.95

Current Ratio 1.13 1.19 1.19 1.22

Div Cover 5.65 4.94 5.49 5.79

49