Page 48 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 48

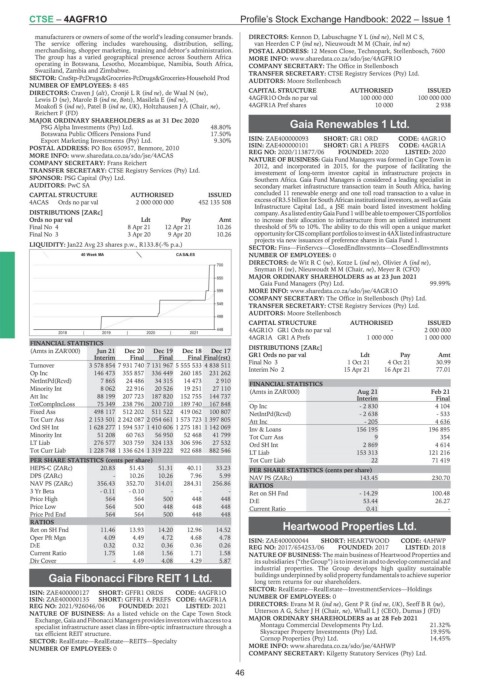

CTSE – 4AGFR1O Profile’s Stock Exchange Handbook: 2022 – Issue 1

manufacturers or owners of some of the world’s leading consumer brands. DIRECTORS: Kennon D, LabuschagneYL(ind ne), NellMCS,

The service offering includes warehousing, distribution, selling, van HeerdenCP(ind ne), Nieuwoudt M M (Chair, ind ne)

merchandising, shopper marketing, training and debtor’s administration. POSTAL ADDRESS: 12 Meson Close, Technopark, Stellenbosch, 7600

The group has a varied geographical presence across Southern Africa MORE INFO: www.sharedata.co.za/sdo/jse/4AGFR1O

operating in Botswana, Lesotho, Mozambique, Namibia, South Africa, COMPANY SECRETARY: The Office in Stellenbosch

Swaziland, Zambia and Zimbabwe. TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

SECTOR: CnsStp-PcDrugs&Groceries-PcDrugs&Groceries-Household Prod AUDITORS: Moore Stellenbosch

NUMBER OF EMPLOYEES: 8 485

DIRECTORS: Craven J (alt), CronjéLR(ind ne), de Waal N (ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Lewis D (ne), Marole B (ind ne, Bots), Masilela E (ind ne), 4AGFR1O Ords no par val 100 000 000 100 000 000

Moakofi S (ind ne), Patel B (ind ne, UK), Holtzhausen J A (Chair, ne), 4AGFR1A Pref shares 10 000 2 938

Reichert F (FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

PSG Alpha Investments (Pty) Ltd. 48.80% Gaia Renewables 1 Ltd.

Botswana Public Officers Pensions Fund 17.50% 4AGR1O

Export Marketing Investments (Pty) Ltd. 9.30% ISIN: ZAE400000093 SHORT: GR1 ORD CODE: 4AGR1O

POSTAL ADDRESS: PO Box 650957, Benmore, 2010 ISIN: ZAE400000101 SHORT: GR1 A PREFS CODE: 4AGR1A

FOUNDED: 2020

REG NO: 2020/113877/06

LISTED: 2020

MORE INFO: www.sharedata.co.za/sdo/jse/4ACAS

COMPANY SECRETARY: Frans Reichert NATURE OF BUSINESS: Gaia Fund Managers was formed in Cape Town in

2012, and incorporated in 2015, for the purpose of facilitating the

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. investement of long-term investor capital in infrastructure projects in

SPONSOR: PSG Capital (Pty) Ltd. Southern Africa. Gaia Fund Managers is considered a leading specialist in

AUDITORS: PwC SA secondary market infrastructure transaction team in South Africa, having

CAPITAL STRUCTURE AUTHORISED ISSUED concluded 11 renewable energy and one toll road transaction to a value in

4ACAS Ords no par val 2 000 000 000 452 135 508 excess of R3.5 billion for South African institutional investors, as well as Gaia

Infrastructure Capital Ltd., a JSE main board listed investment holding

DISTRIBUTIONS [ZARc] company.AsalistedentityGaiaFund1willbeabletoempowerCISportfolios

Ords no par val Ldt Pay Amt to increase their allocation to infrastructure from an unlisted instrument

Final No 4 8 Apr 21 12 Apr 21 10.26 threshold of 5% to 10%. The ability to do this will open a unique market

Final No 3 3 Apr 20 9 Apr 20 10.26 opportunityforCIScompliantportfoliostoinvestin4AXlistedinfrastructure

projects via new issuances of preference shares in Gaia Fund 1.

LIQUIDITY: Jan22 Avg 23 shares p.w., R133.8(-% p.a.)

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

40 Week MA CA SALES NUMBER OF EMPLOYEES: 0

DIRECTORS: de WitRC(ne), Kotze L (ind ne), Olivier A (ind ne),

700

Snyman H (ne), Nieuwoudt M M (Chair, ne), Meyer R (CFO)

650 MAJOR ORDINARY SHAREHOLDERS as at 23 Jun 2021

Gaia Fund Managers (Pty) Ltd. 99.99%

599 MORE INFO: www.sharedata.co.za/sdo/jse/4AGR1O

COMPANY SECRETARY: The Office in Stellenbosch (Pty) Ltd.

549

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

AUDITORS: Moore Stellenbosch

498

CAPITAL STRUCTURE AUTHORISED ISSUED

448 4AGR1O GR1 Ords no par val - 2 000 000

2018 | 2019 | 2020 | 2021

4AGR1A GR1 A Prefs 1 000 000 1 000 000

FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 DISTRIBUTIONS [ZARc]

Interim Final Final Final Final(rst) GR1 Ords no par val Ldt Pay Amt

Turnover 3 578 854 7 931 740 7 131 967 5 555 533 4 838 511 Final No 3 1 Oct 21 4 Oct 21 30.99

Op Inc 146 473 355 857 336 449 260 185 231 262 Interim No 2 15 Apr 21 16 Apr 21 77.01

NetIntPd(Rcvd) 7 865 24 486 34 315 14 473 2 910 FINANCIAL STATISTICS

Minority Int 8 062 22 916 20 526 19 251 27 110 (Amts in ZAR'000) Aug 21 Feb 21

Att Inc 88 199 207 723 187 820 152 755 144 737 Interim Final

TotCompIncLoss 75 349 238 796 200 710 189 740 167 848 Op Inc - 2 830 4 104

Fixed Ass 498 117 512 202 511 522 419 062 100 807 NetIntPd(Rcvd) - 2 638 - 533

Tot Curr Ass 2 153 501 2 242 087 2 054 661 1 573 723 1 397 805 Att Inc - 205 4 636

Ord SH Int 1 628 277 1 594 537 1 410 606 1 275 181 1 142 069 Inv & Loans 156 195 196 895

Minority Int 51 208 60 763 56 950 52 468 41 799 Tot Curr Ass 9 354

LT Liab 276 577 303 759 324 133 306 596 27 532 Ord SH Int 2 869 4 614

Tot Curr Liab 1 228 748 1 336 624 1 319 222 922 688 882 546 LT Liab 153 313 121 216

PER SHARE STATISTICS (cents per share) Tot Curr Liab 22 71 419

HEPS-C (ZARc) 20.83 51.43 51.31 40.11 33.23 PER SHARE STATISTICS (cents per share)

DPS (ZARc) - 10.26 10.26 7.96 5.99

NAV PS (ZARc) 143.45 230.70

NAV PS (ZARc) 356.43 352.70 314.01 284.31 256.86 RATIOS

3 Yr Beta - 0.11 - 0.10 - - - Ret on SH Fnd - 14.29 100.48

Price High 564 564 500 448 448 D:E 53.44 26.27

Price Low 564 500 448 448 448 Current Ratio 0.41 -

Price Prd End 564 564 500 448 448

RATIOS

Ret on SH Fnd 11.46 13.93 14.20 12.96 14.52 Heartwood Properties Ltd.

4AHWP

Oper Pft Mgn 4.09 4.49 4.72 4.68 4.78 ISIN: ZAE400000044 SHORT: HEARTWOOD CODE: 4AHWP

D:E 0.32 0.32 0.36 0.36 0.26 REG NO: 2017/654253/06 FOUNDED: 2017 LISTED: 2018

Current Ratio 1.75 1.68 1.56 1.71 1.58 NATURE OF BUSINESS: The main business of Heartwood Properties and

Div Cover - 4.49 4.08 4.29 5.87 itssubsidiaries (“theGroup”)istoinvestinandtodevelopcommercial and

industrial properties. The Group develops high quality sustainable

Gaia Fibonacci Fibre REIT 1 Ltd. buildings underpinned by solid property fundamentals to achieve superior

long term returns for our shareholders.

4AGFR1O SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

ISIN: ZAE400000127 SHORT: GFFR1 ORDS CODE: 4AGFR1O

ISIN: ZAE400000135 SHORT: GFFR1 A PREFS CODE: 4AGFR1A NUMBER OF EMPLOYEES: 0

REG NO: 2021/926046/06 FOUNDED: 2021 LISTED: 2021 DIRECTORS: EvansMR(ind ne), GentPR(ind ne, UK), SeeffBR(ne),

NATURE OF BUSINESS: As a listed vehicle on the Cape Town Stock Utterson A G, Scher J H (Chair, ne), Whall L J (CEO), Dumas J (FD)

Exchange,GaiaandFibonacciManagersprovidesinvestorswithaccesstoa MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

specialist infrastructure asset class in fibre-optic infrastructure through a Montagu Commercial Developments Pty Ltd. 21.32%

tax efficient REIT structure. Skyscraper Property Investments (Pty) Ltd. 19.95%

SECTOR: RealEstate—RealEstate—REITS—Specialty Cornop Properties (Pty) Ltd. 14.45%

NUMBER OF EMPLOYEES: 0 MORE INFO: www.sharedata.co.za/sdo/jse/4AHWP

COMPANY SECRETARY: Kilgetty Statutory Services (Pty) Ltd.

46