Page 71 - SHB 2021 Issue 4

P. 71

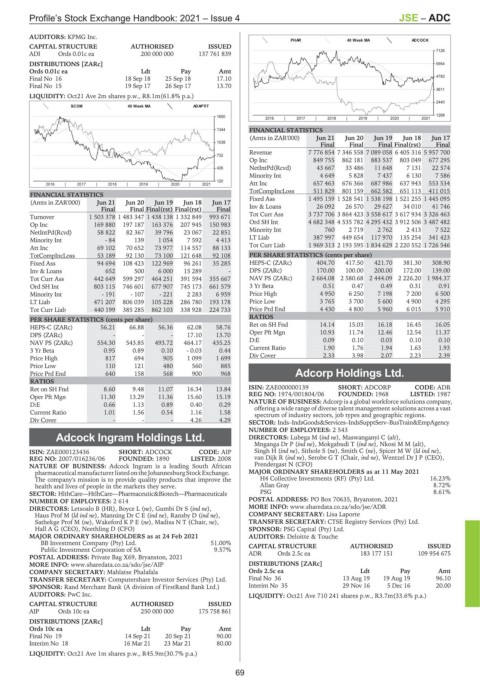

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – ADC

AUDITORS: KPMG Inc.

PHAR 40 Week MA ADCOCK

CAPITAL STRUCTURE AUTHORISED ISSUED

7126

ADI Ords 0.01c ea 200 000 000 137 761 839

DISTRIBUTIONS [ZARc] 5954

Ords 0.01c ea Ldt Pay Amt

Final No 16 18 Sep 18 25 Sep 18 17.10 4783

Final No 15 19 Sep 17 26 Sep 17 13.70

3611

LIQUIDITY: Oct21 Ave 2m shares p.w., R8.1m(61.8% p.a.)

2440

SCOM 40 Week MA ADAPTIT

1650 1268

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1344 FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

1038

Final Final Final Final(rst) Final

Revenue 7 776 854 7 346 558 7 089 058 6 405 316 5 957 700

732

Op Inc 849 755 862 181 883 537 803 049 677 295

426 NetIntPd(Rcvd) 43 667 33 486 11 648 7 131 22 574

Minority Int 4 649 5 828 7 437 6 130 7 586

120 Att Inc 657 463 676 366 687 986 637 943 553 534

2016 | 2017 | 2018 | 2019 | 2020 | 2021

TotCompIncLoss 511 829 801 159 662 582 651 113 411 015

FINANCIAL STATISTICS Fixed Ass 1 495 159 1 528 541 1 538 198 1 521 255 1 445 095

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final(rst) Final Inv & Loans 26 092 26 570 29 627 34 010 41 746

Turnover 1 503 378 1 483 347 1 438 138 1 332 849 993 671 Tot Curr Ass 3 737 706 3 864 423 3 558 617 3 617 934 3 326 463

Ord SH Int 4 682 348 4 535 782 4 295 432 3 912 506 3 487 482

Op Inc 169 880 197 187 163 376 207 945 150 983

NetIntPd(Rcvd) 58 822 82 367 39 796 23 067 22 851 Minority Int 760 2 719 2 762 2 413 7 522

Minority Int - 84 139 1 054 7 592 4 413 LT Liab 387 997 449 654 117 970 135 254 341 423

Att Inc 69 102 70 652 73 977 114 557 88 133 Tot Curr Liab 1 969 313 2 193 595 1 834 629 2 220 552 1 726 546

TotCompIncLoss 53 189 92 130 73 100 121 648 92 108 PER SHARE STATISTICS (cents per share)

Fixed Ass 94 694 108 423 122 969 96 261 35 285 HEPS-C (ZARc) 404.70 417.50 421.70 381.30 308.90

Inv & Loans 652 500 6 000 15 289 - DPS (ZARc) 170.00 100.00 200.00 172.00 139.00

Tot Curr Ass 442 649 599 297 464 251 391 594 355 667 NAV PS (ZARc) 2 664.08 2 580.68 2 444.09 2 226.20 1 984.37

Ord SH Int 803 115 746 601 677 907 745 173 661 579 3 Yr Beta 0.51 0.47 0.49 0.31 0.91

Minority Int - 191 - 107 - 221 2 283 6 959 Price High 4 950 6 250 7 198 7 200 6 500

LT Liab 471 207 806 039 105 228 286 780 193 178 Price Low 3 765 3 700 5 600 4 900 4 295

Tot Curr Liab 440 199 385 285 862 103 338 928 224 733 Price Prd End 4 430 4 800 5 960 6 015 5 910

RATIOS

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 56.21 66.88 56.36 62.08 58.76 Ret on SH Fnd 14.14 15.03 16.18 16.45 16.05

DPS (ZARc) - - - 17.10 13.70 Oper Pft Mgn 10.93 11.74 12.46 12.54 11.37

NAV PS (ZARc) 554.30 543.85 493.72 464.17 435.25 D:E 0.09 0.10 0.03 0.10 0.10

3 Yr Beta 0.95 0.89 0.10 - 0.03 0.44 Current Ratio 1.90 1.76 1.94 1.63 1.93

Price High 817 694 905 1 099 1 699 Div Cover 2.33 3.98 2.07 2.23 2.39

Price Low 110 121 480 560 885

Price Prd End 640 158 568 900 968 Adcorp Holdings Ltd.

RATIOS ADC

Ret on SH Fnd 8.60 9.48 11.07 16.34 13.84 ISIN: ZAE000000139 SHORT: ADCORP CODE: ADR

Oper Pft Mgn 11.30 13.29 11.36 15.60 15.19 REG NO: 1974/001804/06 FOUNDED: 1968 LISTED: 1987

D:E 0.66 1.13 0.89 0.40 0.29 NATURE OF BUSINESS: Adcorp is a global workforce solutions company,

offering a wide range of diverse talent management solutions across a vast

Current Ratio 1.01 1.56 0.54 1.16 1.58 spectrum of industry sectors, job types and geographic regions.

Div Cover - - - 4.26 4.29 SECTOR: Inds–IndsGoods&Services–IndsSupptServ–BusTrain&EmpAgency

NUMBER OF EMPLOYEES: 2 543

Adcock Ingram Holdings Ltd. DIRECTORS: Lubega M (ind ne), Maswanganyi C (alt),

Mnganga Dr P (ind ne), Mokgabudi T (ind ne), NkosiMM(alt),

ADC

ISIN: ZAE000123436 SHORT: ADCOCK CODE: AIP Singh H (ind ne), Sithole S (ne), Smith C (ne), SpicerMW(ld ind ne),

REG NO: 2007/016236/06 FOUNDED: 1890 LISTED: 2008 van Dijk R (ind ne), Serobe G T (Chair, ind ne), Wentzel Dr J P (CEO),

NATURE OF BUSINESS: Adcock Ingram is a leading South African Prendergast N (CFO)

pharmaceutical manufacturerlistedontheJohannesburgStockExchange. MAJOR ORDINARY SHAREHOLDERS as at 11 May 2021

The company's mission is to provide quality products that improve the H4 Collective Investments (RF) (Pty) Ltd. 16.23%

health and lives of people in the markets they serve. Allan Gray 8.72%

SECTOR: HlthCare—HtlhCare—Pharmaceutic&Biotech—Pharmaceuticals PSG 8.61%

NUMBER OF EMPLOYEES: 2 614 POSTAL ADDRESS: PO Box 70635, Bryanston, 2021

DIRECTORS: Letsoalo B (HR), Boyce L (ne), Gumbi Dr S (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/ADR

Haus Prof M (ld ind ne), Manning DrCE(ind ne), Ransby D (ind ne), COMPANY SECRETARY: Lisa Laporte

Sathekge Prof M (ne), WakefordKPE(ne), Madisa N T (Chair, ne), TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

Hall A G (CEO), Neethling D (CFO) SPONSOR: PSG Capital (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 24 Feb 2021 AUDITORS: Deloitte & Touche

BB Investment Company (Pty) Ltd. 51.00% CAPITAL STRUCTURE AUTHORISED ISSUED

Public Investment Corporation of SA 9.57% ADR Ords 2.5c ea 183 177 151 109 954 675

POSTAL ADDRESS: Private Bag X69, Bryanston, 2021

MORE INFO: www.sharedata.co.za/sdo/jse/AIP DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Mahlatse Phalafala Ords 2.5c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 36 13 Aug 19 19 Aug 19 96.10

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Interim No 35 29 Nov 16 5 Dec 16 20.00

AUDITORS: PwC Inc. LIQUIDITY: Oct21 Ave 710 241 shares p.w., R3.7m(33.6% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

AIP Ords 10c ea 250 000 000 175 758 861

DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

Final No 19 14 Sep 21 20 Sep 21 90.00

Interim No 18 16 Mar 21 23 Mar 21 80.00

LIQUIDITY: Oct21 Ave 1m shares p.w., R45.9m(30.7% p.a.)

69