Page 36 - SHB 2021 Issue 4

P. 36

NSX – ORY Profile’s Stock Exchange Handbook: 2021 – Issue 4

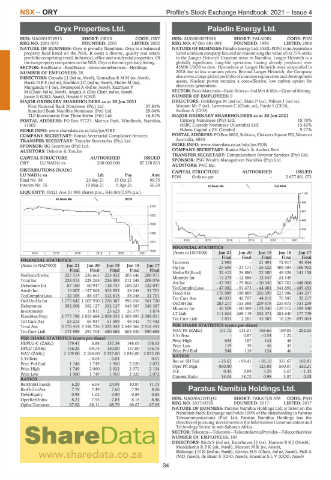

Oryx Properties Ltd. Paladin Energy Ltd.

ORY PDN

ISIN: NA0001574913 SHORT: ORYX CODE: ORY ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002 REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008

NATURE OF BUSINESS: Oryx is proudly Namibian. Oryx is a balanced NATURE OF BUSINESS: Paladin Energy Ltd. (ASX: PDN) is an Australian

property fund listed on the NSX. It owns a diverse, quality real estate listed uranium company focused on maximising the value of its 75% stake

portfolio comprising retail, industrial, office and residential properties. Of in the Langer Heinrich Uranium mine in Namibia. Langer Heinrich is a

thetwopropertycompaniesontheNSX,Oryxistheonlyprimarylisting. globally significant, long-life operation, having already produced over

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings 43Mlb U3O8 to date. Operations at Langer Heinrich were suspended in

NUMBER OF EMPLOYEES: 28 2018 due to low uranium prices. Beyond Langer Heinrich, the Company

DIRECTORS: ComalieJJ(ind ne, Namb), GomachasRMM(ne, Namb), also owns a large global portfolio of uranium exploration and development

Harris N B S (ind ne), Kuehhirt J C (ind ne, Namb), Muller M (ne), assets. Nuclear power remains a cost-effective, low carbon option for

Mungunda V J (ne), Swanepoel A (ind ne, Namb), Kazmaier P electricity generation.

M(Chair, ind ne, Namb), Angula A (Dep Chair, ind ne, Namb), SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

Jooste B (CEO, Namb), Heunis F (CFO) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 DIRECTORS: Holzberger M (ind ne), Main P (ne), Palmer J (ind ne),

First National Bank Nominees (Pty) Ltd. 37.83% Watson Mr P (ne), Lawrenson C (Chair, ne), Purdy I (CEO),

Standard Bank Namibia Nominees (Pty) Ltd. 29.04% Sudlow A (CFO)

TLP Investments One Three Seven (Pty) Ltd. 16.81% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek, Namibia, Citicorp Nominees (Pty) Ltd. 18.70%

11002 HSBC Custody Nominees (Australia) Ltd. 15.82%

MORE INFO: www.sharedata.co.za/sdo/jse/ORY Ndovu Capital x BV (Tembo) 9.77%

COMPANY SECRETARY: Bonsai Secretarial Compliance Services POSTAL ADDRESS: PO Box 8062, Subiaco, Cloisters Square PO, Western

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. Australia, 6850

SPONSOR: IJG Securities (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/PDN

AUDITORS: Deloitte & Touche COMPANY SECRETARY: Ranko Matic & Andrea Betti

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

ORY LU NAD1c ea 200 000 000 87 378 835

AUDITORS: PwC Inc.

DISTRIBUTIONS [NADc] CAPITAL STRUCTURE AUTHORISED ISSUED

LU NAD1c ea Ldt Pay Amt PDN Ords no par - 2 677 891 071

Final No 36 23 Sep 21 15 Oct 21 99.75

Interim No 35 19 Mar 21 9 Apr 21 56.50 40 Week MA PALADIN

LIQUIDITY: Oct21 Ave 31 995 shares p.w., R43.8m(1.9% p.a.) 1108

40 Week MA ORYX

895

2154

681

1923

468

1692

254

1462

41

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1231

FINANCIAL STATISTICS

1000 (Amts in USD'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Final Final Final Final Final

FINANCIAL STATISTICS Turnover 2 985 - 21 491 72 917 95 844

(Amts in NAD'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Op Inc - 25 695 - 21 171 - 26 622 408 384 - 306 902

Final Final Final Final Final

49 326

32 412

24 880

22 500

NetRent/InvInc 227 514 226 663 223 432 203 646 200 971 NetIntPd(Rcvd) - 14 275 - 12 586 - 12 647 - 24 349 141 158 -

Minority Int

Total Inc 228 013 228 265 226 383 211 248 208 076 Att Inc - 43 983 - 79 866 - 30 345 367 762 - 448 060

Debenture Int 87 160 60 947 118 757 108 027 122 047

Attrib Inc 10 007 - 157 568 303 052 38 248 31 701 TotCompIncLoss - 47 082 - 91 473 - 44 481 341 692 - 485 453

Fixed Ass

223 986

190 889

206 599

244 297

178 089

TotCompIncLoss - 32 105 - 88 437 312 815 38 248 31 701 Tot Curr Ass 40 021 42 707 44 816 70 587 55 217

Ord UntHs Int 1 175 845 1 207 950 1 296 387 996 658 961 720 Ord SH Int 283 217 153 388 209 678 235 873 - 331 259

Debentures 392 008 392 127 392 127 349 387 349 387

Investments - 11 811 23 623 26 379 1 874 Minority Int - 36 509 - 60 389 - 133 040 - 129 112 - 104 540

269 119

111 604

252 471

284 640

177 739

LT Liab

FixedAss/Prop 2 775 798 2 855 684 2 858 053 2 509 995 2 389 011 Tot Curr Liab 2 851 2 281 45 587 18 220 697 004

Tot Curr Ass 53 215 65 937 51 599 48 042 77 443

Total Ass 3 176 414 3 358 726 3 322 343 2 648 366 2 518 453 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 171 599 291 708 480 065 604 930 590 685 NAV PS (ZARc) 151.72 131.01 168.66 189.05 - 252.55

3 Yr Beta - 0.87 - 0.54 1.22 -

PER SHARE STATISTICS (cents per share) Price High 635 187 142 46 -

HEPLU-C (ZARc) 179.41 3.88 137.34 148.03 158.63

46

39

DPLU (ZARc) 156.25 69.75 150.00 157.00 156.75 Price Low 119 119 124 43 - -

548

46

Price Prd End

NAV (ZARc) 2 109.00 2 188.00 2 337.00 2 043.00 2 032.00 RATIOS

3 Yr Beta - - 0.05 - 0.04 - 0.01 Ret on SH Fnd - 23.61 - 99.41 - 56.10 321.67 102.81

Price Prd End 1 146 1 749 1 950 2 020 2 072

Price High 1 749 2 060 2 022 2 072 2 154 Oper Pft Mgn - 860.80 2.89 - - 123.88 560.07 - 320.21

- 1.32

2.67

D:E

0.45

3.29

Price Low 1 000 1 749 1 950 2 020 2 072 Current Ratio 14.04 18.72 0.98 3.87 0.08

RATIOS

RetOnSH Funds 6.20 - 6.04 24.98 10.87 11.73

RetOnTotAss 7.79 7.49 7.60 7.98 8.26 Paratus Namibia Holdings Ltd.

Debt:Equity 0.95 1.02 0.90 0.89 0.84 PNH

OperRetOnInv 8.21 7.95 7.84 8.18 8.46 ISIN: NA000A2DTQ42 SHORT: PARATUS NM CODE: PNH

OpInc:Turnover 67.62 68.11 68.79 66.67 67.65 REG NO: 2017/0558 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: Paratus Namibia Holdings Ltd. is listed on the

Namibian Stock Exchange and holds 100% of the shareholding in Paratus

Telecommunications (Pty) Ltd. Paratus Namibia Holdings has the

objective of pursuing investments in the Information Communication and

Technology Sector in sub-Saharan Africa.

SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

NUMBER OF EMPLOYEES: 189

DIRECTORS: Birch S (ind ne), EsterhuyseJJ(ne), HarmseBRJ(Namb),

MendelsohnRPK(alt, Namb), MostertMR(ne, Namb),

ShikongoJNN(ind ne, Namb), Gerdes H B (Chair, ind ne, Namb), Hall A

(MD, Namb), de Bruin S (CFO, Namb), ErasmusSLV (COO, Namb)

34