Page 32 - SHB 2021 Issue 4

P. 32

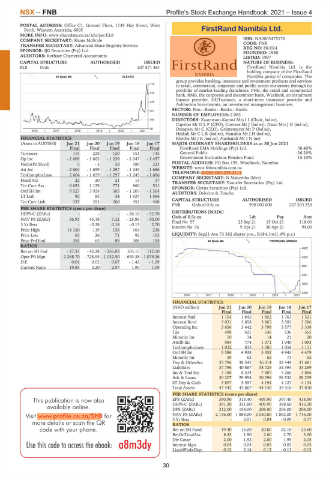

NSX – FNB Profile’s Stock Exchange Handbook: 2021 – Issue 4

POSTAL ADDRESS: Office C1, Ground Floor, 1139 Hay Street, West

Perth, Western Australia, 6005 FirstRand Namibia Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/EL8 FNB

COMPANY SECRETARY: Shane McBride ISIN: NA0003475176

TRANSFER SECRETARY: Advanced Share Registry Services CODE: FNB

REG NO: 88/024

SPONSOR: IJG Securities (Pty) Ltd. FOUNDED: 1988

AUDITORS: Rothsay Chartered Accountants LISTED: 1997

CAPITAL STRUCTURE AUTHORISED ISSUED NATURE OF BUSINESS:

EL8 Ords - 207 871 461 FirstRand Namibia Ltd. is the

holding company of the FirstRand

40 Week MA ELEVATE Namibia group of companies. The

group provides banking, insurance and investment products and services

714

to retail, commercial, corporate and public sector customers through its

portfolio of market-leading franchises; FNB, the retail and commercial

576

bank, RMB, the corporate and investment bank, WesBank, an instalment

finance provider, OUTsurance, a short-term insurance provider and

439

Ashburton Investments, an investment management business.

SECTOR: Fins—Banks—Banks—Banks

301

NUMBER OF EMPLOYEES: 2 085

164 DIRECTORS: Zaamwani-Kamwi Mrs I I (Chair, ind ne),

Capelao MrOLP (CFO), Coetzee Mr J (ind ne), Daun MrsJG(ind ne),

26 Dempsey Mr C (CEO), Grüttemeyer Mr P (ind ne),

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Haikali MrCLR(ind ne), Hausiku MrJH(ind ne),

FINANCIAL STATISTICS Khethe MrJR(ind ne), Nashandi MrIN(ne)

(Amts in AUD'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

Final Final Final Final Final FirstRand EMA Holdings (Pty) Ltd. 58.40%

Turnover 115 228 120 151 135 General Public 26.20%

Op Inc - 2 609 - 1 662 - 1 239 - 1 047 - 1 457 Government Institutions Pension Fund 15.10%

NetIntPd(Rcvd) 5 - 3 58 189 223 POSTAL ADDRESS: PO Box 195, Windhoek, Namibia

Att Inc - 2 604 - 1 659 - 1 297 - 1 245 - 1 686 WEBSITE: www.fnbnamibia.com.na

TotCompIncLoss 2 604 - 1 659 - 1 297 - 1 245 - 1 686 TELEPHONE: 00264 061-299-2111

COMPANY SECRETARY: N Makemba (Mrs)

Fixed Ass 22 20 21 13 17

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

Tot Curr Ass 6 691 1 129 771 860 511 SPONSOR: Cirrus Securities (Pty) Ltd.

Ord SH Int 9 527 3 924 505 - 1 207 - 1 504 AUDITORS: Deloitte & Touche

LT Liab 92 82 34 1 627 1 564

Tot Curr Liab 337 353 260 453 468 CAPITAL STRUCTURE AUTHORISED ISSUED

FNB Ords of 0.5c ea 990 000 000 267 593 250

PER SHARE STATISTICS (cents per share)

DISTRIBUTIONS [NADc]

HEPS-C (ZARc) - - - - 26.10 - 52.70

Ldt

Pay

Amt

NAV PS (ZARc) 56.91 45.18 7.32 - 25.86 - 50.00 Ords of 0.5c ea 23 Sep 21 15 Oct 21 118.00

Final No 57

3 Yr Beta - - 0.38 0.18 - 0.15 2.70 Interim No 56 9 Apr 21 30 Apr 21 94.00

Price High 14 150 119 156 164 236

Price Low 63 26 71 92 103 LIQUIDITY: Sep21 Ave 73 382 shares p.w., R184.1m(1.4% p.a.)

Price Prd End 355 63 89 106 155 40 Week MA FIRSTRAND NAMIBIA

RATIOS

4802

Ret on SH Fnd - 27.33 - 42.28 - 256.83 103.15 112.10

Oper Pft Mgn - 2 268.70 - 728.95 - 1 032.50 - 693.38 - 1 079.26 4302

D:E 0.01 0.02 0.07 - 1.42 - 1.09

Current Ratio 19.85 3.20 2.97 1.90 1.09 3801

3301

2800

2300

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(NAD million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

Interest Paid 1 154 1 845 1 852 1 763 1 521

Interest Rcvd 3 031 3 858 3 865 3 583 3 286

Operating Inc 3 656 3 442 3 798 3 577 3 338

Tax 498 421 546 536 565

Minority Int 10 14 14 21 20

Attrib Inc 984 774 1 071 1 040 1 093

TotCompIncLoss 1 032 833 1 085 1 058 1 111

Ord SH Int 5 586 4 938 5 352 4 943 4 479

Minority Int 59 62 62 73 62

Dep & OtherAcc 35 796 38 545 36 314 32 444 31 681

Liabilities 37 796 40 867 38 726 34 394 33 269

Inv & Trad Sec 7 186 8 534 7 807 5 266 3 866

Adv & Loans 30 207 29 994 30 298 28 532 28 259

ST Dep & Cash 3 897 5 557 4 194 4 127 4 134

Total Assets 43 442 45 867 44 140 39 410 37 810

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 390.90 313.40 409.90 397.40 418.90

HEPS-C (ZARc) 391.20 331.80 409.90 398.60 416.20

DPS (ZARc) 212.00 154.00 208.00 204.00 204.00

NAV PS (ZARc) 2 136.00 1 888.00 2 050.00 1 892.00 1 716.00

3 Yr Beta - 0.01 0.04 - 0.09 0.17

RATIOS

Ret on SH Fund 19.40 16.00 20.80 22.10 25.60

RetOnTotalAss 8.43 1.90 2.60 2.70 3.00

Div Cover 2.00 1.92 2.00 1.95 2.05

Interest Mgn 0.04 0.04 0.05 0.05 0.05

LiquidFnds:Dep 0.12 0.14 0.12 0.13 0.13

30