Page 177 - SHB 2021 Issue 4

P. 177

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – NVE

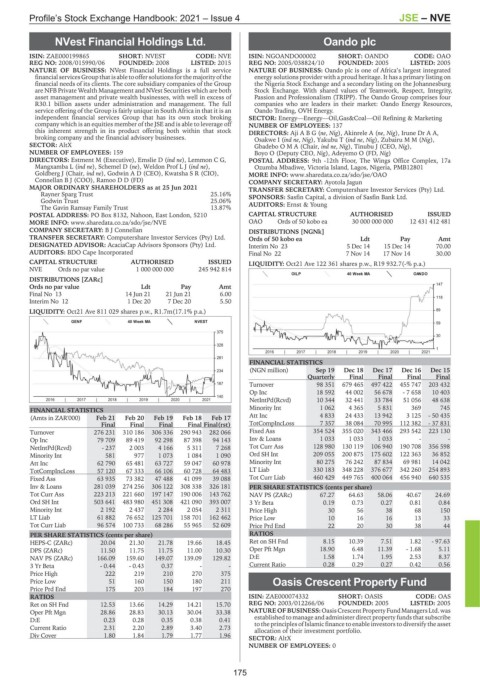

NVest Financial Holdings Ltd. Oando plc

NVE OAN

ISIN: ZAE000199865 SHORT: NVEST CODE: NVE ISIN: NGOANDO00002 SHORT: OANDO CODE: OAO

REG NO: 2008/015990/06 FOUNDED: 2008 LISTED: 2015 REG NO: 2005/038824/10 FOUNDED: 2005 LISTED: 2005

NATURE OF BUSINESS: NVest Financial Holdings is a full service NATURE OF BUSINESS: Oando plc is one of Africa’s largest integrated

financialservicesGroupthatisabletooffersolutionsforthemajorityofthe energy solutions provider with a proud heritage. It has a primary listing on

financial needs of its clients. The core subsidiary companies of the Group the Nigeria Stock Exchange and a secondary listing on the Johannesburg

are NFB Private Wealth Management and NVest Securities which are both Stock Exchange. With shared values of Teamwork, Respect, Integrity,

asset management and private wealth businesses, with well in excess of Passion and Professionalism (TRIPP). The Oando Group comprises four

R30.1 billion assets under administration and management. The full companies who are leaders in their market: Oando Energy Resources,

service offering of the Group is fairly unique in South Africa in that it is an Oando Trading, OVH Energy.

independent financial services Group that has its own stock broking SECTOR: Energy—Energy—Oil,Gas&Coal—Oil Refining & Marketing

company which is an equities member of the JSE and is able to leverage off NUMBER OF EMPLOYEES: 137

this inherent strength in its product offering both within that stock DIRECTORS: AjiABG(ne, Nig), Akinrele A (ne, Nig), Irune Dr A A,

broking company and the financial advisory businesses. Osakwe I (ind ne, Nig), Yakubu T (ind ne, Nig), ZubairuMM(Nig),

SECTOR: AltX GbadeboOMA (Chair, ind ne, Nig), Tinubu J (CEO, Nig),

NUMBER OF EMPLOYEES: 159 Boyo O (Deputy CEO, Nig), Adeyemo O (FD, Nig)

DIRECTORS: Estment M (Executive), Emslie D (ind ne), Lemmon C G, POSTAL ADDRESS: 9th -12th Floor, The Wings Office Complex, 17a

Mangxamba L (ind ne), Schemel D (ne), Weldon ProfLJ(ind ne), Ozumba Mbadiwe, Victoria Island, Lagos, Nigeria, PMB12801

Goldberg J (Chair, ind ne), Godwin A D (CEO), Kwatsha S R (CIO), MORE INFO: www.sharedata.co.za/sdo/jse/OAO

Connellan B J (COO), Ramoo D D (FD) COMPANY SECRETARY: Ayotola Jagun

MAJOR ORDINARY SHAREHOLDERS as at 25 Jun 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Rayner Sparg Trust 25.16% SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

Godwin Trust 25.06%

The Gavin Ramsay Family Trust 13.87% AUDITORS: Ernst & Young

POSTAL ADDRESS: PO Box 8132, Nahoon, East London, 5210 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/NVE OAO Ords of 50 kobo ea 30 000 000 000 12 431 412 481

COMPANY SECRETARY: B J Connellan DISTRIBUTIONS [NGNk]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords of 50 kobo ea Ldt Pay Amt

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. Interim No 23 5 Dec 14 15 Dec 14 70.00

AUDITORS: BDO Cape Incorporated Final No 22 7 Nov 14 17 Nov 14 30.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Oct21 Ave 122 361 shares p.w., R19 932.7(-% p.a.)

NVE Ords no par value 1 000 000 000 245 942 814

OILP 40 Week MA OANDO

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 147

Final No 13 14 Jun 21 21 Jun 21 6.00

118

Interim No 12 1 Dec 20 7 Dec 20 5.50

LIQUIDITY: Oct21 Ave 811 029 shares p.w., R1.7m(17.1% p.a.) 89

GENF 40 Week MA NVEST 59

375

30

328

1

2016 | 2017 | 2018 | 2019 | 2020 | 2021

281

FINANCIAL STATISTICS

234 (NGN million) Sep 19 Dec 18 Dec 17 Dec 16 Dec 15

Quarterly Final Final Final Final

187 Turnover 98 351 679 465 497 422 455 747 203 432

Op Inc 18 592 44 002 56 678 - 7 658 10 403

140

2016 | 2017 | 2018 | 2019 | 2020 | 2021 NetIntPd(Rcvd) 10 344 32 441 33 784 51 056 48 638

Minority Int 1 062 4 365 5 831 369 745

FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 Att Inc 4 833 24 433 13 942 3 125 - 50 435

Final Final Final Final Final(rst) TotCompIncLoss 7 357 38 084 70 995 112 382 - 37 831

Turnover 276 231 310 186 306 336 290 943 282 066 Fixed Ass 354 524 355 020 343 466 293 542 223 130

Op Inc 79 709 89 419 92 298 87 398 94 143 Inv & Loans 1 033 1 033 1 033 - -

NetIntPd(Rcvd) - 237 2 003 4 166 5 311 7 268 Tot Curr Ass 128 980 130 119 106 940 190 708 356 598

Minority Int 581 977 1 073 1 084 1 090 Ord SH Int 209 055 200 875 175 602 122 363 36 852

Att Inc 62 790 65 481 63 727 59 047 60 978 Minority Int 80 275 76 242 87 834 69 981 14 042

TotCompIncLoss 57 120 67 333 66 106 60 728 64 483 LT Liab 330 183 348 228 376 677 342 260 254 893

Fixed Ass 63 935 73 382 47 488 41 099 39 088 Tot Curr Liab 460 429 449 765 400 064 456 940 640 535

Inv & Loans 281 039 274 256 306 122 308 338 326 181 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 223 213 221 660 197 147 190 006 143 762 NAV PS (ZARc) 67.27 64.63 58.06 40.67 24.69

Ord SH Int 503 641 483 980 451 308 421 090 393 007 3 Yr Beta 0.19 0.73 0.27 0.81 0.84

Minority Int 2 192 2 437 2 284 2 054 2 311 Price High 30 56 38 68 150

LT Liab 61 882 76 652 125 701 158 701 162 462 Price Low 10 16 16 13 33

Tot Curr Liab 96 574 100 733 68 286 55 965 52 609 Price Prd End 22 20 30 38 44

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 20.04 21.30 21.78 19.66 18.45 Ret on SH Fnd 8.15 10.39 7.51 1.82 - 97.63

DPS (ZARc) 11.50 11.75 11.75 11.00 10.30 Oper Pft Mgn 18.90 6.48 11.39 - 1.68 5.11

NAV PS (ZARc) 166.09 159.60 149.07 139.09 129.82 D:E 1.58 1.74 1.95 2.53 8.37

3 Yr Beta - 0.44 - 0.43 0.37 - - Current Ratio 0.28 0.29 0.27 0.42 0.56

Price High 222 219 210 270 375

Price Low 51 160 150 180 211 Oasis Crescent Property Fund

Price Prd End 175 203 184 197 270 OAS

RATIOS ISIN: ZAE000074332 SHORT: OASIS CODE: OAS

Ret on SH Fnd 12.53 13.66 14.29 14.21 15.70 REG NO: 2003/012266/06 FOUNDED: 2005 LISTED: 2005

Oper Pft Mgn 28.86 28.83 30.13 30.04 33.38 NATUREOF BUSINESS:OasisCrescent Property FundManagersLtd. was

D:E 0.23 0.28 0.35 0.38 0.41 established to manage and administer direct property funds that subscribe

to the principles of Islamic finance to enable investors to diversify the asset

Current Ratio 2.31 2.20 2.89 3.40 2.73 allocation of their investment portfolio.

Div Cover 1.80 1.84 1.79 1.77 1.96

SECTOR: AltX

NUMBER OF EMPLOYEES: 0

175