Page 176 - SHB 2021 Issue 4

P. 176

JSE – NUW Profile’s Stock Exchange Handbook: 2021 – Issue 4

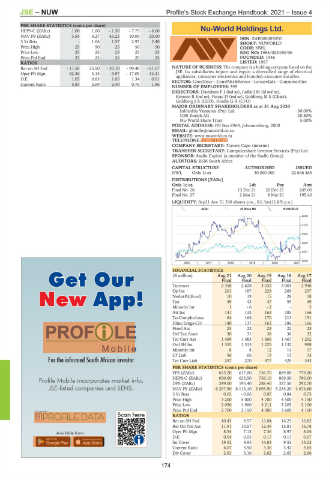

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 1.00 1.00 - 1.50 - 7.75 - 6.00 Nu-World Holdings Ltd.

NAV PS (ZARc) 3.54 4.27 43.25 10.00 20.00 NUW ISIN: ZAE000005070

3 Yr Beta - 1.06 1.57 2.97 2.40 SHORT: NUWORLD

Price High 25 50 25 50 50 CODE: NWL

Price Low 25 25 25 25 25 REG NO: 1968/002490/06

Price Prd End 25 25 25 25 25 FOUNDED: 1946

RATIOS LISTED: 1987

Ret on SH Fnd - 11.58 25.50 - 30.10 - 99.48 - 61.67 NATURE OF BUSINESS: The company is a holding company listed on the

Oper Pft Mgn 92.36 3.15 - 9.97 - 17.09 - 34.41 JSE. Its subsidiaries import and export a diversified range of electrical

appliances, consumer electronics and branded consumer durables.

D:E 1.05 0.83 1.05 1.34 0.61 SECTOR: ConsDiscr—ConsPdts&Servcs—LeisureGds—ConsumerElec

Current Ratio 5.83 2.69 2.40 0.76 1.96

NUMBER OF EMPLOYEES: 395

DIRECTORS: DavidsonFJ(ind ne), JudinJM(ld ind ne),

Kinross R (ind ne), Piaray D (ind ne), Goldberg M S (Chair),

Goldberg J A (CEO), Hindle G R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

Inhlanhla Ventures (Pty) Ltd. 30.00%

UBS Zurich AG 20.80%

Nu-World Share Trust 5.00%

POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000

EMAIL: ghindle@nuworld.co.za

WEBSITE: www.nuworld.co.za

TELEPHONE: 011-321-2111

COMPANY SECRETARY: Travers Cape (interim)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Sasfin Capital (a member of the Sasfin Group)

AUDITORS: RSM South Africa

CAPITAL STRUCTURE AUTHORISED ISSUED

NWL Ords 1c ea 30 000 000 22 646 465

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Final No 28 13 Dec 21 20 Dec 21 249.00

Final No 27 2 Mar 21 8 Mar 21 195.40

LIQUIDITY: Sep21 Ave 51 338 shares p.w., R1.3m(11.8% p.a.)

ALSH 40 Week MA NUWORLD

4650

4122

3593

3065

2537

2008

2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(R million) Aug 21 Aug 20 Aug 19 Aug 18 Aug 17

Final Final Final Final Final

Turnover 2 358 2 628 3 032 3 004 2 948

Op Inc 201 187 223 269 237

NetIntPd(Rcvd) 10 19 15 28 18

Tax 49 42 47 55 49

Minority Int 1 - 6 - 2 - 5

Att Inc 141 133 163 185 166

TotCompIncLoss 84 166 170 213 151

Hline Erngs-CO 140 137 163 186 166

Fixed Ass 23 22 23 22 23

Def Tax Asset 30 31 38 36 32

Tot Curr Ass 1 499 1 483 1 605 1 467 1 252

Ord SH Int 1 355 1 315 1 225 1 132 998

Minority Int 8 8 12 14 17

LT Liab 56 66 15 15 13

Tot Curr Liab 247 270 477 429 343

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 655.20 617.00 756.70 869.00 779.20

HEPS-C (ZARc) 650.60 635.50 756.10 869.50 780.00

DPS (ZARc) 249.00 195.40 288.40 327.50 292.70

NAV PS (ZARc) 6 297.90 6 113.10 5 695.90 5 235.20 4 674.60

3 Yr Beta 0.02 - 0.06 0.07 0.84 0.75

Price High 3 200 5 000 4 700 4 500 4 150

Price Low 2 050 1 900 3 211 3 205 2 100

Price Prd End 2 700 2 150 4 000 3 600 4 100

RATIOS

Ret on SH Fnd 10.43 9.57 13.04 16.25 16.82

Ret On Tot Ass 11.91 10.57 12.49 15.81 16.78

Oper Pft Mgn 8.54 7.13 7.36 8.97 8.04

D:E 0.04 0.05 0.17 0.13 0.07

Int Cover 19.52 9.95 14.83 9.52 13.23

Current Ratio 6.07 5.50 3.36 3.42 3.65

Div Cover 2.63 3.16 2.62 2.65 2.66

174