Page 122 - SHB 2021 Issue 4

P. 122

JSE – EXX Profile’s Stock Exchange Handbook: 2021 – Issue 4

Status

Exxaro Resources Ltd. CALENDAR Expected Unconfirmed

Next Final Results

Mar 2022

EXX

Annual General Meeting May 2022 Unconfirmed

Next Interim Results Aug 2022 Unconfirmed

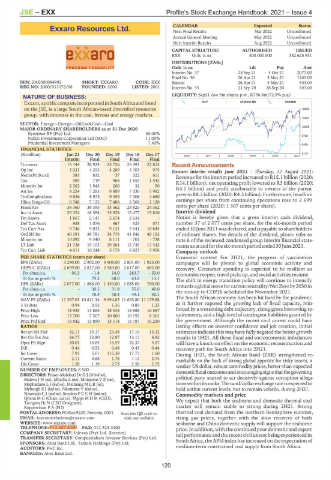

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 352 625 931

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Interim No 37 28 Sep 21 4 Oct 21 2077.00

Final No 36 26 Apr 21 3 May 21 1243.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Special 26 Apr 21 3 May 21 543.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001 Interim No 35 21 Sep 20 28 Sep 20 643.00

NATURE OF BUSINESS: LIQUIDITY: Sep21 Ave 5m shares p.w., R738.6m(72.9% p.a.)

Exxaro,apubliccompanyincorporatedinSouthAfricaandlisted OILP 40 Week MA EXXARO

on the JSE, is a large South African-based diversified resources 18606

group, with interests in the coal, ferrous and energy markets.

15307

SECTOR: Energy—Energy—OilGas&Coal—Coal

12008

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Eyesizwe RF (Pty) Ltd. 30.00%

Public Investment Corporation Ltd (SOC) 11.00% 8708

Prudential Investment Managers 7.40% 5409

FINANCIAL STATISTICS

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 2016 | 2017 | 2018 | 2019 | 2020 | 2021 2110

Interim Final Final Final Final

Turnover 15 144 28 924 25 726 25 491 22 813 Recent Announcements

Op Inc 3 031 4 293 4 269 5 703 975 Exxaro interim results June 2021 - Thursday, 12 August 2021:

NetIntPd(Rcvd) 385 832 37 322 611 Revenue for the interim period increased to R15.1 billion (2020:

Tax 589 719 968 1 653 1 542 R14.1 billion), net operating profit lowered to R3 billion (2020:

Minority Int 2 362 1 943 260 32 50 R4.1 billion) and profit attributable to owners of the parent

Att Inc 8 224 7 283 9 809 7 030 5 982

TotCompIncLoss 9 836 8 975 9 359 7 308 4 680 grewtoR8.2billion(2020:R4.3billion).Furthermore, headline

Hline Erngs-CO 6 748 7 122 7 488 6 568 2 120 earnings per share from continuing operations rose to 2 699

Fixed Ass 38 360 38 395 33 562 28 825 24 362 cents per share (2020: 1 307 cents per share).

Inv in Assoc 20 324 18 594 15 928 15 477 15 810 Interim dividend

Fin Assets 1 867 2 141 2 674 2 634 - Notice is hereby given that a gross interim cash dividend,

Def Tax Asset 938 1 076 467 523 571 number 37 of 2 077 cents per share, for the six-month period

Tot Curr Ass 9 746 9 033 9 121 7 641 10 844 ended 30 June 2021was declared, andis payabletoshareholders

Ord SH Int 40 191 38 781 34 776 41 846 40 103 of ordinary shares. For details of the dividend, please refer to

Minority Int 10 092 9 340 8 111 - 701 - 738 note 6 of the reviewed condensed group interim financial state-

LT Liab 21 738 19 103 19 364 15 745 17 442 mentsasatandforthesix-monthperiodended30June2021.

Tot Curr Liab 4 611 10 244 5 179 6 823 3 956 Company outlook

PER SHARE STATISTICS (cents per share) Economic context For 2H21, the progress of vaccination

EPS (ZARc) 3 290.00 2 902.00 3 908.00 2 801.00 1 923.00 campaigns will be pivotal to global economic activity and

HEPS-C (ZARc) 2 699.00 2 837.00 2 983.00 2 617.00 682.00 recovery. Consumer spending is expected to be resilient as

Pct chng p.a. 90.3 - 1.8 14.0 283.7 - 53.0 economiesreopen,travelpicksup, andsocialactivitiesresume.

Tr 5yr av grwth % - 79.2 68.0 63.8 13.1 The shift in energy transition policy will continue to intensify

DPS (ZARc) 2 077.00 1 886.00 1 430.00 1 085.00 700.00 towards aglobalmoveforcarbonneutrality/NetZeroby2050in

Pct chng p.a. - 30.5 31.8 55.0 40.0 the run-up to COP26 scheduled for November 2021.

Tr 5yr av grwth % - 78.4 58.4 49.1 40.1

NAV PS (ZARc) 11 397.63 10 811.34 9 694.83 11 665.80 11 179.88 The South African economy has been hit hard by the pandemic

3 Yr Beta 0.94 0.92 1.36 0.89 1.23 as it further exposed the growing lack of fiscal capacity, rein-

Price High 18 935 14 865 18 345 16 988 16 567 forced by a worsening debt trajectory, rising gross borrowing re-

Price Low 13 700 7 507 10 860 10 192 8 301 quirements, and a high level of contingent liabilities granted by

Price Prd End 16 842 13 890 13 114 13 787 16 250 the government. Although the recent civil unrest could have

RATIOS lasting effects on investor confidence and job creation, initial

Ret on SH Fnd 42.11 19.17 23.48 17.16 15.32 estimates indicate this may have fully negated the better growth

Ret On Tot Ass 24.77 12.80 12.97 13.17 6.92 results in 1H21. All these fiscal and socioeconomic imbalances

Oper Pft Mgn 20.01 14.84 16.59 22.37 4.27 will have a knock-on effect on the economic reconstruction and

D:E 0.44 0.53 0.48 0.43 0.44 recovery path for South Africa into 2H21.

Int Cover 7.93 5.01 115.38 17.73 1.60 During 1H21, the South African Rand (ZAR) strengthened re-

Current Ratio 2.11 0.88 1.76 1.12 2.74 markably on the back of strong global appetite for risky assets, a

Div Cover 1.58 1.19 2.73 2.58 2.75 weaker US dollar, robust commodity prices, better-than-expected

NUMBER OF EMPLOYEES: 8 500 domesticfiscaloutcomesandencouragingsignsthatthegoverning

DIRECTORS: Fraser-Moleketi Dr G J (ld ind ne),

Malevu I N (ne), Mbatha L (ne), Mntambo V Z (ne), political party started to act decisively against corruption allega-

Mophatlane L I (ind ne), Msimang M LB(ne), tionswithinitsranks.Therand/dollarexchangerateisexpectedto

Myburgh E J (ind ne), NkonyeniV(ind ne), hold within current levels, but to remain volatile, during 2H21.

Nxumalo C J (ind ne), Snyders P CCH (ind ne), Commodity markets and price

Qhena M G (Chair, ind ne), Mgojo M D M (CEO), We expect that both the seaborne and domestic thermal coal

Tsengwa Dr N (CEO Designate),

Koppeschaar P A (FD) market will remain stable to strong during 2H21. Strong

POSTAL ADDRESS:POBox9229, Pretoria,0001 Scan the QR code to thermal coal demand from the northern hemisphere summer,

EMAIL: investorrelations@exxaro.com visit our website rising gas prices, together with the slow recovery of both

WEBSITE: www.exxaro.com seaborne and China domestic supply will support the seaborne

TELEPHONE: 012-307-5000 FAX: 012-323-3400 price. In addition, with the continued poor domestic and export

COMPANY SECRETARY: Inlexso (Pty) Ltd. (Interim) rail performanceandthe recentcivilunrest beingexperienced in

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. South Africa, the API4 index has increased on the expectation of

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd.

AUDITORS: PwC Inc. medium-term constrained coal supply from South Africa.

BANKERS: Absa Bank Ltd.

120