Page 119 - SHB 2021 Issue 4

P. 119

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – EPP

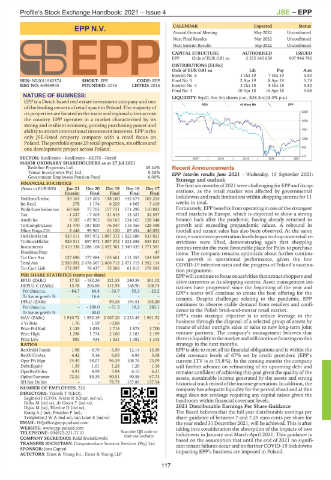

EPP N.V. CALENDAR Expected Status

Annual General Meeting May 2022 Unconfirmed

EPP

Next Final Results Mar 2022 Unconfirmed

Next Interim Results Sep 2022 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EPP Ords of EUR 0.81 ea 2 572 645 659 907 946 792

DISTRIBUTIONS [EURc]

Ords of EUR 0.81 ea Ldt Pay Amt

Interim No 6 1 Oct 19 7 Oct 19 5.80

ISIN: NL0011983374 SHORT: EPP CODE: EPP Final No 5 2 Apr 19 8 Apr 19 5.78

REG NO: 64965945 FOUNDED: 2016 LISTED: 2016 Interim No 4 2 Oct 18 8 Oct 18 5.82

Final No 3 10 Apr 18 16 Apr 18 5.68

NATURE OF BUSINESS: LIQUIDITY: Sep21 Ave 3m shares p.w., R28.3m(18.0% p.a.)

EPP is a Dutch based real estate investment company and one

REIV 40 Week MA EPP

of the leading owners of retail space in Poland. The majority of

its properties are located in the main and regional cities across 2350

the country. EPP operates in a market characterised by its 1976

strong and resilient economy, growing purchasing power and

ability to attract international investment interests. EPP is the 1601

only JSE-listed property company with a retail focus on 1226

Poland.The portfoliospans 29retailproperties, six officesand

one development project across Poland. 852

SECTOR: RealEstate—RealEstate—REITS—Retail 2017 | 2018 | 2019 | 2020 | 2021 477

MAJOR ORDINARY SHAREHOLDERS as at 27 Jul 2021

Redefine Properties Ltd. 45.44% Recent Announcements

Tensai Investments Pty) Ltd. 8.26% EPP interim results June 2021 - Wednesday, 15 September 2021:

Government Employees Pension Fund 6.00%

Strategy and outlook

FINANCIAL STATISTICS The first six months of 2021 were challenging for EPP and its op-

(Amts in EUR’000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 erations, as the retail market was affected by governmental

Interim Final Final Final Final

NetRent/InvInc 59 163 114 205 148 100 142 674 103 255 lockdowns and trade limitations within shopping centres for 11

Int Recd 278 1 174 6 229 4 865 7 419 weeks in total.

Profit/Loss before tax 60 968 77 705 157 731 171 298 110 883 Fortunately, EPP benefits from operating in one of the strongest

Tax - 1 237 - 7 405 21 615 13 427 32 557 retail markets in Europe, which is expected to show a strong

Attrib Inc 9 187 - 87 905 66 165 124 165 128 348 bounce back after the pandemic, having already returned to

TotCompIncLoss 31 470 - 187 800 76 047 118 356 128 498 growth and exceeding prepandemic values. A rebound in

Hline Erngs-CO 8 446 99 961 61 120 87 454 46 053 footfall and tenant sales has also been observed. At the same

Ord UntHs Int 929 511 897 972 1 087 372 1 022 688 833 821 time, e-commercepenetrationlevelsbegantodrop onceretail re-

TotStockHldInt 929 511 897 972 1 087 372 1 022 688 833 821 strictions were lifted, demonstrating again that shopping

Investments 2 410 338 2 288 168 2 492 501 2 340 435 1 771 581 centres remain the most favourable place for Poles to purchase

FixedAss/Prop - - - - 47 items. The company remains optimistic about further continu-

Tot Curr Ass 127 696 177 484 105 661 111 355 154 569 ous growth in operational performance, given the low

Total Ass 2 550 092 2 476 367 2 606 715 2 471 715 1 952 114 COVID-19 infection rates and the progress of Poland’s vaccina-

Tot Curr Liab 172 097 76 437 75 506 61 815 176 583

tion programme.

PER SHARE STATISTICS (cents per share) EPP will continuetofocusonactivitiesthat attractshoppers and

EPLU (ZARc) 17.53 - 182.26 121.33 240.39 301.02 drive turnovers at its shopping centres. Asset management ini-

HEPLU-C (ZARc) 15.78 206.88 111.94 168.90 108.74 tiatives have progressed since the beginning of the year and

Pct chng p.a. - 84.7 84.8 - 33.7 55.3 - 23.2 EPP’s teams will continue to create the best offering for the

Tr 5yr av grwth % - 16.6 - - - tenants. Despite challenges relating to the pandemic, EPP

DPLU (ZARc) - - 94.36 194.51 163.20 continues to observe stable demand from retailers and confi-

Pct chng p.a. - - 100.0 - 51.5 19.2 282.1

Tr 5yr av grwth % - 30.0 - - - dence in the Polish brick-and-mortar retail market.

NAV (ZARc) 1 910.72 1 952.19 2 067.20 2 223.45 1 961.52 EPP’s main strategic objective is to reduce leverage in the

business through the disposal of a selected group of assets by

3 Yr Beta 1.76 1.59 - 0.08 - -

Price Prd End 1 135 1 035 1 715 1 875 1 700 means of either outright sales or sales to new long-term joint

Price High 1 298 1 774 2 100 2 183 2 199 venture partners. The company’s management believes that

Price Low 885 434 1 631 1 382 1 315 thereisliquidityinthemarketandwillcontinuefocusingonthis

RATIOS strategy in the next months.

RetOnSH Funds 1.98 - 9.79 5.99 12.14 15.39 EPP is able to meet all its financial obligations and is within the

RetOnTotAss 4.42 3.14 6.05 6.93 5.68 debt covenant levels of 67% set by credit providers (EPP’s

Oper Pft Mgn 74.45 58.07 96.39 108.76 73.09 current LTV is at 55.8%). In the coming months the company

Debt:Equity 1.59 1.61 1.26 1.29 1.16 will further advance on refinancing of its upcoming debt and

OperRetOnInv 4.91 4.99 5.94 6.10 6.21 remains confident of achieving this goal given the quality of the

OpInc:Turnover 72.24 85.35 90.51 90.58 67.73 assets, sustainable income generated by the assets and strong

SH Ret On Inv - - 78.79 157.86 137.54 historical track record of the income generation. In addition, the

NUMBER OF EMPLOYEES: 220 company has adequate liquidity for the period ahead and at this

DIRECTORS: Trzoslo T (CEO), stage does not envisage requiring any capital raises given the

Baginski J (CFO), Weisz R (Chair, ind ne), headroom within financial covenant levels.

Belka M (ind ne), de Groot T (ind ne),

Dyjas M (ne), Ellerine D (ind ne), 2021 Distributable Earnings Per Share Guidance

KonigAJ(ne), Prinsloo P (ne), The Board believes that the full year distributable earnings per

TempletonJWA(ind ne), van Loon S (ind ne) share guidance of between 7 and 7.25 euro cents per share for

EMAIL: HQoffice@epp-poland.com the year ended 31 December 2021, will be achieved. This is after

WEBSITE: www.epp-poland.com taking into consideration the absorption of the impacts of two

TELEPHONE: 004822-221-7110 Scan the QR code to lockdowns in January and March-April 2021. This guidance is

visit our website

COMPANY SECRETARY: Rafal Kwiatkowski based on the assumption that until the end of 2021 no signifi-

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. cant tenant failures occur and no further COVID-19 lockdowns

SPONSOR: Java Capital impacting EPP’s business are imposed in Poland.

AUDITORS: Ernst & Young Inc., Ernst & Young LLP

117