Page 83 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 83

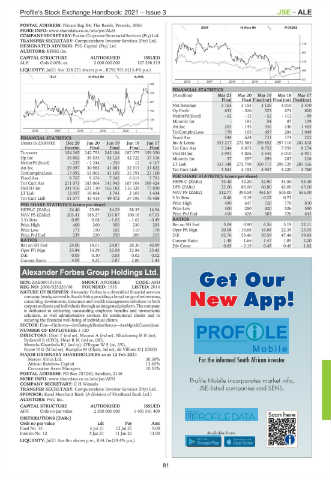

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – ALE

POSTAL ADDRESS: Private Bag X4, The Reeds, Pretoria, 0061

GENF 40 Week MA AFORBES

MORE INFO: www.sharedata.co.za/sdo/jse/ALH

COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. 716

AUDITORS: KPMG Inc.

597

CAPITAL STRUCTURE AUTHORISED ISSUED

ALH Ords 0.005c ea 2 000 000 000 127 298 219 479

LIQUIDITY: Jul21 Ave 328 221 shares p.w., R792 951.8(13.4% p.a.) 360

TELE 40 Week MA ALARIS

241

2016 | 2017 | 2018 | 2019 | 2020 |

388

FINANCIAL STATISTICS

324

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Final Final Final(rst) Final(rst) Final(rst)

261

Net Revenue 3 153 3 153 3 136 3 010 3 470

197 Op Profit 633 - 526 523 674 800

NetIntPd(Rcvd) - 62 - 12 - 52 - 112 - 89

134

Minority Int - 191 54 87 109

Att Inc 203 - 145 336 240 1 465

70

2016 | 2017 | 2018 | 2019 | 2020 | TotCompIncLoss 170 105 457 284 1 049

FINANCIAL STATISTICS Fixed Ass 544 624 731 174 202

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Inv & Loans 333 217 272 585 299 852 297 110 281 818

Interim Final Final Final Final Tot Curr Ass 5 244 6 873 8 752 7 959 8 274

Turnover 154 365 242 753 245 184 187 075 159 350 Ord SH Int 3 991 4 806 5 645 6 010 6 901

Op Inc 36 802 39 535 54 125 42 722 37 316 Minority Int 37 297 299 287 218

NetIntPd(Rcvd) - 237 - 1 244 - 256 12 4 167 LT Liab 333 348 272 798 300 717 298 729 283 556

Att Inc 29 097 30 985 41 081 32 919 31 822 Tot Curr Liab 3 541 4 152 5 947 4 220 3 760

TotCompIncLoss 17 092 51 005 41 109 35 791 27 100

Fixed Ass 8 767 9 376 7 242 6 619 5 793 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 211 073 183 064 141 945 107 104 109 424 HEPS-C (ZARc) 33.40 32.20 32.90 34.50 53.40

Ord SH Int 241 916 221 110 165 182 116 328 77 830 DPS (ZARc) 22.00 80.00 60.00 42.00 63.00

LT Liab 12 057 18 864 3 741 2 103 1 434 NAV PS (ZARc) 312.77 394.58 461.57 505.00 555.00

Tot Curr Liab 51 577 43 414 49 472 37 195 76 488 3 Yr Beta 0.46 0.19 - 0.22 0.73 -

Price High 490 647 720 770 810

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 24.40 25.89 34.29 28.35 14.94 Price Low 300 280 420 526 550

NAV PS (ZARc) 203.41 185.27 137.87 100.18 67.03 Price Prd End 410 428 503 720 643

3 Yr Beta 0.89 0.08 - 1.02 - 1.62 - 0.49 RATIOS

Price High 400 260 350 230 293 Ret on SH Fnd 5.04 0.90 6.56 5.19 22.11

Price Low 171 150 105 110 170 Oper Pft Mgn 20.08 - 16.68 16.68 22.39 23.05

Price Prd End 239 220 250 200 215 D:E 82.76 53.46 50.59 47.44 39.83

RATIOS Current Ratio 1.48 1.66 1.47 1.89 2.20

Ret on SH Fnd 24.06 14.01 24.87 28.30 40.89 Div Cover 0.65 - 0.15 0.45 0.45 1.82

Oper Pft Mgn 23.84 16.29 22.08 22.84 23.42

D:E 0.05 0.10 0.03 0.02 0.02

Current Ratio 4.09 4.22 2.87 2.88 1.43

Alexander Forbes Group Holdings Ltd.

ALE

ISIN: ZAE000191516 SHORT: AFORBES CODE: AFH

REG NO: 2006/025226/06 FOUNDED: 1935 LISTED: 2014

NATURE OF BUSINESS: Alexander Forbes is a diversified financial services

companyheadquarteredinSouthAfricaprovidingabroadrangeofretirements,

consulting, investments, insurance and wealth management solutions to both

corporateclientsandindividualsthroughanintegratedplatform.Thecompany

is dedicated to delivering outstanding employee benefits and investments

solutions, as well administrative services for institutional clients and to

securing the financial well-being of individual clients.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

NUMBER OF EMPLOYEES: 3 120

DIRECTORS: Dloti T (ind ne), Mazwai A (ind ne), NkadimengMR(ne),

Bydawell B (CFO), HeadRM(ind ne, UK),

Memela-KhambulaBJ(ind ne), O'ReganWS(ne, UK),

PayneNG(ld ind ne), Ramplin M (Chair, ind ne), de Villiers D J (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 12 Feb 2021

Mercer Africa Ltd. 30.58%

African Rainbow Capital 13.65%

Coronation Asset Managers 10.51%

POSTAL ADDRESS: PO Box 787240, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/AFH

COMPANY SECRETARY: C H Wessels

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

AFH Ords no par value 2 500 000 000 1 401 541 409

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 13 6 Jul 21 12 Jul 21 9.00

Interim No 12 5 Jan 21 11 Jan 21 13.00

LIQUIDITY: Jul21 Ave 8m shares p.w., R34.7m(29.4% p.a.)

81