Page 80 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 80

JSE – AFR Profile’s Stock Exchange Handbook: 2021 – Issue 3

WEBSITE: www.arm.co.za

African Rainbow Minerals Ltd. TELEPHONE: 011-779-1300

FAX: 011-779-1312

AFR

COMPANY SECRETARY: Alyson D'Oyley

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: Deloitte, Ernst & Young Inc.

BANKERS: ABSA Bank Ltd., FirstRand Bank Ltd.,

Scan the QR code to NedbankLtd.,StandardBankofSouthAfricaLtd.

visit our website

SEGMENTAL REPORTING as at 30 Jun 20 (asa%of Sales)

ISIN: ZAE000054045 SHORT: ARM CODE: ARI Ferrous 57.42%

REG NO: 1933/004580/06 FOUNDED: 1933 LISTED: 1988

Platinum 38.54%

Coal 3.86%

NATURE OF BUSINESS: Corporate 0.18%

ARM is a diversified South African mining company with

longlife, low unit-cost operations in key commodities. ARM, CALENDAR Expected Status

its subsidiaries, jointventures, jointoperationsandassociates Next Final Results 31 Aug 2021 Confirmed

explore, develop, operate and hold interests in the mining and Annual General Meeting 6 Dec 2021 Confirmed

minerals industry. Next Interim Results Mar 2022 Unconfirmed

The current operational focus is on precious metals, base CAPITAL STRUCTURE AUTHORISED ISSUED

metals, ferrous metals and alloys, which include platinum ARI Ords 5c ea 500 000 000 224 409 073

group metals, nickel, coal, iron ore, manganese ore and ferro- DISTRIBUTIONS [ZARc]

manganese. ARM also has an investment in Harmony Gold Ords 5c ea Ldt Pay Amt

Mining Company Ltd. Interim No 124 23 Mar 21 29 Mar 21 1000.00

Final No 123 29 Sep 20 5 Oct 20 700.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining Interim No 122 17 Mar 20 23 Mar 20 500.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 Final No 121 23 Sep 19 30 Sep 19 900.00

African Rainbow Minerals & Exploration Investments 39.64% LIQUIDITY: Mar21 Ave 4m shares p.w., R679.8m(82.7% p.a.)

Government Employees Pension Fund (PIC) 7.83%

ARM Broad-Based Economic Empowerment Trust 7.10% INDM 40 Week MA ARM

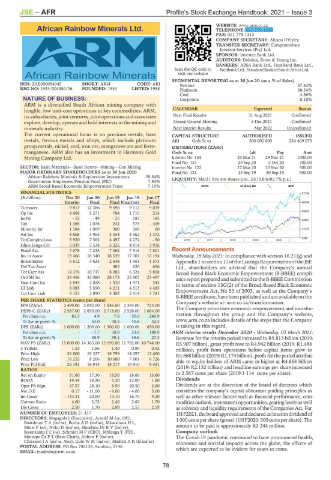

FINANCIAL STATISTICS 57154

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final(rst) Final 46399

Turnover 9 813 12 386 9 596 9 112 9 019

35645

Op Inc 4 668 3 271 784 1 710 214

IntPd - 52 - 49 - 25 183 185 24891

Tax 1 365 1 076 242 573 - 409

Minority Int 1 184 1 069 300 260 60 14137

Att Inc 4 868 3 965 3 554 4 562 1 372

TotCompIncLoss 5 920 7 562 4 497 4 274 - 50 2016 | 2017 | 2018 | 2019 | 2020 | 3382

Hline Erngs-CO 5 039 5 534 5 226 4 814 3 916

Fixed Ass 7 678 7 235 7 062 7 916 7 801 Recent Announcements

Inv in Assoc 19 466 18 340 18 539 17 302 16 194 Wednesday, 19 May 2021: In compliance with section 16.21(g) and

Investments 5 612 5 635 2 648 1 561 1 573 Appendix 1tosection11oftheListingsRequirementsoftheJSE

Def Tax Asset - - 485 620 656 Ltd., shareholders are advised that the Company’s annual

Tot Curr Ass 14 376 10 747 8 085 6 324 5 858 Broad-Based Black Economic Empowerment (B-BBEE) compli-

Ord SH Int 35 456 32 080 28 173 25 907 23 497 ancereport prepared and submitted to the B-BBEE Commission

Non-Cont Int 2 844 2 028 1 530 1 471 543 in terms of section 13G(2) of the Broad-Based Black Economic

LT Liab 6 085 5 550 4 211 4 513 4 465

Tot Curr Liab 3 123 2 890 3 302 2 414 3 741 Empowerment Act, No 53 of 2003, as well as the Company’s

B-BBEE certificate, have been published and are available on the

PER SHARE STATISTICS (cents per share) Company’s website at: arm.co.za/transformation.

EPS (ZARc) 2 499.00 2 042.00 1 848.00 2 393.00 723.00 The Company prioritises economic empowerment and transfor-

HEPS-C (ZARc) 2 587.00 2 850.00 2 718.00 2 526.00 1 684.00

Pct chng p.a. 81.5 4.9 7.6 50.0 240.9 mation throughout the group and the Company’s website,

Tr 5yr av grwth % - 53.0 40.5 40.8 32.3 www.arm.co.za includes details of the steps that the Company

DPS (ZARc) 1 000.00 1 200.00 1 300.00 1 000.00 650.00 is taking in this regard.

Pct chng p.a. - - 7.7 30.0 53.8 188.9 ARM interim results December 2020 - Wednesday, 03 March 2021:

Tr 5yr av grwth % - 45.9 39.1 36.6 27.3 Revenue for the interim period increased to R9.813 billion (2019:

NAV PS (ZARc) 15 800.00 14 365.00 12 690.00 11 792.00 10 744.00 R5.907 billion), gross profit rose to R4.942 billion (2019: R1.488

3 Yr Beta 1.53 1.86 1.40 0.89 0.92 million), profit from operations before capital items grew to

Price High 26 800 19 327 18 799 14 097 12 690 R4.668 billion (2019: R1.174 billion), profit for the period attribut-

Price Low 16 255 8 206 10 680 7 801 6 726 able to equity holders of ARM came in higher at R4.868 billion

Price Prd End 26 191 16 915 18 217 10 910 8 431 (2019: R2.132 billion) and headline earnings per share increased

RATIOS

Ret on Equity 31.60 17.30 18.50 18.60 13.60 to 2 587 cents per share (2019:1 114 cents per share).

ROOA 19.54 18.20 5.20 12.00 1.80 Dividends

Oper Pft Mgn 47.57 28.10 8.90 20.50 2.60 Dividends are at the discretion of the board of directors which

Net D:E 0.17 - 11.00 - 9.00 - 4.00 5.00 considers the company’s capital allocation guiding principles as

Int Cover - 143.31 20.60 19.10 16.70 9.20 well as other relevant factors such as financial performance, com-

Current Ratio 4.60 3.72 2.40 2.60 1.70 modities outlook, investment opportunities, gearing levels as well

Div Cover 2.50 1.70 2.09 2.53 2.59 as solvency and liquidity requirements of the Companies Act. For

NUMBER OF EMPLOYEES: 21 417 1H F2021, the board approved and declared an interim dividend of

DIRECTORS: Magagula J (Executive), Arnold M (ne, UK), 1000centspershare(gross)(1HF2020:500centspershare).The

BoardmanTA(ind ne), BothaAD(ind ne), Mkatshana H L,

Mnisi P (ne), Noko D (ind ne), Simelane DrRV(ind ne), amount to be paid is approximately R2 244 million.

SteenkampJC(ne), Schmidt M P (CEO), Mhlanga T (FD), Company outlook

Motsepe Dr P T (Exec Chair), Abbott F (ind ne), The Covid-19 pandemic continued to have pronounced health,

ChissanoJA(ind ne, Moz), GuleWM(ind ne), MaditsiAK(ld ind ne) economic and societal impacts across the globe, the effects of

POSTAL ADDRESS: PO Box 786136, Sandton, 2146 which are expected to be evident for years to come.

EMAIL: ir.admin@arm.co.za

78