Page 73 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 73

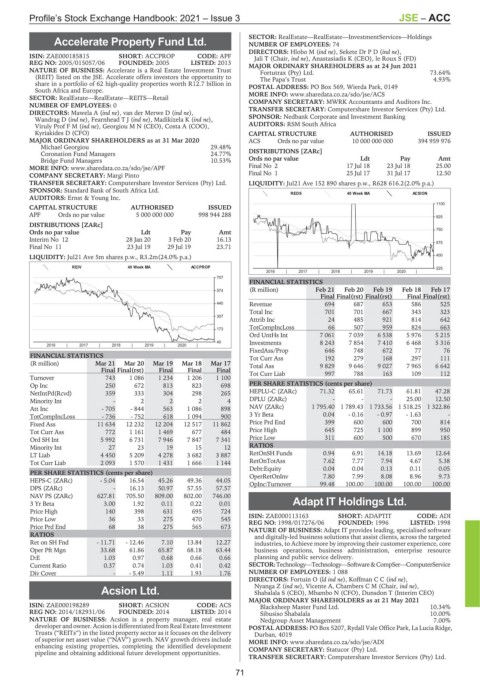

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – ACC

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

Accelerate Property Fund Ltd. NUMBER OF EMPLOYEES: 74

ACC DIRECTORS: Hlobo M (ind ne), Sekete DrPD(ind ne),

ISIN: ZAE000185815 SHORT: ACCPROP CODE: APF Jali T (Chair, ind ne), Anastasiadis K (CEO), le Roux S (FD)

REG NO: 2005/015057/06 FOUNDED: 2005 LISTED: 2013 MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2021

NATURE OF BUSINESS: Accelerate is a Real Estate Investment Trust Fortutrax (Pty) Ltd. 73.64%

(REIT) listed on the JSE. Accelerate offers investors the opportunity to The Papa’s Trust 4.93%

share in a portfolio of 62 high-quality properties worth R12.7 billion in POSTAL ADDRESS: PO Box 569, Wierda Park, 0149

South Africa and Europe.

SECTOR: RealEstate—RealEstate—REITS—Retail MORE INFO: www.sharedata.co.za/sdo/jse/ACS

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: MWRK Accountants and Auditors Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Mawela A (ind ne), van der Merwe D (ind ne),

Wandrag D (ind ne), FearnheadTJ(ind ne), Madikizela K (ind ne), SPONSOR: Nedbank Corporate and Investment Banking

Viruly ProfFM(ind ne), Georgiou M N (CEO), Costa A (COO), AUDITORS: RSM South Africa

Kyriakides D (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 ACS Ords no par value 10 000 000 000 394 959 976

Michael Georgiou 29.48%

Coronation Fund Managers 24.77% DISTRIBUTIONS [ZARc]

Bridge Fund Managers 10.53% Ords no par value Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/APF Final No 2 17 Jul 18 23 Jul 18 25.00

COMPANY SECRETARY: Margi Pinto Final No 1 25 Jul 17 31 Jul 17 12.50

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 152 890 shares p.w., R628 616.2(2.0% p.a.)

SPONSOR: Standard Bank of South Africa Ltd.

REDS 40 Week MA ACSION

AUDITORS: Ernst & Young Inc.

1100

CAPITAL STRUCTURE AUTHORISED ISSUED

APF Ords no par value 5 000 000 000 998 944 288

925

DISTRIBUTIONS [ZARc]

750

Ords no par value Ldt Pay Amt

Interim No 12 28 Jan 20 3 Feb 20 16.13

Final No 11 23 Jul 19 29 Jul 19 23.71 575

LIQUIDITY: Jul21 Ave 5m shares p.w., R3.2m(24.0% p.a.) 400

REIV 40 Week MA ACCPROP 225

2016 | 2017 | 2018 | 2019 | 2020 |

707

FINANCIAL STATISTICS

574 (R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

Final Final(rst) Final(rst) Final Final(rst)

440 Revenue 694 687 653 586 525

Total Inc 701 701 667 343 323

307

Attrib Inc 24 485 921 814 642

TotCompIncLoss 66 507 959 824 663

173

Ord UntHs Int 7 061 7 039 6 538 5 976 5 215

40 Investments 8 243 7 854 7 410 6 468 5 316

2016 | 2017 | 2018 | 2019 | 2020 |

FixedAss/Prop 646 748 672 77 76

FINANCIAL STATISTICS Tot Curr Ass 192 279 168 297 111

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Total Ass 9 829 9 646 9 027 7 965 6 642

Final Final(rst) Final Final Final

Turnover 743 1 086 1 234 1 206 1 100 Tot Curr Liab 997 788 163 109 112

Op Inc 250 672 813 823 698 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 359 333 304 298 265 HEPLU-C (ZARc) 71.32 65.61 71.73 61.81 47.28

Minority Int - 2 2 2 4 DPLU (ZARc) - - - 25.00 12.50

Att Inc - 705 - 844 563 1 086 898 NAV (ZARc) 1 795.40 1 789.43 1 733.56 1 518.25 1 322.86

TotCompIncLoss - 736 - 752 618 1 094 900 3 Yr Beta 0.04 - 0.16 - 0.97 - 1.63 -

Fixed Ass 11 634 12 232 12 204 12 517 11 862 Price Prd End 399 600 600 700 814

Tot Curr Ass 772 1 161 1 469 677 484 Price High 645 725 1 100 899 950

Ord SH Int 5 992 6 731 7 946 7 847 7 341 Price Low 311 600 500 670 185

Minority Int 27 23 19 15 12 RATIOS

LT Liab 4 450 5 209 4 278 3 682 3 887 RetOnSH Funds 0.94 6.91 14.18 13.69 12.64

Tot Curr Liab 2 093 1 570 1 431 1 666 1 144 RetOnTotAss 7.62 7.77 7.94 4.67 5.38

Debt:Equity 0.04 0.04 0.13 0.11 0.05

PER SHARE STATISTICS (cents per share) OperRetOnInv 7.80 7.99 8.08 8.96 9.73

HEPS-C (ZARc) - 5.04 16.54 45.26 49.36 44.05 OpInc:Turnover 99.48 100.00 100.00 100.00 100.00

DPS (ZARc) - 16.13 50.97 57.55 57.57

NAV PS (ZARc) 627.81 705.50 809.00 802.00 746.00

3 Yr Beta 3.00 1.92 0.11 0.22 0.01 Adapt IT Holdings Ltd.

Price High 140 398 631 695 724 ISIN: ZAE000113163 SHORT: ADAPTIT CODE: ADI

ADA

Price Low 36 33 275 470 545 REG NO: 1998/017276/06 FOUNDED: 1996 LISTED: 1998

Price Prd End 68 38 275 565 673 NATURE OF BUSINESS: Adapt IT provides leading, specialised software

RATIOS and digitally-led business solutions that assist clients, across the targeted

Ret on SH Fnd - 11.71 - 12.46 7.10 13.84 12.27 industries, to Achieve more by improving their customer experience, core

Oper Pft Mgn 33.68 61.86 65.87 68.18 63.44 business operations, business administration, enterprise resource

D:E 1.03 0.97 0.68 0.66 0.66 planning and public service delivery.

Current Ratio 0.37 0.74 1.03 0.41 0.42 SECTOR:Technology—Technology—Software&CompSer—ComputerService

Div Cover - - 5.49 1.11 1.93 1.76 NUMBER OF EMPLOYEES: 1 088

DIRECTORS: Fortuin O (ld ind ne), KoffmanCC(ind ne),

Nyanga Z (ind ne), Vicente A, Chambers C M (Chair, ind ne),

Acsion Ltd. Shabalala S (CEO), Mbambo N (CFO), Dunsdon T (Interim CEO)

ACS MAJOR ORDINARY SHAREHOLDERS as at 21 May 2021

ISIN: ZAE000198289 SHORT: ACSION CODE: ACS Blacksheep Master Fund Ltd. 10.34%

REG NO: 2014/182931/06 FOUNDED: 2014 LISTED: 2014 Sibusiso Shabalala 10.00%

NATURE OF BUSINESS: Acsion is a property manager, real estate Nedgroup Asset Management 7.00%

developer and owner. Acsion is differentiated from Real Estate Investment POSTAL ADDRESS: PO Box 5207, Rydall Vale Office Park, La Lucia Ridge,

Trusts (“REITs”) in the listed property sector as it focuses on the delivery Durban, 4019

of superior net asset value (“NAV”) growth. NAV growth drivers include MORE INFO: www.sharedata.co.za/sdo/jse/ADI

enhancing existing properties, completing the identified development COMPANY SECRETARY: Statucor (Pty) Ltd.

pipeline and obtaining additional future development opportunities.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

71