Page 37 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 37

Profile’s Stock Exchange Handbook: 2021 – Issue 3 NSX – OMJ

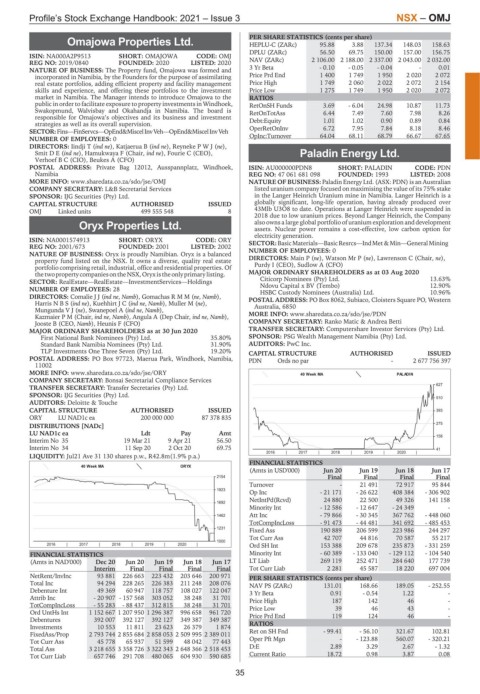

PER SHARE STATISTICS (cents per share)

Omajowa Properties Ltd. HEPLU-C (ZARc) 95.88 3.88 137.34 148.03 158.63

OMJ DPLU (ZARc) 56.50 69.75 150.00 157.00 156.75

ISIN: NA000A2P9513 SHORT: OMAJOWA CODE: OMJ

REG NO: 2019/0840 FOUNDED: 2020 LISTED: 2020 NAV (ZARc) 2 106.00 2 188.00 2 337.00 2 043.00 2 032.00

NATURE OF BUSINESS: The Property fund, Omajowa was formed and 3 Yr Beta - 0.10 - 0.05 - 0.04 - 0.01

incorporated in Namibia, by the Founders for the purpose of assimilating Price Prd End 1 400 1 749 1 950 2 020 2 072

real estate portfolios, adding efficient property and facility management Price High 1 749 2 060 2 022 2 072 2 154

skills and experience, and offering these portfolios to the investment Price Low 1 275 1 749 1 950 2 020 2 072

market in Namibia. The Manager intends to introduce Omajowa to the RATIOS

public in order to facilitate exposure to property investments in Windhoek, RetOnSH Funds 3.69 - 6.04 24.98 10.87 11.73

Swakopmund, Walvisbay and Okahandja in Namibia. The board is RetOnTotAss 6.44 7.49 7.60 7.98 8.26

responsible for Omajowa’s objectives and its business and investment

strategies as well as its overall supervision. Debt:Equity 1.01 1.02 0.90 0.89 0.84

SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh OperRetOnInv 6.72 7.95 7.84 8.18 8.46

NUMBER OF EMPLOYEES: 0 OpInc:Turnover 64.04 68.11 68.79 66.67 67.65

DIRECTORS: Iindji T (ind ne), Katjaerua B (ind ne), ReynekePWJ(ne),

SmitDE(ind ne), Hamukwaya F (Chair, ind ne), Fourie C (CEO), Paladin Energy Ltd.

Verhoef B C (CIO), Beukes A (CFO)

PDN

POSTAL ADDRESS: Private Bag 12012, Ausspannplatz, Windhoek, ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN

Namibia REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008

MORE INFO: www.sharedata.co.za/sdo/jse/OMJ NATURE OF BUSINESS: Paladin Energy Ltd. (ASX: PDN) is an Australian

COMPANY SECRETARY: L&B Secretarial Services listed uranium company focused on maximising the value of its 75% stake

SPONSOR: IJG Securities (Pty) Ltd. in the Langer Heinrich Uranium mine in Namibia. Langer Heinrich is a

CAPITAL STRUCTURE AUTHORISED ISSUED globally significant, long-life operation, having already produced over

OMJ Linked units 499 555 548 8 43Mlb U3O8 to date. Operations at Langer Heinrich were suspended in

2018 due to low uranium prices. Beyond Langer Heinrich, the Company

Oryx Properties Ltd. also owns a large global portfolio of uranium exploration and development

assets. Nuclear power remains a cost-effective, low carbon option for

ORY electricity generation.

ISIN: NA0001574913 SHORT: ORYX CODE: ORY SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002

NATURE OF BUSINESS: Oryx is proudly Namibian. Oryx is a balanced NUMBER OF EMPLOYEES: 0

property fund listed on the NSX. It owns a diverse, quality real estate DIRECTORS: Main P (ne), Watson Mr P (ne), Lawrenson C (Chair, ne),

portfolio comprising retail, industrial, office and residential properties. Of Purdy I (CEO), Sudlow A (CFO)

thetwopropertycompaniesontheNSX,Oryxistheonlyprimarylisting. MAJOR ORDINARY SHAREHOLDERS as at 03 Aug 2020

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings Citicorp Nominees (Pty) Ltd. 13.63%

12.90%

Ndovu Capital x BV (Tembo)

NUMBER OF EMPLOYEES: 28 HSBC Custody Nominees (Australia) Ltd. 10.96%

DIRECTORS: ComalieJJ(ind ne, Namb), Gomachas RMM(ne, Namb), POSTAL ADDRESS: PO Box 8062, Subiaco, Cloisters Square PO, Western

Harris N B S (ind ne), Kuehhirt J C (ind ne, Namb), Muller M (ne), Australia, 6850

Mungunda V J (ne), Swanepoel A (ind ne, Namb),

Kazmaier P M (Chair, ind ne, Namb), Angula A (Dep Chair, ind ne, Namb), MORE INFO: www.sharedata.co.za/sdo/jse/PDN

Jooste B (CEO, Namb), Heunis F (CFO) COMPANY SECRETARY: Ranko Matic & Andrea Betti

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

First National Bank Nominees (Pty) Ltd. 35.80% SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

Standard Bank Namibia Nominees (Pty) Ltd. 31.90% AUDITORS: PwC Inc.

TLP Investments One Three Seven (Pty) Ltd. 19.20% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek, Namibia, PDN Ords no par - 2 677 756 397

11002

MORE INFO: www.sharedata.co.za/sdo/jse/ORY 40 Week MA PALADIN

COMPANY SECRETARY: Bonsai Secretarial Compliance Services

627

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

SPONSOR: IJG Securities (Pty) Ltd.

510

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 393

ORY LU NAD1c ea 200 000 000 87 378 835

DISTRIBUTIONS [NADc] 275

LU NAD1c ea Ldt Pay Amt

Interim No 35 19 Mar 21 9 Apr 21 56.50 158

Interim No 34 11 Sep 20 2 Oct 20 69.75 41

2016 | 2017 | 2018 | 2019 | 2020 |

LIQUIDITY: Jul21 Ave 31 130 shares p.w., R42.8m(1.9% p.a.)

FINANCIAL STATISTICS

40 Week MA ORYX

(Amts in USD'000) Jun 20 Jun 19 Jun 18 Jun 17

2154 Final Final Final Final

Turnover - 21 491 72 917 95 844

1923

Op Inc - 21 171 - 26 622 408 384 - 306 902

NetIntPd(Rcvd) 24 880 22 500 49 326 141 158

1692

Minority Int - 12 586 - 12 647 - 24 349 -

1462 Att Inc - 79 866 - 30 345 367 762 - 448 060

TotCompIncLoss - 91 473 - 44 481 341 692 - 485 453

1231

Fixed Ass 190 889 206 599 223 986 244 297

Tot Curr Ass 42 707 44 816 70 587 55 217

1000

2016 | 2017 | 2018 | 2019 | 2020 | Ord SH Int 153 388 209 678 235 873 - 331 259

FINANCIAL STATISTICS Minority Int - 60 389 - 133 040 - 129 112 - 104 540

(Amts in NAD'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 LT Liab 269 119 252 471 284 640 177 739

Interim Final Final Final Final Tot Curr Liab 2 281 45 587 18 220 697 004

NetRent/InvInc 93 881 226 663 223 432 203 646 200 971 PER SHARE STATISTICS (cents per share)

Total Inc 94 294 228 265 226 383 211 248 208 076 NAV PS (ZARc) 131.01 168.66 189.05 - 252.55

Debenture Int 49 369 60 947 118 757 108 027 122 047 3 Yr Beta 0.91 - 0.54 1.22 -

Attrib Inc - 20 907 - 157 568 303 052 38 248 31 701 Price High 187 142 46 -

TotCompIncLoss - 55 283 - 88 437 312 815 38 248 31 701 Price Low 39 46 43 -

Ord UntHs Int 1 152 667 1 207 950 1 296 387 996 658 961 720

Debentures 392 007 392 127 392 127 349 387 349 387 Price Prd End 119 124 46 -

Investments 10 553 11 811 23 623 26 379 1 874 RATIOS

FixedAss/Prop 2 793 744 2 855 684 2 858 053 2 509 995 2 389 011 Ret on SH Fnd - 99.41 - 56.10 321.67 102.81

Tot Curr Ass 45 778 65 937 51 599 48 042 77 443 Oper Pft Mgn - - 123.88 560.07 - 320.21

Total Ass 3 218 655 3 358 726 3 322 343 2 648 366 2 518 453 D:E 2.89 3.29 2.67 - 1.32

Tot Curr Liab 657 746 291 708 480 065 604 930 590 685 Current Ratio 18.72 0.98 3.87 0.08

35