Page 30 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 30

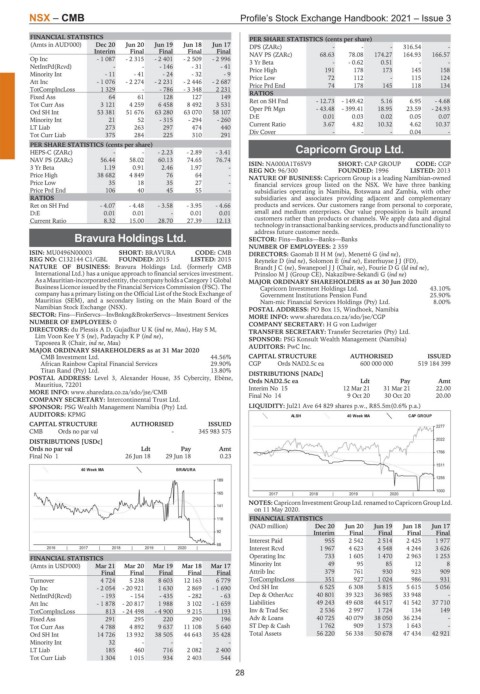

NSX – CMB Profile’s Stock Exchange Handbook: 2021 – Issue 3

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in AUD'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 DPS (ZARc) - - - 316.54 -

Interim Final Final Final Final

Op Inc - 1 087 - 2 315 - 2 401 - 2 509 - 2 996 NAV PS (ZARc) 68.63 - 78.08 174.27 164.93 - 166.57 -

- 0.62

3 Yr Beta

0.51

NetIntPd(Rcvd) - - - 146 - 31 - 41 Price High 191 178 173 145 158

Minority Int - 11 - 41 - 24 - 32 - 9 Price Low 72 112 - 115 124

Att Inc - 1 076 - 2 274 - 2 231 - 2 446 - 2 687 Price Prd End 74 178 145 118 134

TotCompIncLoss 1 329 - - 786 - 3 348 2 231

Fixed Ass 64 61 128 127 149 RATIOS - 12.73 - 149.42 5.16 6.95 - 4.68

Ret on SH Fnd

Tot Curr Ass 3 121 4 259 6 458 8 492 3 531

Ord SH Int 53 381 51 676 63 280 63 070 58 107 Oper Pft Mgn - 43.48 - 399.41 18.95 23.59 - 24.93

D:E

0.01

0.03

0.02

0.05

0.07

Minority Int 21 52 - 315 - 294 - 260

LT Liab 273 263 297 474 440 Current Ratio 3.67 4.82 10.32 4.62 10.37

Tot Curr Liab 375 284 225 310 291 Div Cover - - - 0.04 -

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - - - 2.23 - 2.89 - 3.41 Capricorn Group Ltd.

NAV PS (ZARc) 56.44 58.02 60.13 74.65 76.74 CGP

CODE: CGP

3 Yr Beta 1.19 0.91 2.46 1.97 - ISIN: NA000A1T6SV9 SHORT: CAP GROUP LISTED: 2013

FOUNDED: 1996

REG NO: 96/300

Price High 38 682 4 849 76 64 - NATURE OF BUSINESS: Capricorn Group is a leading Namibian-owned

Price Low 35 18 35 27 - financial services group listed on the NSX. We have three banking

Price Prd End 106 40 45 55 - subsidiaries operating in Namibia, Botswana and Zambia, with other

RATIOS subsidiaries and associates providing adjacent and complementary

Ret on SH Fnd - 4.07 - 4.48 - 3.58 - 3.95 - 4.66 products and services. Our customers range from personal to corporate,

D:E 0.01 0.01 - 0.01 0.01 small and medium enterprises. Our value proposition is built around

Current Ratio 8.32 15.00 28.70 27.39 12.13 customers rather than products or channels. We apply data and digital

technology in transactionalbanking services, products andfunctionality to

address future customer needs.

Bravura Holdings Ltd. SECTOR: Fins—Banks—Banks—Banks

NUMBER OF EMPLOYEES: 2 359

CMB

ISIN: MU0496N00003 SHORT: BRAVURA CODE: CMB DIRECTORS: Gaomab IIHM(ne), Menetté G (ind ne),

REG NO: C132144 C1/GBL FOUNDED: 2015 LISTED: 2015 Reyneke D (ind ne), Solomon E (ind ne), Esterhuyse J J (FD),

NATURE OF BUSINESS: Bravura Holdings Ltd. (formerly CMB BrandtJC(ne), Swanepoel J J (Chair, ne), FourieDG(ld ind ne),

International Ltd.) has a unique approach to financial services investment. Prinsloo M J (Group CE), Nakazibwe-Sekandi G (ind ne)

AsaMauritian-incorporatedentity,thecompanyholdsaCategory 1Global MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Business Licence issued by the Financial Services Commission (FSC). The Capricorn Investment Holdings Ltd. 43.10%

company has a primary listing on the Official List of the Stock Exchange of Government Institutions Pension Fund 25.90%

Mauritius (SEM), and a secondary listing on the Main Board of the Nam-mic Financial Services Holdings (Pty) Ltd. 8.00%

Namibian Stock Exchange (NSX). POSTAL ADDRESS: PO Box 15, Windhoek, Namibia

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—Investment Services MORE INFO: www.sharedata.co.za/sdo/jse/CGP

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: H G von Ludwiger

DIRECTORS: du Plessis A D, GujadhurUK(ind ne, Mau), Hay S M, TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

Lim Voon KeeYS(ne), PadayachyKP(ind ne), SPONSOR: PSG Konsult Wealth Management (Namibia)

Taposeea R (Chair, ind ne, Mau) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

CMB Investment Ltd. 44.56% CAPITAL STRUCTURE AUTHORISED ISSUED

African Rainbow Capital Financial Services 29.90% CGP Ords NAD2.5c ea 600 000 000 519 184 399

Titan Rand (Pty) Ltd. 13.80% DISTRIBUTIONS [NADc]

POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebène, Ords NAD2.5c ea Ldt Pay Amt

Mauritius, 72201 Interim No 15 12 Mar 21 31 Mar 21 22.00

MORE INFO: www.sharedata.co.za/sdo/jse/CMB Final No 14 9 Oct 20 30 Oct 20 20.00

COMPANY SECRETARY: Intercontinental Trust Ltd.

SPONSOR: PSG Wealth Management Namibia (Pty) Ltd. LIQUIDITY: Jul21 Ave 64 829 shares p.w., R85.5m(0.6% p.a.)

AUDITORS: KPMG ALSH 40 Week MA CAP GROUP

CAPITAL STRUCTURE AUTHORISED ISSUED 2277

CMB Ords no par val - 345 983 575

DISTRIBUTIONS [USDc] 2022

Ords no par val Ldt Pay Amt

1766

Final No 1 26 Jun 18 29 Jun 18 0.23

1511

40 Week MA BRAVURA

1255

189

1000

165 2017 | 2018 | 2019 | 2020 |

NOTES: Capricorn Investment Group Ltd. renamed to Capricorn Group Ltd.

141

on 11 May 2020.

116 FINANCIAL STATISTICS

(NAD million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

92 Interim Final Final Final Final

Interest Paid 955 2 542 2 514 2 425 1 977

68

2016 | 2017 | 2018 | 2019 | 2020 | Interest Rcvd 1 967 4 623 4 548 4 244 3 626

FINANCIAL STATISTICS Operating Inc 733 1 605 1 470 2 963 1 253

(Amts in USD'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Minority Int 49 95 85 12 8

Final Final Final Final Final Attrib Inc 379 761 930 923 909

Turnover 4 724 5 238 8 603 12 163 6 779 TotCompIncLoss 351 927 1 024 986 931

Op Inc - 2 054 - 20 921 1 630 2 869 - 1 690 Ord SH Int 6 525 6 308 5 815 5 615 5 056

NetIntPd(Rcvd) - 193 - 154 - 435 - 282 - 63 Dep & OtherAcc 40 801 39 323 36 985 33 948 -

Att Inc - 1 878 - 20 817 1 988 3 102 - 1 659 Liabilities 49 243 49 608 44 517 41 542 37 710

TotCompIncLoss 813 - 24 498 - 4 900 9 215 1 193 Inv & Trad Sec 2 536 2 997 1 724 134 149

Fixed Ass 291 295 220 290 196 Adv & Loans 40 725 40 079 38 050 36 234 -

Tot Curr Ass 4 788 4 892 9 637 11 108 5 640 ST Dep & Cash 1 762 909 1 573 1 643 -

Ord SH Int 14 726 13 932 38 505 44 643 35 428 Total Assets 56 220 56 338 50 678 47 434 42 921

Minority Int 32 - - - -

LT Liab 185 460 716 2 082 2 400

Tot Curr Liab 1 304 1 015 934 2 403 544

28