Page 195 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 195

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – REM

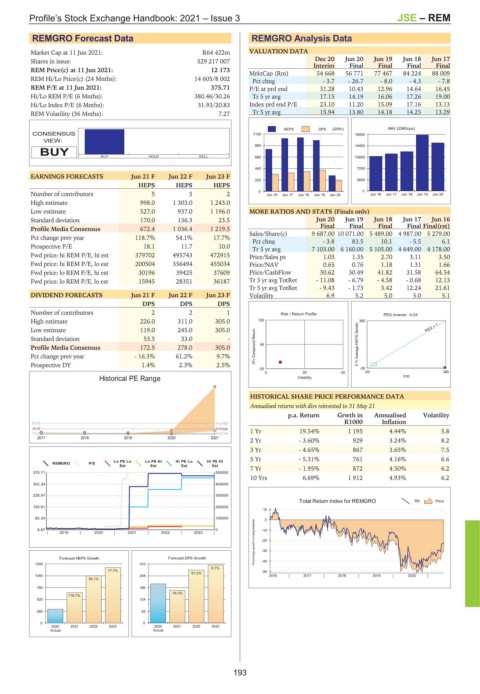

REMGRO Forecast Data REMGRO Analysis Data

Market Cap at 11 Jun 2021: R64 422m VALUATION DATA

Shares in issue: 529 217 007 Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final Final

REM Price(c) at 11 Jun 2021: 12 173

MrktCap (Rm) 54 668 56 771 77 467 84 224 88 009

REM Hi/Lo Price(c) (24 Mnths): 14 605/8 002 Pct chng - 3.7 - 26.7 - 8.0 - 4.3 - 7.8

REM P/E at 11 Jun 2021: 375.71 P/E at prd end 31.28 10.43 12.96 14.64 16.45

Hi/Lo REM P/E (6 Mnths): 380.46/30.26 Tr 5 yr avg 17.15 14.19 16.06 17.26 19.00

Hi/Lo Index P/E (6 Mnths): 31.93/20.83 Index prd end P/E 23.10 11.20 15.09 17.16 13.13

REM Volatility (36 Mnths): 7.27 Tr 5 yr avg 15.94 13.80 14.18 14.25 13.29

HEPS DPS (ZARc) NAV (ZAR/cps)

CONSENSUS 1100 18000

VIEW:

880 14400

BUY

BUY HOLD SELL 660 10800

440 7200

EARNINGS FORECASTS Jun 21 F Jun 22 F Jun 23 F

220 3600

HEPS HEPS HEPS

Number of contributors 5 5 2 0 Jun 16 Jun 17 Jun 18 Jun 19 Jun 20 0 Jun 16 Jun 17 Jun 18 Jun 19 Jun 20

High estimate 998.0 1 303.0 1 243.0

Low estimate 527.0 937.0 1 196.0 MORE RATIOS AND STATS (Finals only)

Standard deviation 170.0 136.3 23.5 Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final Final Final Final(rst)

Profile Media Consensus 672.4 1 036.4 1 219.5

Sales/Share(c) 9 687.00 10 071.00 5 489.00 4 987.00 5 279.00

Pct change prev year 118.7% 54.1% 17.7%

Pct chng - 3.8 83.5 10.1 - 5.5 6.1

Prospective P/E 18.1 11.7 10.0

Tr 5 yr avg 7 103.00 6 160.00 5 105.00 4 649.00 4 178.00

Fwd price: hi REM P/E, hi est 379702 495743 472915 Price/Sales ps 1.03 1.35 2.70 3.11 3.50

Fwd price: hi REM P/E, lo est 200504 356494 455034 Price/NAV 0.65 0.76 1.18 1.31 1.66

Fwd price: lo REM P/E, hi est 30196 39425 37609 Price/CashFlow 30.62 30.49 41.82 31.58 64.54

Fwd price: lo REM P/E, lo est 15945 28351 36187 Tr 3 yr avg TotRet - 11.08 - 6.79 - 4.58 - 0.68 12.13

Tr 5 yr avg TotRet - 9.43 - 1.73 3.42 12.24 21.61

DIVIDEND FORECASTS Jun 21 F Jun 22 F Jun 23 F Volatility 6.9 5.2 5.0 5.0 5.1

DPS DPS DPS

Number of contributors 2 2 1 Risk / Return Profile PEG inverse: -0.04

High estimate 226.0 311.0 305.0 100 380

Low estimate 119.0 245.0 305.0 PEG = 1

Standard deviation 53.5 33.0 -

Profile Media Consensus 172.5 278.0 305.0 3Yr Compound Return 40 5 Yr Average HEPS Growth

Pct change prev year - 16.3% 61.2% 9.7%

Prospective DY 1.4% 2.3% 2.5%

-20 -20

0 20 40 -20 380

Historical PE Range Volatility P/E

HISTORICAL SHARE PRICE PERFORMANCE DATA

Annualised returns with divs reinvested to 31 May 21

p.a. Return Grwth in Annualised Volatility

R1000 Inflation

93.28 Avg High

49.39 Average 1 Yr 19.54% 1 195 4.44% 5.8

15.23 Avg Low

2017 2018 2019 2020 2021

2 Yr - 3.60% 929 3.24% 8.2

3 Yr - 4.65% 867 3.65% 7.5

5 Yr - 5.31% 761 4.16% 6.6

Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

REMGRO P/E

Est Est Est Est

7 Yr - 1.95% 872 4.50% 6.2

375.71 500000

10 Yrs 6.69% 1 912 4.93% 6.2

302.34 400000

228.97 300000

Total Return Index for REMGRO TRI Price

155.61 200000

10

82.24 100000 0

Percentage growthincluding dividends -20

8.87 0 -10

| 2019 | 2020 | 2021 | 2022 | 2023 |

Forecast HEPS Growth Forecast DPS Growth -30

1300 310 -40

9.7%

17.7% 61.2% -50

1040 248 2016 | 2017 | 2018 | 2019 | 2020 |

54.1%

780 186

-16.3%

118.7%

520 124

260 62

0 0

2020 2021 2022 2023 2020 2021 2022 2023

Actual Actual

193