Page 192 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 192

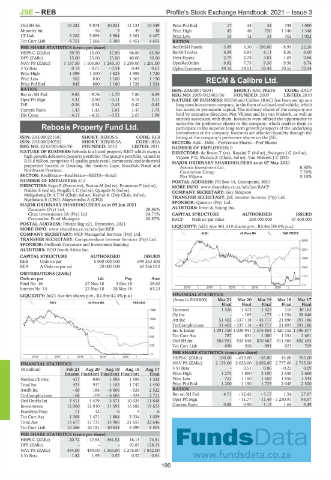

JSE – REB Profile’s Stock Exchange Handbook: 2021 – Issue 3

Ord SH Int 10 282 9 878 10 831 11 131 10 349 Price Prd End 17 45 34 738 1 090

Minority Int - - 56 3 49 38 Price High 45 48 750 1 140 1 348

LT Liab 5 262 5 099 3 984 3 361 4 467 Price Low 15 12 33 702 1 052

Tot Curr Liab 8 751 7 566 5 589 6 451 4 655 RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds - 3.99 5.30 - 196.00 - 8.95 22.26

HEPS-C (ZARc) 59.70 13.00 37.90 96.80 63.50 RetOnTotAss 6.29 6.95 8.11 8.26 6.60

DPS (ZARc) 15.00 25.00 25.00 40.00 30.00 Debt:Equity 2.79 2.78 3.01 1.04 0.86

NAV PS (ZARc) 1 157.50 1 105.80 1 245.10 1 289.00 1 201.00 OperRetOnInv 6.92 7.73 9.36 9.56 6.74

3 Yr Beta 0.14 - 0.01 - 0.54 0.44 0.61 OpInc:Turnover 49.16 54.53 59.42 70.53 70.34

Price High 1 099 1 300 1 825 1 995 1 720

Price Low 562 810 1 100 1 363 1 150 RECM & Calibre Ltd.

Price Prd End 845 880 1 180 1 728 1 524

REC

RATIOS ISIN: ZAE000145041 SHORT: RAC PREFS CODE: RACP

Ret on SH Fnd 9.83 - 9.76 - 1.70 7.86 4.59 REG NO: 2009/012403/06 FOUNDED: 2009 LISTED: 2010

Oper Pft Mgn 4.31 - 2.90 - 0.11 5.18 3.11 NATURE OF BUSINESS: RECM and Calibre (RAC) has been set up as a

D:E 0.56 0.54 0.43 0.42 0.45 long term investment company, in the form of a closed-end vehicle, which

Current Ratio 1.43 1.43 1.61 1.47 1.75 has access to permanent capital. The ordinary shares of the company are

Div Cover 4.11 - 4.12 - 0.51 2.67 1.99 held by executive directors: Piet Viljoen and Jan van Niekerk, as well as

entities associated with them. Investors were offered the opportunity to

subscribe for preference shares in the company, which enables them to

Rebosis Property Fund Ltd. participate in the superior long-term growth prospects of the underlying

investments of the company. Investors are afforded liquidity through the

REB

ISIN: ZAE000201687 SHORT: REBOSIS CODE: REB listing of the company’s preference shares on the JSE.

ISIN: ZAE000240552 SHORT: REBOSISA CODE: REA SECTOR: Add—Debt—Preference Shares—Pref Shares

REG NO: 2010/003468/06 FOUNDED: 2010 LISTED: 2011 NUMBER OF EMPLOYEES: 0

NATURE OF BUSINESS: Rebosis is a listed property REIT which owns a DIRECTORS: de Bruyn T (ne), Rossini T (ind ne), SwiegersJG(ind ne),

high growth defensive property portfolio. The group’s portfolio, valued at Viljoen P G, Matlala Z (Chair, ind ne), Van Niekerk J C (FD)

R15.6 billion, comprises 43 quality grade retail, commercial and industrial MAJOR ORDINARY SHAREHOLDERS as at 07 May 2021

properties located in Gauteng, the Eastern Cape, KwaZulu-Natal and Astoria Investment Ltd. 8.80%

Northwest Province. Coronation Group 7.70%

SECTOR: RealEstate—RealEstate—REITS—Retail Piet Viljoen 5.10%

NUMBER OF EMPLOYEES: 211 POSTAL ADDRESS: PO Box 44, Greenpoint, 8001

DIRECTORS: Kogo Z (Executive), Burton M (ind ne), Froneman F (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/RACP

Naidoo S (ind ne), Pengilly L C (ind ne), Qangule N (ind ne), COMPANY SECRETARY: Guy Simpson

Mokgokong Dr A T M (Chair, ind ne), Keshav K (Dep Chair, ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Ngebulana S (CEO), Magwentshu A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 09 Jun 2021 SPONSOR: Questco (Pty) Ltd.

Zacacode (Pty) Ltd. 28.86% AUDITORS: Ernst & Young Inc.

Citax Investments SA (Pty) Ltd. 24.71% CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Fund Managers 20.87% RACP Prefs no par value 200 000 000 47 400 000

POSTAL ADDRESS: Private Bag x21, Bryanston, 2021 LIQUIDITY: Jul21 Ave 361 319 shares p.w., R3.4m(39.6% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/REB

COMPANY SECRETARY: MCP Managerial Services (Pty) Ltd. ALSH 40 Week MA RAC PREFS

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 2600

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: BDO South Africa Inc. 2234

CAPITAL STRUCTURE AUTHORISED ISSUED

1868

REB Ords no par 5 000 000 000 699 253 200

REA A Ords no par val 70 000 000 63 266 012 1503

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 1137

Final No 16 27 Nov 18 3 Dec 18 29.60 771

Interim No 15 22 May 18 28 May 18 63.23 2016 | 2017 | 2018 | 2019 | 2020 |

LIQUIDITY: Jul21 Ave 6m shares p.w., R1.5m(42.4% p.a.) FINANCIAL STATISTICS

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

REIV 40 Week MA REBOSIS

Final Final Final Final Final

1325 Turnover 1 526 1 572 1 523 110 30 163

Op Inc - - 185 - 175 - 1 354 28 646

1063

Att Inc 51 402 - 337 118 - 43 717 21 890 391 186

TotCompIncLoss 51 402 - 337 118 - 43 717 21 891 391 186

802

Inv & Loans 1 091 350 1 039 941 1 376 854 1 420 152 1 396 877

Tot Curr Ass 787 831 1 000 1 351 2 681

540

Ord SH Int 584 951 533 548 870 667 914 384 892 493

279 Tot Curr Liab 890 928 891 823 769

PER SHARE STATISTICS (cents per share)

17

2016 | 2017 | 2018 | 2019 | 2020 | HEPS-C (ZARc) 100.00 - 659.00 - 85.00 43.00 765.00

FINANCIAL STATISTICS NAV PS (ZARc) 2 133.00 2 033.00 2 692.00 2 777.00 2 735.00

(R million) Feb 21 Aug 20 Aug 19 Aug 18 Aug 17 3 Yr Beta - 0.51 0.06 - 0.23 0.09

Interim Final(rst) Final(rst) Final(rst) Final Price High 1 275 1 800 2 100 2 550 2 660

NetRent/InvInc 417 930 1 095 1 595 1 325 Price Low 753 1 150 1 650 1 850 1 544

Total Inc 423 937 1 103 1 747 1 450 Price Prd End 1 200 1 150 1 725 2 045 2 500

Attrib Inc - 68 184 - 6 606 - 924 2 522 RATIOS

TotCompIncLoss - 68 109 - 6 606 - 924 2 711 Ret on SH Fnd 4.71 - 32.42 - 3.17 1.54 27.97

Ord UntHs Int 3 411 3 479 3 371 10 329 11 848 Oper Pft Mgn - - 11.77 - 11.49 - 1 230.91 94.97

Investments 12 060 12 010 11 691 16 682 19 653 Current Ratio 0.88 0.90 1.12 1.64 3.49

FixedAss/Prop 11 12 6 9 6

Tot Curr Ass 1 368 1 471 1 884 2 034 1 029

Total Ass 13 677 13 731 13 906 21 655 22 646

Tot Curr Liab 10 266 10 151 10 535 6 399 5 504

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 20.72 - 47.94 - 361.52 16.13 74.51

DPS (ZARc) - - - 92.83 128.35

NAV PS (ZARc) 484.00 489.00 1 365.00 1 276.00 1 842.00

3 Yr Beta 1.82 1.99 0.57 0.57 0.91

190