Page 106 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 106

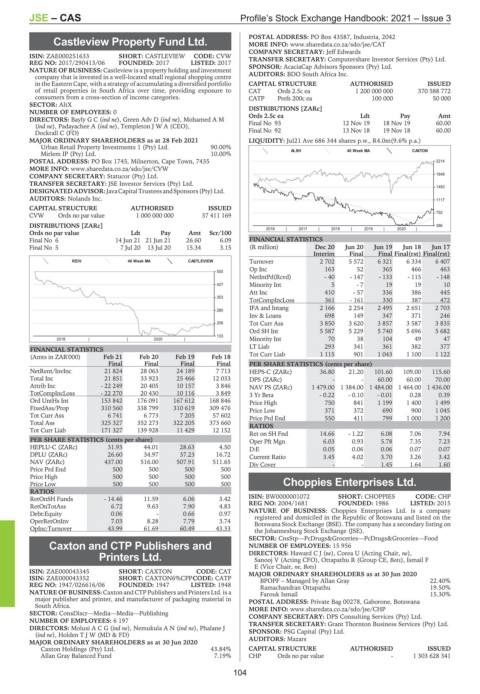

JSE – CAS Profile’s Stock Exchange Handbook: 2021 – Issue 3

POSTAL ADDRESS: PO Box 43587, Industria, 2042

Castleview Property Fund Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/CAT

CAS COMPANY SECRETARY: Jeff Edwards

ISIN: ZAE000251633 SHORT: CASTLEVIEW CODE: CVW TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 2017/290413/06 FOUNDED: 2017 LISTED: 2017 SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

NATURE OF BUSINESS: Castleview is a property holding and investment

company that is invested in a well-located small regional shopping centre AUDITORS: BDO South Africa Inc.

in the Eastern Cape, with a strategy of accumulating a diversified portfolio CAPITAL STRUCTURE AUTHORISED ISSUED

of retail properties in South Africa over time, providing exposure to CAT Ords 2.5c ea 1 200 000 000 370 588 772

consumers from a cross-section of income categories. CATP Prefs 200c ea 100 000 50 000

SECTOR: AltX

NUMBER OF EMPLOYEES: 0 DISTRIBUTIONS [ZARc]

DIRECTORS: BaylyGC(ind ne), Green Adv D (ind ne), Mohamed A M Ords 2.5c ea Ldt Pay Amt

(ind ne), Padayachee A (ind ne), TempletonJWA (CEO), Final No 93 12 Nov 19 18 Nov 19 60.00

Dockrall C (FD) Final No 92 13 Nov 18 19 Nov 18 60.00

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 LIQUIDITY: Jul21 Ave 686 344 shares p.w., R4.0m(9.6% p.a.)

Urban Retail Property Investments 1 (Pty) Ltd. 90.00%

Mirlem IP (Pty) Ltd. 10.00% ALSH 40 Week MA CAXTON

POSTAL ADDRESS: PO Box 1745, Milnerton, Cape Town, 7435 2214

MORE INFO: www.sharedata.co.za/sdo/jse/CVW

COMPANY SECRETARY: Statucor (Pty) Ltd. 1848

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

1483

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

AUDITORS: Nolands Inc. 1117

CAPITAL STRUCTURE AUTHORISED ISSUED

CVW Ords no par value 1 000 000 000 37 411 169 752

DISTRIBUTIONS [ZARc] 386

2016 | 2017 | 2018 | 2019 | 2020 |

Ords no par value Ldt Pay Amt Scr/100

Final No 6 14 Jun 21 21 Jun 21 26.60 6.09 FINANCIAL STATISTICS

Final No 5 7 Jul 20 13 Jul 20 15.34 3.15 (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final(rst) Final(rst)

REIV 40 Week MA CASTLEVIEW Turnover 2 702 5 572 6 321 6 334 6 407

Op Inc 163 52 365 466 463

500

NetIntPd(Rcvd) - 40 - 147 - 133 - 115 - 148

427 Minority Int 5 - 7 19 19 10

Att Inc 410 - 57 336 386 445

353

TotCompIncLoss 361 - 161 330 387 472

IFA and Intang 2 166 2 254 2 495 2 651 2 703

280

Inv & Loans 698 149 347 371 246

206 Tot Curr Ass 3 850 3 620 3 857 3 587 3 835

Ord SH Int 5 587 5 229 5 740 5 696 5 682

133

2018 | | 2020 | Minority Int 70 38 104 49 47

LT Liab 293 341 361 382 377

FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Tot Curr Liab 1 115 901 1 043 1 100 1 122

Final Final Final Final PER SHARE STATISTICS (cents per share)

NetRent/InvInc 21 824 28 063 24 189 7 713 HEPS-C (ZARc) 36.80 21.20 101.60 109.00 115.60

Total Inc 21 851 33 923 25 466 12 033 DPS (ZARc) - - 60.00 60.00 70.00

Attrib Inc - 22 249 20 405 10 157 3 846 NAV PS (ZARc) 1 479.00 1 384.00 1 484.00 1 464.00 1 436.00

TotCompIncLoss - 22 270 20 430 10 116 3 849 3 Yr Beta - 0.22 - 0.10 - 0.01 0.28 0.39

Ord UntHs Int 153 842 176 091 167 612 168 846 Price High 750 841 1 199 1 400 1 499

FixedAss/Prop 310 560 338 799 310 619 309 476 Price Low 371 372 690 900 1 045

Tot Curr Ass 6 741 6 773 7 205 57 602 Price Prd End 550 411 799 1 000 1 200

Total Ass 325 327 352 273 322 205 373 660 RATIOS

Tot Curr Liab 171 327 139 928 11 429 12 152

Ret on SH Fnd 14.66 - 1.22 6.08 7.06 7.94

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 6.03 0.93 5.78 7.35 7.23

HEPLU-C (ZARc) 31.93 44.01 28.63 4.50 D:E 0.05 0.06 0.06 0.07 0.07

DPLU (ZARc) 26.60 34.97 37.23 16.72 Current Ratio 3.45 4.02 3.70 3.26 3.42

NAV (ZARc) 437.00 516.00 507.91 511.65 Div Cover - - 1.45 1.64 1.60

Price Prd End 500 500 500 500

Price High 500 500 500 500

Price Low 500 500 500 500 Choppies Enterprises Ltd.

RATIOS CHO

RetOnSH Funds - 14.46 11.59 6.06 3.42 ISIN: BW0000001072 SHORT: CHOPPIES CODE: CHP

RetOnTotAss 6.72 9.63 7.90 4.83 REG NO: 2004/1681 FOUNDED: 1986 LISTED: 2015

Debt:Equity 0.06 - 0.66 0.97 NATURE OF BUSINESS: Choppies Enterprises Ltd. is a company

registered and domiciled in the Republic of Botswana and listed on the

OperRetOnInv 7.03 8.28 7.79 3.74 Botswana Stock Exchange (BSE). The company has a secondary listing on

OpInc:Turnover 43.99 61.69 60.49 43.33

the Johannesburg Stock Exchange (JSE).

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

Caxton and CTP Publishers and NUMBER OF EMPLOYEES: 15 956

Printers Ltd. DIRECTORS: HawardCJ(ne), Corea U (Acting Chair, ne),

Sanooj V (Acting CFO), Ottapathu R (Group CE, Bots), Ismail F

CAX E (Vice Chair, ne, Bots)

ISIN: ZAE000043345 SHORT: CAXTON CODE: CAT MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

ISIN: ZAE000043352 SHORT: CAXTON6%CPPCODE: CATP BPOPF – Managed by Allan Gray 22.40%

REG NO: 1947/026616/06 FOUNDED: 1947 LISTED: 1948 Ramachandran Ottapathu 19.50%

NATURE OF BUSINESS: Caxton and CTP Publishers and Printers Ltd. is a Farouk Ismail 15.30%

major publisher and printer, and manufacturer of packaging material in POSTAL ADDRESS: Private Bag 00278, Gaborone, Botswana

South Africa. MORE INFO: www.sharedata.co.za/sdo/jse/CHP

SECTOR: ConsDiscr—Media—Media—Publishing COMPANY SECRETARY: DPS Consulting Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 6 197 TRANSFER SECRETARY: Grant Thornton Business Services (Pty) Ltd.

DIRECTORS: MolusiACG(ind ne), NemukulaAN(ind ne), Phalane J SPONSOR: PSG Capital (Pty) Ltd.

(ind ne), HoldenTJW(MD&FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 AUDITORS: Mazars

Caxton Holdings (Pty) Ltd. 43.84% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray Balanced Fund 7.19% CHP Ords no par value - 1 303 628 341

104