Page 104 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 104

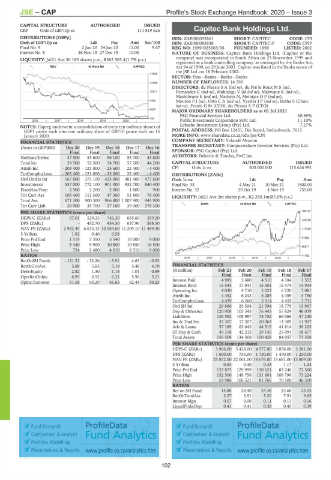

JSE – CAP Profile’s Stock Exchange Handbook: 2020 – Issue 3

CAPITAL STRUCTURE AUTHORISED ISSUED

CRP Ords of GBP10p ea - 111 819 626 Capitec Bank Holdings Ltd.

CAP

DISTRIBUTIONS [GBPp] ISIN: ZAE000035861 SHORT: CAPITEC CODE: CPI

Ords of GBP10p ea Ldt Pay Amt Scr/100 ISIN: ZAE000083838 SHORT: CAPITEC-P CODE: CPIP

Final No 9 2 Jun 20 24 Jun 20 11.00 9.67 REG NO: 1999/025903/06 FOUNDED: 1999 LISTED: 2002

Interim No 8 26 Nov 19 27 Dec 19 10.00 - NATURE OF BUSINESS: Capitec Bank Holdings Ltd. (Capitec or the

company) was incorporated in South Africa on 23 November 1999 and

LIQUIDITY: Jul21 Ave 36 189 shares p.w., R562 505.4(1.7% p.a.)

registered as a bank controlling company, as envisaged by the Banks Act,

REIV 40 Week MA CAPREG Act 94 of 1990, on 29 June 2001. Capitec was listed in the Banks sector of

the JSE Ltd. on 18 February 2002.

17525

SECTOR: Fins—Banks—Banks—Banks

14168 NUMBER OF EMPLOYEES: 14 590

DIRECTORS: du PlessisSA(ind ne), du Pré le RouxMS(ne),

10811 Fernandez C (ind ne), Mahlangu V (ld ind ne), Makwane K (ind ne),

Mashilwane E (ind ne), Mashiya N, MeintjesDP(ind ne),

7454 MoutonPJ(ne), OttoCA(ind ne), VersterJP(ind ne), Botha S (Chair,

ind ne), Fourie G M (CEO), du Plessis A P (CFO)

4097

MAJOR ORDINARY SHAREHOLDERS as at 01 Jul 2021

PSG Financial Services Ltd. 30.69%

740

2016 | 2017 | 2018 | 2019 | 2020 | Public Investment Corporation SOC Ltd. 11.10%

Lebashe Investment Group (Pty) Ltd. 7.27%

NOTES: Capreg underwent a consolidation of every ten ordinary shares of

GBP1 pence each into one ordinary share of GBP10 pence each on 15 POSTAL ADDRESS: PO Box 12451, Die Boord, Stellenbosch, 7613

January 2020. MORE INFO: www.sharedata.co.za/sdo/jse/CPI

COMPANY SECRETARY: Yolandé Mouton

FINANCIAL STATISTICS

(Amts in GBP'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final Final Final Final Final SPONSOR: PSG Capital (Pty) Ltd.

NetRent/InvInc 37 500 53 600 56 100 55 700 43 800 AUDITORS: Deloitte & Touche, PwC Inc.

Total Inc 39 500 52 500 54 700 57 200 44 200 CAPITAL STRUCTURE AUTHORISED ISSUED

Attrib Inc - 203 400 - 121 000 - 25 600 22 400 - 4 400 CPI Ords 1c ea 500 000 000 115 626 991

TotCompIncLoss - 203 400 - 121 000 - 25 600 22 400 - 4 400 DISTRIBUTIONS [ZARc]

Ord UntHs Int 167 800 375 100 433 000 481 400 477 600 Ords 1c ea Ldt Pay Amt

Investments 537 000 772 100 901 000 932 700 840 400 Final No 33 4 May 21 10 May 21 1600.00

FixedAss/Prop 2 500 2 200 2 000 1 800 900 Interim No 32 29 Oct 19 4 Nov 19 755.00

Tot Curr Ass 105 400 111 300 47 300 51 800 76 400 LIQUIDITY: Jul21 Ave 2m shares p.w., R2 250.1m(87.0% p.a.)

Total Ass 671 300 900 300 966 800 1 007 900 945 900

BANK 40 Week MA CAPITEC

Tot Curr Liab 30 900 35 700 37 100 39 000 376 300

168127

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 97.01 529.23 746.20 685.60 359.20

142738

DPS (ZARc) - 432.70 454.30 637.96 588.50

NAV PS (ZARc) 2 982.49 6 673.13 10 584.00 11 209.10 11 489.30 117349

3 Yr Beta 1.92 0.40 0.58 - -

Price Prd End 1 519 5 350 5 540 10 000 9 000 91960

Price High 5 440 9 900 10 800 10 850 16 500

66571

Price Low 724 2 480 4 010 8 510 9 000

RATIOS 41182

2016 | 2017 | 2018 | 2019 | 2020 |

RetOnSH Funds - 121.22 - 32.26 - 5.91 4.65 - 0.92

RetOnTotAss 5.88 5.83 5.18 5.48 4.70 FINANCIAL STATISTICS

Debt:Equity 2.82 1.30 1.15 1.01 0.89 (R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

OperRetOnInv 6.95 6.92 6.21 5.96 5.21 Final Final Final Final Final

OpInc:Turnover 51.58 60.29 61.65 62.44 50.23 Interest Paid 4 985 5 680 4 510 4 184 3 552

Interest Rcvd 16 544 17 041 15 501 15 474 14 934

Operating Inc 4 030 4 710 5 223 6 720 7 081

Attrib Inc 4 452 6 243 5 285 4 459 3 790

TotCompIncLoss 4 439 6 260 5 314 4 459 3 731

Ord SH Int 29 860 25 508 21 594 18 779 15 967

Dep & OtherAcc 120 908 103 343 76 443 57 824 48 039

Liabilities 126 592 108 987 78 752 66 066 57 240

Inv & Trad Sec 35 307 17 207 20 063 14 309 11 927

Adv & Loans 57 189 62 043 44 515 41 814 39 205

ST Dep & Cash 49 318 42 232 29 145 25 091 18 677

Total Assets 156 508 134 568 100 428 84 957 73 358

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 3 966.00 5 428.00 4 577.00 3 858.00 3 281.00

DPS (ZARc) 1 600.00 755.00 1 750.00 1 470.00 1 250.00

NAV PS (ZARc) 25 872.00 22 061.00 18 676.00 15 681.00 13 809.00

3 Yr Beta 0.63 0.40 0.43 1.17 1.24

Price Prd End 133 875 129 999 130 621 83 246 72 500

Price High 152 500 149 756 131 601 109 796 73 224

Price Low 53 986 106 521 81 766 70 500 46 500

RATIOS

Ret on SH Fund 14.88 24.40 24.38 23.60 23.52

RetOnTotalAss 2.57 3.51 5.20 7.91 9.65

Interest Mgn 0.07 0.08 0.11 0.13 0.16

LiquidFnds:Dep 0.41 0.41 0.38 0.43 0.39

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

102