Page 7 - 2021 Issue 2

P. 7

Profile’s Stock Exchange Handbook: 2021 – Issue 2 About the Stock Exchange Handbook

HEPLU-C: Headline Earnings per Linked Unit NAV: Net Asset Value

from continued operations – used for loan stock (P): Pro-forma financials

companies where shares are linked to a debt P/E: Ratio of Price to Earnings (12-month rolling

instrument (see HEPS-C)

HEPS-C)

HEPS-C: Headline Earnings per Share from PEG: Price/Earnings Growth ratio

continuedoperations–Earnings(profits)pershare

excluding the effects of exceptional items and (rst): Restated result

discontinued operations. Scr/100: The number of shares a shareholder can

Hline Erngs-CO: Headline earnings from continuing elect to receive per one hundred ordinary share

operations. held instead of a cash dividend.

Ldt: Last day to trade (to qualify for dividends or Tr 5yr av grwth %: Trailing five year average

other corporate action) growth (ie, average of five years to that point)

Ldr: Last day to register (to qualify for dividends or TRI: Total Return Index (ie, price performance

other corporate action) includingreinvestmentofdividends/distributions)

Liquidity: The three figures shown are (i) the Volatility: Standard deviation of month-on-month

average number of shares traded per week, (ii) the percentage price change over 36 months

average value of shares traded per week, and (iii) ZAR: South African rands

the percentage of issued shares traded over the last ZARc: South African cents

year. (ii) is based on the latest share price available

before going to print. (iii) is annualised where full Note: All financial statements are presented in

year data is not available. accordance with International Financial Reporting

Standards (IFRS) unless otherwise stated.

Market Cap: Market Capitalisation (calculated as

total number of outstanding shares multiplied by

share price)

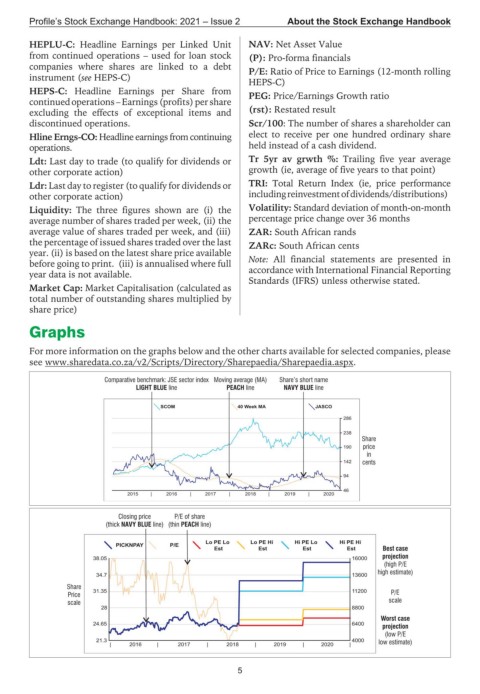

Graphs

For more information on the graphs below and the other charts available for selected companies, please

see www.sharedata.co.za/v2/Scripts/Directory/Sharepaedia/Sharepaedia.aspx.

Comparative benchmark: JSE sector index Moving average (MA) Share’s short name

LIGHT BLUE line PEACH line NAVY BLUE line

SCOM 40 Week MA JASCO

286

238

Share

190 price

in

142 cents

94

46

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Closing price P/E of share

(thick NAVY BLUE line) (thin PEACH line)

Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

PICKNPAY P/E

Est Est Est Est Best case

projection

38.05 16000

(high P/E

high estimate)

34.7 13600

Share

31.35 11200 P/E

Price

scale scale

28 8800

Worst case

24.65 6400

projection

(low P/E

21.3 4000 low estimate)

| 2016 | 2017 | 2018 | 2019 | 2020 |

5