Page 231 - 2021 Issue 2

P. 231

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – TIG

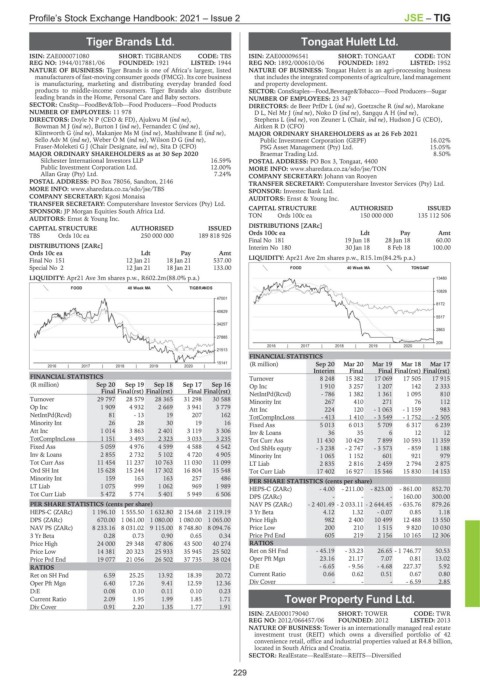

Tiger Brands Ltd. Tongaat Hulett Ltd.

TIG TON

ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS ISIN: ZAE000096541 SHORT: TONGAAT CODE: TON

REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944 REG NO: 1892/000610/06 FOUNDED: 1892 LISTED: 1952

NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed NATURE OF BUSINESS: Tongaat Hulett is an agri-processing business

manufacturers of fast-moving consumer goods (FMCG). Its core business that includes the integrated components of agriculture, land management

is manufacturing, marketing and distributing everyday branded food and property development.

products to middle-income consumers. Tiger Brands also distribute SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Sugar

leading brands in the Home, Personal Care and Baby sectors. NUMBER OF EMPLOYEES: 23 347

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products DIRECTORS: de Beer PrfDr L (ind ne), Goetzsche R (ind ne), Marokane

NUMBER OF EMPLOYEES: 11 978 DL,Nel MrJ(ind ne), Noko D (ind ne), SangquAH(ind ne),

DIRECTORS: Doyle N P (CEO & FD), Ajukwu M (ind ne), Stephens L (ind ne), von Zeuner L (Chair, ind ne), Hudson J G (CEO),

BowmanMJ(ind ne), Burton I (ind ne), Fernandez C (ind ne), Aitken R D (CFO)

Klintworth G (ind ne), Makanjee Ms M (ind ne), Mashilwane E (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 26 Feb 2021

Sello Adv M (ind ne), WeberOM(ind ne), WilsonDG(ind ne), Public Investment Corporation (GEPF) 16.02%

Fraser-Moleketi G J (Chair Designate, ind ne), Sita D (CFO) PSG Asset Management (Pty) Ltd. 15.05%

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 Braemar Trading Ltd. 8.50%

Silchester International Investors LLP 16.59% POSTAL ADDRESS: PO Box 3, Tongaat, 4400

Public Investment Corporation Ltd. 12.00% MORE INFO: www.sharedata.co.za/sdo/jse/TON

Allan Gray (Pty) Ltd. 7.24% COMPANY SECRETARY: Johann van Rooyen

POSTAL ADDRESS: PO Box 78056, Sandton, 2146 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TBS SPONSOR: Investec Bank Ltd.

COMPANY SECRETARY: Kgosi Monaisa AUDITORS: Ernst & Young Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISSUED

SPONSOR: JP Morgan Equities South Africa Ltd. CAPITAL STRUCTURE AUTHORISED 135 112 506

TON

Ords 100c ea

150 000 000

AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

TBS Ords 10c ea 250 000 000 189 818 926 Ords 100c ea Ldt Pay Amt

Final No 181 19 Jun 18 28 Jun 18 60.00

DISTRIBUTIONS [ZARc] Interim No 180 30 Jan 18 8 Feb 18 100.00

Ords 10c ea Ldt Pay Amt

Final No 151 12 Jan 21 18 Jan 21 537.00 LIQUIDITY: Apr21 Ave 2m shares p.w., R15.1m(84.2% p.a.)

Special No 2 12 Jan 21 18 Jan 21 133.00 FOOD 40 Week MA TONGAAT

LIQUIDITY: Apr21 Ave 3m shares p.w., R602.2m(88.0% p.a.) 13480

FOOD 40 Week MA TIGBRANDS

10826

47001

8172

40629

5517

34257

2863

27885

209

2016 | 2017 | 2018 | 2019 | 2020 |

21513

FINANCIAL STATISTICS

15141 (R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

2016 | 2017 | 2018 | 2019 | 2020 |

Interim Final Final Final(rst) Final(rst)

FINANCIAL STATISTICS Turnover 8 248 15 382 17 069 17 505 17 915

(R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16 Op Inc 1 910 3 257 1 207 142 2 333

Final Final(rst) Final(rst) Final Final(rst) NetIntPd(Rcvd) - 786 1 382 1 361 1 095 810

Turnover 29 797 28 579 28 365 31 298 30 588

Minority Int 267 410 271 76 112

Op Inc 1 909 4 932 2 669 3 941 3 779 Att Inc 224 120 - 1 063 - 1 159 983

NetIntPd(Rcvd) 81 - 13 19 207 162 TotCompIncLoss - 413 1 410 - 3 549 - 1 752 - 2 505

Minority Int 26 28 30 19 16 Fixed Ass 5 013 6 013 5 709 6 317 6 239

Att Inc 1 014 3 863 2 401 3 119 3 306 Inv & Loans 36 35 6 12 12

TotCompIncLoss 1 151 3 493 2 323 3 033 3 235 Tot Curr Ass 11 430 10 429 7 899 10 593 11 359

Fixed Ass 5 059 4 976 4 599 4 588 4 542 Ord ShHs equty - 3 238 - 2 747 - 3 573 - 859 1 188

Inv & Loans 2 855 2 732 5 102 4 720 4 905 Minority Int 1 065 1 152 601 921 979

Tot Curr Ass 11 454 11 237 10 763 11 030 11 099 LT Liab 2 835 2 816 2 459 2 794 2 875

Ord SH Int 15 628 15 244 17 302 16 804 15 548 Tot Curr Liab 17 402 16 927 15 546 15 830 14 153

Minority Int 159 163 163 257 486 PER SHARE STATISTICS (cents per share)

LT Liab 1 075 999 1 062 969 1 989 HEPS-C (ZARc) - 4.00 - 211.00 - 823.00 - 861.00 852.70

Tot Curr Liab 5 472 5 774 5 401 5 949 6 506 DPS (ZARc) - - - 160.00 300.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) - 2 401.49 - 2 033.11 - 2 644.45 - 635.76 879.26

HEPS-C (ZARc) 1 196.10 1 555.50 1 632.80 2 154.68 2 119.19 3 Yr Beta 4.12 1.32 - 0.07 0.85 1.18

DPS (ZARc) 670.00 1 061.00 1 080.00 1 080.00 1 065.00 Price High 982 2 400 10 499 12 488 13 550

NAV PS (ZARc) 8 233.16 8 031.02 9 115.00 8 748.80 8 094.76 Price Low 200 210 1 515 9 820 10 030

3 Yr Beta 0.28 0.73 0.90 0.65 0.34 Price Prd End 605 219 2 156 10 165 12 306

Price High 24 000 29 348 47 806 43 500 40 274 RATIOS

Price Low 14 381 20 323 25 933 35 945 25 502 Ret on SH Fnd - 45.19 - 33.23 26.65 - 1 746.77 50.53

Price Prd End 19 077 21 056 26 502 37 735 38 024 Oper Pft Mgn 23.16 21.17 7.07 0.81 13.02

RATIOS D:E - 6.65 - 9.56 - 4.68 227.37 5.92

Ret on SH Fnd 6.59 25.25 13.92 18.39 20.72 Current Ratio 0.66 0.62 0.51 0.67 0.80

Oper Pft Mgn 6.40 17.26 9.41 12.59 12.36 Div Cover - - - - 6.59 2.85

D:E 0.08 0.10 0.11 0.10 0.23

Current Ratio 2.09 1.95 1.99 1.85 1.71 Tower Property Fund Ltd.

Div Cover 0.91 2.20 1.35 1.77 1.91 TOW

ISIN: ZAE000179040 SHORT: TOWER CODE: TWR

REG NO: 2012/066457/06 FOUNDED: 2012 LISTED: 2013

NATURE OF BUSINESS: Tower is an internationally managed real estate

investment trust (REIT) which owns a diversified portfolio of 42

convenience retail, office and industrial properties valued at R4.8 billion,

located in South Africa and Croatia.

SECTOR: RealEstate—RealEstate—REITS—Diversified

229