Page 92 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 92

JSE – ARB Profile’s Stock Exchange Handbook: 2021 – Issue 1

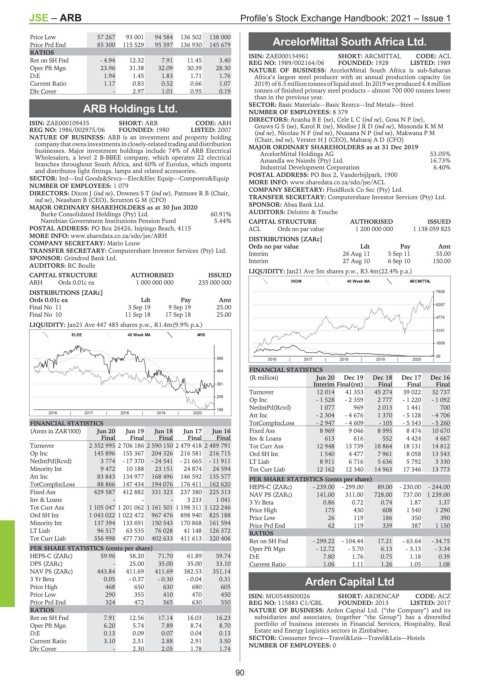

Price Low 57 267 93 001 94 584 136 502 138 000

Price Prd End 85 300 115 529 95 597 136 930 145 679 ArcelorMittal South Africa Ltd.

RATIOS ISIN: ZAE000134961 SHORT: ARCMITTAL CODE: ACL

ARC

Ret on SH Fnd - 4.94 12.32 7.91 11.45 3.40 REG NO: 1989/002164/06 FOUNDED: 1928 LISTED: 1989

Oper Pft Mgn 23.96 31.38 32.09 30.39 28.30 NATURE OF BUSINESS: ArcelorMittal South Africa is sub-Saharan

D:E 1.94 1.45 1.83 1.71 1.76 Africa’s largest steel producer with an annual production capacity (in

Current Ratio 1.17 0.83 0.52 0.66 1.07 2019) of 6.5 million tonnesof liquid steel. In 2019 we produced 4.4 million

Div Cover - 2.97 1.01 0.95 0.19 tonnes of finished primary steel products – almost 700 000 tonnes lower

than in the previous year.

ARB Holdings Ltd. SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Steel

NUMBER OF EMPLOYEES: 8 379

ARB DIRECTORS: AranhaBE(ne), CeleLC(ind ne), GosaNP(ne),

ISIN: ZAE000109435 SHORT: ARB CODE: ARH GouwsGS(ne), Karol R (ne), ModiseJRD(ind ne), MusondaKMM

REG NO: 1986/002975/06 FOUNDED: 1980 LISTED: 2007 (ind ne), NicolauNF(ind ne), NxasanaNP(ind ne), Makwana P M

NATURE OF BUSINESS: ARB is an investment and property holding (Chair, ind ne), Verster H J (CEO), Maharaj A D (CFO)

company that ownsinvestmentsinclosely-related trading anddistribution MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

businesses. Major investment holdings include 74% of ARB Electrical ArcelorMittal Holdings AG 53.05%

Wholesalers, a level 2 B-BBEE company, which operates 22 electrical Amandla we Nsimbi (Pty) Ltd. 16.73%

branches throughout South Africa, and 60% of Eurolux, which imports Industrial Development Corporation 6.40%

and distributes light fittings, lamps and related accessories.

SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip POSTAL ADDRESS: PO Box 2, Vanderbijlpark, 1900

NUMBER OF EMPLOYEES: 1 079 MORE INFO: www.sharedata.co.za/sdo/jse/ACL

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

DIRECTORS: Dixon J (ind ne), DownesST(ind ne), Patmore R B (Chair, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ind ne), Neasham B (CEO), Scrutton G M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 SPONSOR: Absa Bank Ltd.

Burke Consolidated Holdings (Pty) Ltd. 60.91% AUDITORS: Deloitte & Touche

Namibian Government Institutions Pension Fund 5.44% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 26426, Isipingo Beach, 4115 ACL Ords no par value 1 200 000 000 1 138 059 825

MORE INFO: www.sharedata.co.za/sdo/jse/ARH DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Mario Louw Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim 26 Aug 11 5 Sep 11 55.00

SPONSOR: Grindrod Bank Ltd. Interim 27 Aug 10 6 Sep 10 150.00

AUDITORS: RC Boulle

LIQUIDITY: Jan21 Ave 5m shares p.w., R3.4m(22.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

ARH Ords 0.01c ea 1 000 000 000 235 000 000 INDM 40 Week MA ARCMITTAL

DISTRIBUTIONS [ZARc] 7939

Ords 0.01c ea Ldt Pay Amt

6357

Final No 11 3 Sep 19 9 Sep 19 25.00

Final No 10 11 Sep 18 17 Sep 18 25.00

4774

LIQUIDITY: Jan21 Ave 447 485 shares p.w., R1.4m(9.9% p.a.)

3191

ELEE 40 Week MA ARB

1609

26

566 2016 | 2017 | 2018 | 2019 | 2020 |

464 FINANCIAL STATISTICS

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

361 Interim Final(rst) Final Final Final

Turnover 12 014 41 353 45 274 39 022 32 737

258

Op Inc - 1 528 - 2 359 2 777 - 1 220 - 1 092

NetIntPd(Rcvd) 1 077 969 2 013 1 441 700

156

2016 | 2017 | 2018 | 2019 | 2020 |

Att Inc - 2 304 - 4 676 1 370 - 5 128 - 4 706

FINANCIAL STATISTICS TotCompIncLoss - 2 947 - 4 609 - 105 - 5 543 - 5 260

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Fixed Ass 8 969 9 046 8 995 8 474 10 670

Final Final Final Final Final Inv & Loans 613 616 552 4 424 4 667

Turnover 2 352 995 2 706 186 2 590 150 2 479 418 2 489 791 Tot Curr Ass 12 948 13 739 18 864 18 131 14 812

Op Inc 145 896 155 367 204 326 216 581 216 715 Ord SH Int 1 540 4 477 7 961 8 058 13 543

NetIntPd(Rcvd) 3 774 - 17 370 - 24 541 - 21 665 - 11 911 LT Liab 8 911 6 716 5 636 5 792 3 330

Minority Int 9 472 10 188 23 151 24 874 24 594 Tot Curr Liab 12 162 12 340 14 963 17 346 13 773

Att Inc 83 843 134 977 168 496 146 592 135 577 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 88 866 147 434 194 076 176 411 162 620 HEPS-C (ZARc) - 239.00 - 299.00 89.00 - 230.00 - 244.00

Fixed Ass 429 587 412 882 331 323 237 380 225 313

NAV PS (ZARc) 141.00 311.00 728.00 737.00 1 239.00

Inv & Loans - - - 3 233 1 041 3 Yr Beta 0.86 0.72 0.74 1.87 1.37

Tot Curr Ass 1 105 047 1 201 062 1 161 501 1 198 311 1 122 246 Price High 175 430 608 1 540 1 290

Ord SH Int 1 043 022 1 022 472 967 476 898 940 825 188 Price Low 26 119 186 350 390

Minority Int 137 394 133 691 150 543 170 868 161 594 Price Prd End 62 119 339 387 1 150

LT Liab 96 517 63 535 76 028 41 148 126 372 RATIOS

Tot Curr Liab 356 998 477 730 402 633 411 613 320 406

Ret on SH Fnd - 299.22 - 104.44 17.21 - 63.64 - 34.75

PER SHARE STATISTICS (cents per share) Oper Pft Mgn - 12.72 - 5.70 6.13 - 3.13 - 3.34

HEPS-C (ZARc) 59.96 58.20 71.70 61.89 59.74 D:E 7.80 1.76 0.75 1.18 0.39

DPS (ZARc) - 25.00 35.00 35.00 33.10 Current Ratio 1.06 1.11 1.26 1.05 1.08

NAV PS (ZARc) 443.84 411.69 411.69 382.53 351.14

3 Yr Beta 0.05 - 0.37 - 0.30 - 0.04 0.31 Arden Capital Ltd

Price High 468 650 630 680 605

ARD

Price Low 290 355 410 470 450 ISIN: MU0548S00026 SHORT: ARDENCAP CODE: ACZ

Price Prd End 324 472 565 630 550 REG NO: 115883 C1/GBL FOUNDED: 2013 LISTED: 2017

RATIOS NATURE OF BUSINESS: Arden Capital Ltd. (“the Company”) and its

Ret on SH Fnd 7.91 12.56 17.14 16.03 16.23 subsidiaries and associates, (together “the Group”) has a diversifed

Oper Pft Mgn 6.20 5.74 7.89 8.74 8.70 portfolio of business interests in Financial Services, Hospitality, Real

D:E 0.13 0.09 0.07 0.04 0.13 Estate and Energy Logistics sectors in Zimbabwe.

Current Ratio 3.10 2.51 2.88 2.91 3.50 SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Hotels

NUMBER OF EMPLOYEES: 0

Div Cover - 2.30 2.05 1.78 1.74

90