Page 91 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 91

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – ANG

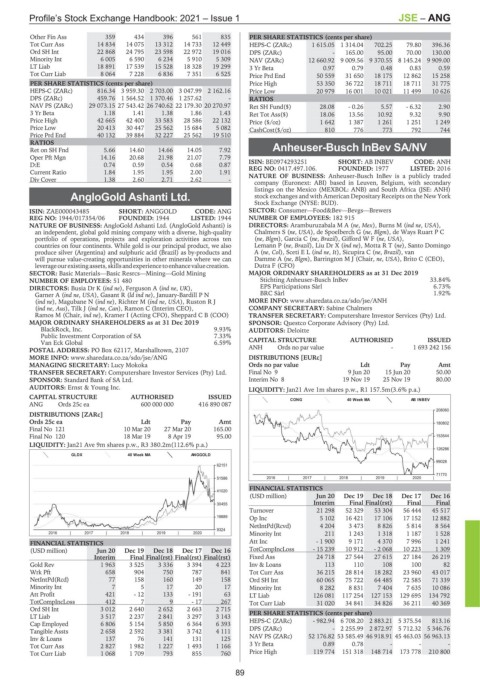

Other Fin Ass 359 434 396 561 835 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 14 834 14 075 13 312 14 733 12 449 HEPS-C (ZARc) 1 615.05 1 314.04 702.25 79.80 396.36

Ord SH Int 22 868 24 795 23 598 22 972 19 016 DPS (ZARc) - 165.00 95.00 70.00 130.00

Minority Int 6 005 6 590 6 234 5 910 5 309 NAV (ZARc) 12 660.92 9 009.56 9 370.55 8 145.24 9 909.00

LT Liab 18 891 17 539 15 528 18 328 19 299 3 Yr Beta 0.97 0.79 0.48 0.83 0.59

Tot Curr Liab 8 064 7 228 6 836 7 351 6 525 Price Prd End 50 559 31 650 18 175 12 862 15 258

PER SHARE STATISTICS (cents per share) Price High 53 350 36 722 18 711 18 711 31 775

HEPS-C (ZARc) 816.34 3 959.30 2 703.00 3 047.99 2 162.16 Price Low 20 979 16 001 10 021 11 499 10 626

DPS (ZARc) 459.76 1 564.52 1 370.46 1 257.62 - RATIOS

NAV PS (ZARc) 29 073.15 27 543.42 26 740.62 22 179.30 20 270.97 Ret SH Fund($) 28.08 - 0.26 5.57 - 6.32 2.90

3 Yr Beta 1.18 1.41 1.38 1.86 1.43 Ret Tot Ass($) 18.06 13.56 10.92 9.32 9.90

Price High 42 665 42 400 33 583 28 586 22 132 Price ($/oz) 1 642 1 387 1 261 1 251 1 249

Price Low 20 413 30 447 25 562 15 684 5 082 CashCost($/oz) 810 776 773 792 744

Price Prd End 40 132 39 884 32 227 25 562 19 510

RATIOS

Ret on SH Fnd 5.66 14.60 14.66 14.05 7.92 Anheuser-Busch InBev SA/NV

Oper Pft Mgn 14.16 20.68 21.98 21.07 7.79 ANH

CODE: ANH

D:E 0.74 0.59 0.54 0.68 0.87 ISIN: BE0974293251 SHORT: AB INBEV LISTED: 2016

FOUNDED: 1977

REG NO: 0417.497.106.

Current Ratio 1.84 1.95 1.95 2.00 1.91

Div Cover 1.38 2.60 2.71 2.62 - NATURE OF BUSINESS: Anheuser-Busch InBev is a publicly traded

company (Euronext: ABI) based in Leuven, Belgium, with secondary

listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH)

AngloGold Ashanti Ltd. stock exchanges and with American Depositary Receipts on the New York

Stock Exchange (NYSE: BUD).

ANG

ISIN: ZAE000043485 SHORT: ANGGOLD CODE: ANG SECTOR: Consumer—Food&Bev—Bevgs—Brewers

REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944 NUMBER OF EMPLOYEES: 182 915

NATURE OF BUSINESS: AngloGold Ashanti Ltd. (AngloGold Ashanti) is DIRECTORS: AramburuzabalaMA(ne, Mex), Burns M (ind ne, USA),

an independent, global gold mining company with a diverse, high-quality Chalmers S (ne, USA), de Spoelberch G (ne, Blgm), de Ways Ruart P C

portfolio of operations, projects and exploration activities across ten (ne, Blgm), Garcia C (ne, Brazil), GiffordWF(ne, USA),

countries on four continents. While gold is our principal product, we also Lemann P (ne, Brazil), Liu Dr X (ind ne), MottaRT(ne), Santo Domingo

produce silver (Argentina) and sulphuric acid (Brazil) as by-products and A(ne, Col), ScetiEL(ind ne, It), Sicupira C (ne, Brazil), van

will pursue value-creating opportunities in other minerals where we can Damme A (ne, Blgm), Barrington M J (Chair, ne, USA), Brito C (CEO),

leverageourexistingassets,skillsandexperiencetoenhancevaluecreation. Dutra F (CFO)

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

NUMBER OF EMPLOYEES: 51 480 Stichting Anheuser-Busch InBev 33.84%

DIRECTORS: Busia Dr K (ind ne), Ferguson A (ind ne, UK), EPS Participations Sàrl 6.73%

Garner A (ind ne, USA), Gasant R (ld ind ne), January-Bardill P N BRC Sàrl 1.92%

(ind ne), Magubane N (ind ne), Richter M (ind ne, USA), Ruston R J MORE INFO: www.sharedata.co.za/sdo/jse/ANH

(ind ne, Aus), Tilk J (ind ne, Can), Ramon C (Interim CEO), COMPANY SECRETARY: Sabine Chalmers

Ramos M (Chair, ind ne), Kramer I (Acting CFO), Sheppard C B (COO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 SPONSOR: Questco Corporate Advisory (Pty) Ltd.

BlackRock, Inc. 9.93% AUDITORS: Deloitte

Public Investment Corporation of SA 7.33%

Van Eck Global 6.59% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107 ANH Ords no par value - 1 693 242 156

MORE INFO: www.sharedata.co.za/sdo/jse/ANG DISTRIBUTIONS [EURc]

MANAGING SECRETARY: Lucy Mokoka Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 9 9 Jun 20 15 Jun 20 50.00

SPONSOR: Standard Bank of SA Ltd. Interim No 8 19 Nov 19 25 Nov 19 80.00

AUDITORS: Ernst & Young Inc. LIQUIDITY: Jan21 Ave 1m shares p.w., R1 157.5m(3.6% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

CONG 40 Week MA AB INBEV

ANG Ords 25c ea 600 000 000 416 890 087

208060

DISTRIBUTIONS [ZARc]

Ords 25c ea Ldt Pay Amt 180802

Final No 121 10 Mar 20 27 Mar 20 165.00

Final No 120 18 Mar 19 8 Apr 19 95.00 153544

LIQUIDITY: Jan21 Ave 9m shares p.w., R3 380.2m(112.6% p.a.)

126286

GLDX 40 Week MA ANGGOLD

99028

62151

71770

51586 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

41020

(USD million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final(rst) Final Final

30455

Turnover 21 298 52 329 53 304 56 444 45 517

19889 Op Inc 5 102 16 421 17 106 17 152 12 882

NetIntPd(Rcvd) 4 204 3 473 8 826 5 814 8 564

9324

2016 | 2017 | 2018 | 2019 | 2020 | Minority Int 211 1 243 1 318 1 187 1 528

FINANCIAL STATISTICS Att Inc - 1 900 9 171 4 370 7 996 1 241

(USD million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 TotCompIncLoss - 15 239 10 912 - 2 068 10 223 1 309

Interim Final Final(rst) Final(rst) Final(rst) Fixed Ass 24 718 27 544 27 615 27 184 26 219

Gold Rev 1 963 3 525 3 336 3 394 4 223 Inv & Loans 113 110 108 100 82

Wrk Pft 658 904 750 787 841 Tot Curr Ass 36 215 28 814 18 282 23 960 43 017

NetIntPd(Rcd) 77 158 160 149 158 Ord SH Int 60 065 75 722 64 485 72 585 71 339

Minority Int 7 5 17 20 17 Minority Int 8 282 8 831 7 404 7 635 10 086

Att Profit 421 - 12 133 - 191 63 LT Liab 126 081 117 254 127 153 129 695 134 792

TotCompIncLoss 412 7 9 - 17 267 Tot Curr Liab 31 020 34 841 34 826 36 211 40 369

Ord SH Int 3 012 2 640 2 652 2 663 2 715

LT Liab 3 517 2 237 2 841 3 297 3 143 PER SHARE STATISTICS (cents per share)

Cap Employed 6 806 5 154 5 850 6 364 6 393 HEPS-C (ZARc) - 982.94 6 708.20 2 883.21 5 375.54 813.16

Tangible Assts 2 658 2 592 3 381 3 742 4 111 DPS (ZARc) - 2 255.99 2 872.97 5 712.32 5 346.76

Inv & Loans 137 76 141 131 125 NAV PS (ZARc) 52 176.82 53 585.49 46 918.91 45 463.03 56 963.13

Tot Curr Ass 2 827 1 982 1 227 1 493 1 166 3 Yr Beta 0.89 0.78 - - -

Tot Curr Liab 1 068 1 709 793 855 760 Price High 119 774 151 318 148 714 173 778 210 800

89