Page 221 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 221

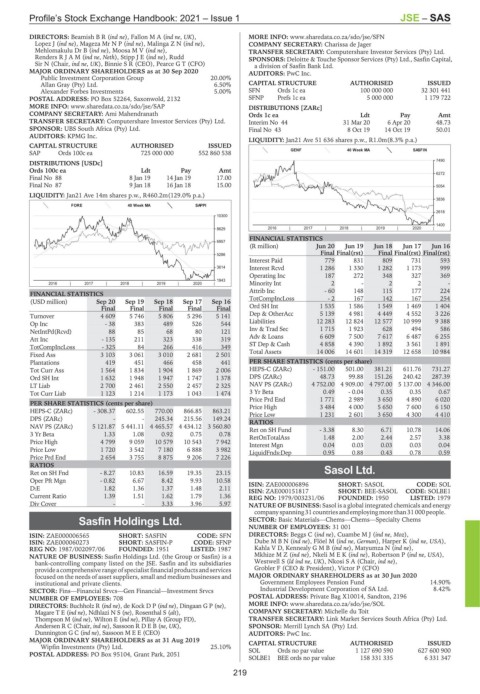

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – SAS

DIRECTORS: BeamishBR(ind ne), FallonMA(ind ne, UK), MORE INFO: www.sharedata.co.za/sdo/jse/SFN

Lopez J (ind ne), Mageza MrNP(ind ne), MalingaZN(ind ne), COMPANY SECRETARY: Charissa de Jager

Mehlomakulu Dr B (ind ne), MoosaMV(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

RendersRJAM(ind ne, Neth), StippJE(ind ne), Rudd SPONSORS: Deloitte & Touche Sponsor Services (Pty) Ltd., Sasfin Capital,

Sir N (Chair, ind ne, UK), Binnie S R (CEO), Pearce G T (CFO) a division of Sasfin Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 AUDITORS: PwC Inc.

Public Investment Corporation Group 20.00%

Allan Gray (Pty) Ltd. 6.50% CAPITAL STRUCTURE AUTHORISED ISSUED

Alexander Forbes Investments 5.00% SFN Ords 1c ea 100 000 000 32 301 441

POSTAL ADDRESS: PO Box 52264, Saxonwold, 2132 SFNP Prefs 1c ea 5 000 000 1 179 722

MORE INFO: www.sharedata.co.za/sdo/jse/SAP DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Ami Mahendranath Ords 1c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 44 31 Mar 20 6 Apr 20 48.73

SPONSOR: UBS South Africa (Pty) Ltd. Final No 43 8 Oct 19 14 Oct 19 50.01

AUDITORS: KPMG Inc.

LIQUIDITY: Jan21 Ave 51 636 shares p.w., R1.0m(8.3% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

SAP Ords 100c ea 725 000 000 552 860 538 GENF 40 Week MA SASFIN

7490

DISTRIBUTIONS [USDc]

Ords 100c ea Ldt Pay Amt

6272

Final No 88 8 Jan 19 14 Jan 19 17.00

Final No 87 9 Jan 18 16 Jan 18 15.00 5054

LIQUIDITY: Jan21 Ave 14m shares p.w., R460.2m(129.0% p.a.)

3836

FORE 40 Week MA SAPPI

2618

10300

1400

8629 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

6957

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final Final(rst) Final(rst)

5286

Interest Paid 779 831 809 731 593

3614 Interest Rcvd 1 286 1 330 1 282 1 173 999

Operating Inc 187 272 348 327 369

1943

2016 | 2017 | 2018 | 2019 | 2020 | Minority Int 2 - 2 2 -

Attrib Inc - 60 148 115 177 224

FINANCIAL STATISTICS

(USD million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16 TotCompIncLoss - 2 167 142 167 254

Final Final Final Final Final Ord SH Int 1 535 1 586 1 549 1 469 1 404

Turnover 4 609 5 746 5 806 5 296 5 141 Dep & OtherAcc 5 139 4 981 4 449 4 552 3 226

Op Inc - 38 383 489 526 544 Liabilities 12 283 12 824 12 577 10 999 9 388

NetIntPd(Rcvd) 88 85 68 80 121 Inv & Trad Sec 1 715 1 923 628 494 586

Att Inc - 135 211 323 338 319 Adv & Loans 6 609 7 500 7 617 6 487 6 255

TotCompIncLoss - 325 84 266 416 349 ST Dep & Cash 4 858 4 390 1 892 3 561 1 891

Fixed Ass 3 103 3 061 3 010 2 681 2 501 Total Assets 14 006 14 601 14 319 12 658 10 984

Plantations 419 451 466 458 441 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 564 1 834 1 904 1 869 2 006 HEPS-C (ZARc) - 151.00 501.00 381.21 611.76 731.27

Ord SH Int 1 632 1 948 1 947 1 747 1 378 DPS (ZARc) 48.73 99.88 151.26 240.42 287.39

LT Liab 2 700 2 461 2 550 2 457 2 325 NAV PS (ZARc) 4 752.00 4 909.00 4 797.00 5 137.00 4 346.00

Tot Curr Liab 1 123 1 214 1 173 1 043 1 474 3 Yr Beta 0.49 - 0.04 0.35 0.35 0.67

Price Prd End 1 771 2 989 3 650 4 890 6 020

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 308.37 602.55 770.00 866.85 863.21 Price High 3 484 4 000 5 650 7 600 6 150

1 231

Price Low

2 601

4 300

4 410

3 650

DPS (ZARc) - - 245.34 215.56 149.24 RATIOS

NAV PS (ZARc) 5 121.87 5 441.11 4 465.57 4 434.12 3 560.80 Ret on SH Fund - 3.38 8.30 6.71 10.78 14.06

3 Yr Beta 1.33 1.08 0.92 0.75 0.78 RetOnTotalAss 1.48 2.00 2.44 2.57 3.38

Price High 4 799 9 059 10 579 10 543 7 942 Interest Mgn 0.04 0.03 0.03 0.03 0.04

Price Low 1 720 3 542 7 180 6 888 3 982 LiquidFnds:Dep 0.95 0.88 0.43 0.78 0.59

Price Prd End 2 654 3 755 8 875 9 206 7 226

RATIOS

Ret on SH Fnd - 8.27 10.83 16.59 19.35 23.15 Sasol Ltd.

Oper Pft Mgn - 0.82 6.67 8.42 9.93 10.58 SAS

CODE: SOL

D:E 1.82 1.36 1.37 1.48 2.11 ISIN: ZAE000006896 SHORT: SASOL CODE: SOLBE1

ISIN: ZAE000151817

SHORT: BEE-SASOL

Current Ratio 1.39 1.51 1.62 1.79 1.36 REG NO: 1979/003231/06 FOUNDED: 1950 LISTED: 1979

Div Cover - - 3.33 3.96 5.97 NATURE OF BUSINESS: Sasol is a global integrated chemicals and energy

companyspanning31countriesandemployingmorethan31000 people.

Sasfin Holdings Ltd. SECTOR: Basic Materials—Chems—Chems—Specialty Chems

NUMBER OF EMPLOYEES: 31 001

SAS

ISIN: ZAE000006565 SHORT: SASFIN CODE: SFN DIRECTORS: Beggs C (ind ne), CuambeMJ(ind ne, Moz),

ISIN: ZAE000060273 SHORT: SASFIN-P CODE: SFNP DubeMBN(ind ne), Flöel M (ind ne, German), Harper K (ind ne, USA),

REG NO: 1987/002097/06 FOUNDED: 1951 LISTED: 1987 Kahla V D, KennealyGMB(ind ne), Matyumza N (ind ne),

NATURE OF BUSINESS: Sasfin Holdings Ltd. (the Group or Sasfin) is a MkhizeMZ(ind ne), NkeliMEK(ind ne), Robertson P (ind ne, USA),

bank-controlling company listed on the JSE. Sasfin and its subsidiaries Westwell S (ld ind ne, UK), Nkosi S A (Chair, ind ne),

provide acomprehensive range ofspecialist financialproductsandservices Grobler F (CEO & President), Victor P (CFO)

focused on the needs of asset suppliers, small and medium businesses and MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

institutional and private clients. Government Employees Pension Fund 14.90%

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs Industrial Development Corporation of SA Ltd. 8.42%

NUMBER OF EMPLOYEES: 708 POSTAL ADDRESS: Private Bag X10014, Sandton, 2196

DIRECTORS: Buchholz R (ind ne), de Kock D P (ind ne), Dingaan G P (ne), MORE INFO: www.sharedata.co.za/sdo/jse/SOL

Magare T E (ind ne), Ndhlazi N S (ne), Rosenthal S (alt), COMPANY SECRETARY: Michelle du Toit

Thompson M (ind ne), Wilton E (ind ne), Pillay A (Group FD), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Andersen R C (Chair, ind ne), Sassoon R D E B (ne, UK), SPONSOR: Merrill Lynch SA (Pty) Ltd.

Dunnington G C (ind ne), Sassoon M E E (CEO) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019 CAPITAL STRUCTURE AUTHORISED ISSUED

Wipfin Investments (Pty) Ltd. 25.10%

POSTAL ADDRESS: PO Box 95104, Grant Park, 2051 SOL Ords no par value 1 127 690 590 627 600 900

SOLBE1 BEE ords no par value 158 331 335 6 331 347

219