Page 212 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 212

JSE – RHB Profile’s Stock Exchange Handbook: 2021 – Issue 1

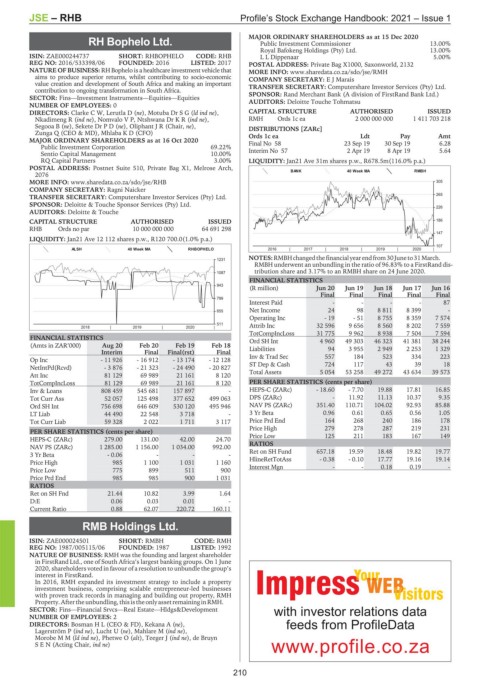

MAJOR ORDINARY SHAREHOLDERS as at 15 Dec 2020

RH Bophelo Ltd. Public Investment Commissioner 13.00%

Royal Bafokeng Holdings (Pty) Ltd. 13.00%

RHB

ISIN: ZAE000244737 SHORT: RHBOPHELO CODE: RHB L L Dippenaar 5.00%

REG NO: 2016/533398/06 FOUNDED: 2016 LISTED: 2017 POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132

NATURE OF BUSINESS: RH Bophelo is a healthcare investment vehicle that MORE INFO: www.sharedata.co.za/sdo/jse/RMH

aims to produce superior returns, whilst contributing to socio-economic COMPANY SECRETARY: E J Marais

value creation and development of South Africa and making an important TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

contribution to ongoing transformation in South Africa.

SECTOR: Fins—Investment Instruments—Equities—Equities SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

NUMBER OF EMPLOYEES: 0 AUDITORS: Deloitte Touche Tohmatsu

DIRECTORS: Clarke C W, Lerutla D (ne), Motuba DrSG(ld ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Nkadimeng R (ind ne), Nomvalo V P, Ntshwana DrKR(ind ne), RMH Ords 1c ea 2 000 000 000 1 411 703 218

Segooa B (ne), Sekete DrPD(ne), Oliphant J R (Chair, ne), DISTRIBUTIONS [ZARc]

Zunga Q (CEO & MD), Mhlaba K D (CFO) Ords 1c ea Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 16 Oct 2020 Final No 58 23 Sep 19 30 Sep 19 6.28

Public Investment Corporation 69.22%

Sentio Capital Management 10.00% Interim No 57 2 Apr 19 8 Apr 19 5.64

RQ Capital Partners 3.00% LIQUIDITY: Jan21 Ave 31m shares p.w., R678.5m(116.0% p.a.)

POSTAL ADDRESS: Postnet Suite 510, Private Bag X1, Melrose Arch,

BANK 40 Week MA RMBH

2076

MORE INFO: www.sharedata.co.za/sdo/jse/RHB 305

COMPANY SECRETARY: Ragni Naicker

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 265

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

226

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 186

RHB Ords no par 10 000 000 000 64 691 298

147

LIQUIDITY: Jan21 Ave 12 112 shares p.w., R120 700.0(1.0% p.a.)

107

ALSH 40 Week MA RHBOPHELO 2016 | 2017 | 2018 | 2019 | 2020 |

NOTES:RMBHchangedthefinancialyearendfrom30Juneto31March.

1231

RMBH underwent an unbundling in the ratio of 96.83% to a FirstRand dis-

tribution share and 3.17% to an RMBH share on 24 June 2020.

1087

FINANCIAL STATISTICS

943

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final Final Final Final

799

Interest Paid - - - - 87

655 Net Income 24 98 8 811 8 399 -

Operating Inc - 19 - 51 8 755 8 359 7 574

511 Attrib Inc 32 596 9 656 8 560 8 202 7 559

2018 | 2019 | 2020 |

TotCompIncLoss 31 775 9 962 8 938 7 504 7 594

FINANCIAL STATISTICS Ord SH Int 4 960 49 303 46 323 41 381 38 244

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Liabilities 94 3 955 2 949 2 253 1 329

Interim Final Final(rst) Final

Op Inc - 11 926 - 16 912 - 13 174 - 12 128 Inv & Trad Sec 557 184 523 334 223

NetIntPd(Rcvd) - 3 876 - 21 323 - 24 490 - 20 827 ST Dep & Cash 724 117 43 39 18

Att Inc 81 129 69 989 21 161 8 120 Total Assets 5 054 53 258 49 272 43 634 39 573

TotCompIncLoss 81 129 69 989 21 161 8 120 PER SHARE STATISTICS (cents per share)

Inv & Loans 808 459 545 681 157 897 - HEPS-C (ZARc) - 18.60 - 7.70 19.88 17.81 16.85

Tot Curr Ass 52 057 125 498 377 652 499 063 DPS (ZARc) - 11.92 11.13 10.37 9.35

Ord SH Int 756 698 646 609 530 120 495 946 NAV PS (ZARc) 351.40 110.71 104.02 92.93 85.88

LT Liab 44 490 22 548 3 718 - 3 Yr Beta 0.96 0.61 0.65 0.56 1.05

Tot Curr Liab 59 328 2 022 1 711 3 117 Price Prd End 164 268 240 186 178

Price High 279 278 287 219 231

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 279.00 131.00 42.00 24.70 Price Low 125 211 183 167 149

NAV PS (ZARc) 1 285.00 1 156.00 1 034.00 992.00 RATIOS

3 Yr Beta - 0.06 - - - Ret on SH Fund 657.18 19.59 18.48 19.82 19.77

Price High 985 1 100 1 031 1 160 HlineRetTotAss - 0.38 - - 0.10 - 17.77 19.16 19.14 -

Interest Mgn

0.18

0.19

Price Low 775 899 511 900

Price Prd End 985 985 900 1 031

RATIOS

Ret on SH Fnd 21.44 10.82 3.99 1.64

D:E 0.06 0.03 0.01 -

Current Ratio 0.88 62.07 220.72 160.11

RMB Holdings Ltd.

RMB

ISIN: ZAE000024501 SHORT: RMBH CODE: RMH

REG NO: 1987/005115/06 FOUNDED: 1987 LISTED: 1992

NATURE OF BUSINESS: RMH was the founding and largest shareholder

in FirstRand Ltd., one of South Africa’s largest banking groups. On 1 June

2020, shareholders voted in favour of a resolution to unbundle the group’s

interest in FirstRand.

In 2016, RMH expanded its investment strategy to include a property

investment business, comprising scalable entrepreneur-led businesses

with proven track records in managing and building out property, RMH

Property.Aftertheunbundling,thisistheonlyassetremaininginRMH.

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development with investor relations data

NUMBER OF EMPLOYEES: 2

DIRECTORS: Bosman H L (CEO & FD), Kekana A (ne), feeds from ProfileData

Lagerström P (ind ne), Lucht U (ne), Mahlare M (ind ne),

MorobeMM(ld ind ne), Phetwe O (alt), Teeger J (ind ne), de Bruyn

www.profile.co.za

S E N (Acting Chair, ind ne)

210