Page 203 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 203

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – RDI

POSTAL ADDRESS: 2nd Floor, St Mary’s Court,

RDI REIT P.L.C. 20 Hill Street, Douglas, Isle of Man, IM1 4EU

RDI EMAIL: info@rdireit.com

WEBSITE: www.rdireit.com

TELEPHONE: 0044207-811-0100

FAX: 0044207-811-0101

COMPANY SECRETARY: Lisa Hibberd

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

Scan the QR code to SPONSOR: Java Capital Trustees and Sponsors

visit our website (Pty) Ltd.

ISIN: IM00BH3JLY32 SHORT: RDI CODE: RPL

REG NO: 010534V FOUNDED: 2004 LISTED: 2013 AUDITORS: KPMG UK

NATURE OF BUSINESS: CALENDAR Expected Status

RDI is an income focused UK Real Estate Investment Trust Annual General Meeting 28 Jan 2021 Confirmed

(UK-REIT)withadiversifiedportfolioinvestedprincipallyinthe Next Interim Results Apr 2021 Unconfirmed

UK. The investment approach is driven by an in depth under- Next Final Results Nov 2021 Unconfirmed

standing of occupational demand including the impact of tech-

nology, transport and infrastructure investment. The portfolio CAPITAL STRUCTURE AUTHORISED ISSUED

has been repositioned in recent years to increase its weighting to RPL Ords 40p ea 600 000 000 380 590 061

London and the South East and to provide greater exposure to DISTRIBUTIONS [GBPp]

our leading hotel and serviced office operating platforms. Ords 40p ea Ldt Pay Amt

RDI is committed to delivering attractive income led total Final No 14 1 Dec 20 22 Dec 20 5.00

Final No 13 19 Nov 19 10 Dec 19 6.00

returns across the real estate cycle. The current strategic ob- Interim No 12 4 Jun 19 25 Jun 19 4.00

jectives of a lower leverage capital structure and more focused Final No 11 27 Nov 18 18 Dec 18 6.75

allocation of capital are targeted at delivering an industry LIQUIDITY: Nov20 Ave 2m shares p.w., R33.3m(22.8% p.a.)

leading and sustainable income return.

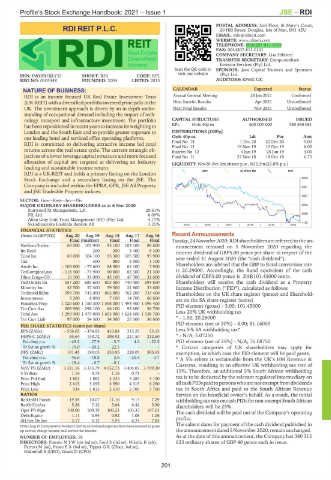

J867 40 Week MA RDI

RDI is a UK-REIT and holds a primary listing on the London

Stock Exchange and a secondary listing on the JSE. The 5955

Company is included within the EPRA, GPR, JSE All Property 4991

and JSE Tradeable Property indices.

4027

SECTOR: Fins—Rest—Inv—Div

MAJOR ORDINARY SHAREHOLDERS as at 6 Nov 2020 3063

Starwood XI Management, L.P. 29.61%

FIL Ltd. 6.09% 2099

Allan Gray Unit Trust Management (RF) (Pty) Ltd. 4.77%

Skandinaviska Enskilda Banken AB 3.25% 2015 | 2016 | 2017 | 2018 | 2019 | 2020 1135

FINANCIAL STATISTICS

(Amts in GBP’000) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16 Recent Announcements

Final Final(rst) Final Final Final Tuesday, 24 November2020: RDI shareholders are referred tothe an-

NetRent/InvInc 69 000 103 900 95 100 102 100 89 600 nouncement released on 5 November 2020 regarding the

Int Recd - 200 200 3 400 6 300 interim dividend of GBP5.00 pence per share in respect of the

Total Inc 69 000 104 100 95 300 105 500 95 900 year ended 31 August 2020 (the “cash dividend”).

Tax - 300 800 3 900 1 100

Attrib Inc - 103 800 - 77 600 88 900 66 100 7 900 Shareholders are advised that the GBP to Rand conversion rate

TotCompIncLoss - 118 400 - 73 900 90 800 82 300 21 400 is 20.29000. Accordingly, the Rand equivalent of the cash

Hline Erngs-CO 16 100 31 000 45 100 47 300 32 600 dividend of GBP5.00 pence is ZAR101.45000 cents.

Ord UntHs Int 557 200 685 600 803 300 740 400 699 800 Shareholders will receive the cash dividend as a Property

Minority Int 42 500 57 400 59 500 21 800 33 600 Income Distribution (“PID”), calculated as follows:

TotStockHldInt 599 700 743 000 862 800 762 200 733 400 Shareholders on the UK share register (pence) and Sharehold-

Investments 3 200 8 000 7 100 14 700 66 600 ers on the SA share register (cents)

FixedAss/Prop 1 020 600 1 150 300 1 598 000 1 494 900 1 396 400 PID element (gross) - 5.00; 101.45000

Tot Curr Ass 209 900 298 100 66 100 95 600 58 700

Total Ass 1 299 900 1 475 000 1 693 900 1 624 600 1 538 700 Less 20% UK withholding tax

Tot Curr Liab 97 000 54 300 34 300 25 300 36 600 * - 1.00; 20.29000

PID element (net of 20%) - 4.00; 81.16000

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 556.65 - 374.95 410.88 315.25 53.15 Less 5% SA withholding tax*

HEPS-C (ZARc) 85.64 150.72 208.92 221.50 212.60 * - N/A; 5.07250

Pct chng p.a. - 43.2 - 27.9 - 5.7 4.2 - 22.5 PID element (net of 25%) - N/A; 76.08750

Tr 5yr av grwth % - 19.0 - 20.2 22.5 - - * Certain categories of UK shareholders may apply for

DPS (ZARc) 101.45 190.05 233.95 228.05 305.65 exemption, in which case the PID element will be paid gross.

Pct chng p.a. - 46.6 - 18.8 2.6 - 25.4 - 3.7 * A 5% rebate is reclaimable from the UK’s HM Revenue &

Tr 5yr av grwth % - 18.4 - 6.7 - 0.1 - - Customs, resulting in an effective UK withholding tax rate of

NAV PS (ZARc) 3 321.16 3 333.79 4 052.73 3 404.05 3 709.30 15%. Therefore, an additional 5% South African withholding

3 Yr Beta 1.14 0.73 1.16 0.71 -

Price Prd End 1 801 1 882 3 235 3 285 4 190 tax is to be deducted by the relevant regulated intermediary on

Price High 2 615 3 295 3 590 4 315 6 250 allcashPIDspaid topersonswhoarenotexemptfromdividends

Price Low 934 1 813 2 610 2 700 3 760 tax in South Africa and paid to the South African Revenue

RATIOS Service on the beneficial owner’s behalf. As a result, the initial

RetOnSH Funds - 19.34 - 10.07 11.16 9.13 7.29 withholding taxrateoncashPIDsfornon-exemptSouthAfrican

RetOnTotAss 5.28 7.12 5.64 6.42 5.90 shareholders will be 25%.

Oper Pft Mgn 100.00 100.19 100.21 103.33 107.03 The cash dividend will be paid out of the Company’s operating

Debt:Equity 1.11 0.94 0.92 1.08 1.06

SH Ret On Inv 3.17 5.12 5.95 6.24 7.83 profits.

The salient dates for payment of the cash dividend published in

Note: Aug 19 Comparative NetRent/InvIncand relatedexpenseshave beenrestated to gross

up service charge income and service fee income. theannouncementdated5November2020,remainunchanged.

NUMBER OF EMPLOYEES: 58 As at the date of this announcement, the Company has 380 315

DIRECTORS: FarrowMJW(snr ind ne), Ford S (ind ne), Nikolic K (alt), 623 ordinary shares of GBP 40 pence each in issue.

Parrott M (ne), PeaceEA(ind ne), Tipper G R (Chair, ind ne),

Oakenfull S (CEO), Grant D (CFO)

201