Page 129 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 129

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – EXX

Status

Exxaro Resources Ltd. CALENDAR Expected Unconfirmed

Next Final Results

Mar 2021

EXX

Annual General Meeting May 2021 Unconfirmed

Next Interim Results Aug 2021 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 358 706 754

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Interim No 35 21 Sep 20 28 Sep 20 643.00

Final No 34 21 Apr 20 28 Apr 20 566.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Interim No 33 8 Oct 19 14 Oct 19 864.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001 Special No 4 8 Oct 19 14 Oct 19 897.00

NATURE OF BUSINESS: LIQUIDITY: Dec20 Ave 6m shares p.w., R727.5m(82.7% p.a.)

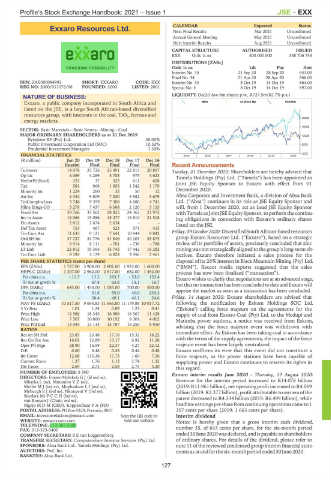

Exxaro, a public company incorporated in South Africa and MINI 40 Week MA EXXARO

listed on the JSE, is a large South African-based diversified

resources group, with interests in the coal, TiO 2 , ferrous and

20466

energy markets.

16402

SECTOR: Basic Materials—Basic Resrcs—Mining—Coal

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 12339

Eyesizwe RF (Pty) Ltd. 30.00%

Public Investment Corporation Ltd (SOC) 10.52% 8275

Prudential Investment Managers 7.30%

FINANCIAL STATISTICS 2015 | 2016 | 2017 | 2018 | 2019 | 2020 4212

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final Final Final Recent Announcements

Turnover 14 078 25 726 25 491 22 813 20 897 Tuesday, 01 December 2020: Shareholders are hereby advised that

Op Inc 4 069 4 269 5 703 975 4 623 Tamela Holdings (Pty) Ltd. (“Tamela”) has been appointed as

NetIntPd(Rcvd) 321 37 322 611 628 Joint JSE Equity Sponsor to Exxaro with effect from 01

Tax 581 968 1 653 1 542 1 179

Minority Int 1 224 260 32 50 12 December 2020.

Att Inc 4 334 9 809 7 030 5 982 5 679 Absa Corporate and Investment Bank, a division of Absa Bank

TotCompIncLoss 5 748 9 359 7 308 4 680 4 741 Ltd. (“Absa”) continues in its role as JSE Equity Sponsor and

Hline Erngs-CO 3 279 7 437 6 568 2 120 5 155 will, from 1 December 2020, act as Lead JSE Equity Sponsor

Fixed Ass 39 766 33 562 28 825 24 362 21 972 with Tamela as Joint JSE Equity Sponsor, to perform the continu-

Inv in Assoc 16 066 15 056 15 477 15 810 21 518 ing obligations in connection with Exxaro’s ordinary shares

Fin Assets 2 812 2 674 2 634 - - listed on the JSE.

Def Tax Asset 753 467 523 571 415

Tot Curr Ass 11 633 9 121 7 641 10 844 9 842 Friday,09October2020:DiversifiedSouthAfrican-basedresources

Ord SH Int 37 727 34 776 41 846 40 103 35 875 group Exxaro Resources Ltd. (“Exxaro”), based on a strategic

Minority Int 8 914 8 111 - 701 - 738 - 788 review of its portfolio of assets, previously concluded that zinc

LT Liab 22 812 19 364 15 745 17 442 16 282 mining was not strategically aligned to the group’s long-term ob-

Tot Curr Liab 9 193 5 179 6 823 3 956 7 461 jectives. Exxaro therefore initiated a sales process for the

PER SHARE STATISTICS (cents per share) disposal of its 26% interest in Black Mountain Mining (Pty) Ltd.

EPS (ZARc) 1 727.00 3 908.00 2 801.00 1 923.00 1 600.00 (“BMM”). Recent media reports suggested that the sales

HEPS-C (ZARc) 1 307.00 2 962.00 2 617.00 682.00 1 452.00 process has now been finalised (“transaction”).

Pct chng p.a. - 11.7 13.2 283.7 - 53.0 153.4 Exxaro wishes to clarify that negotiations are at an advanced stage,

Tr 5yr av grwth % - 67.8 63.8 13.1 16.7

DPS (ZARc) 643.00 1 430.00 1 085.00 700.00 500.00 but that no transaction has been concluded to date and Exxaro will

Pct chng p.a. - 31.8 55.0 40.0 233.3 apprise the market as soon as a transaction has been concluded.

Tr 5yr av grwth % - 58.4 49.1 40.1 24.6 Friday, 14 August 2020: Exxaro shareholders are advised that

NAV PS (ZARc) 10 517.50 9 694.83 11 665.80 11 179.88 10 017.72 following the notification by Eskom Holdings SOC Ltd.

3 Yr Beta 1.01 1.24 0.89 1.23 0.41 (‘Eskom’) calling force majeure on the agreements for the

Price High 14 588 18 345 16 988 16 567 11 428 supply of coal from Exxaro Coal (Pty) Ltd. to the Medupi and

Price Low 7 507 10 860 10 192 8 301 4 002 Matimba power stations, a notice was received from Eskom,

Price Prd End 13 044 13 114 13 787 16 250 8 950 advising that the force majeure event was withdrawn with

RATIOS

Ret on SH Fnd 23.83 23.48 17.16 15.32 16.22 immediate effect. As Eskom has been taking coal in accordance

Ret On Tot Ass 16.01 12.89 13.17 6.92 11.28 with the terms of the supply agreements, the impact of the force

Oper Pft Mgn 28.90 16.59 22.37 4.27 22.12 majeure event has been largely neutralized.

D:E 0.60 0.48 0.43 0.44 0.48 Exxaro reaffirms its view that this event did not constitute a

Int Cover 12.68 115.38 17.73 1.60 7.36 force majeure, as the power stations have been capable of

Current Ratio 1.27 1.76 1.12 2.74 1.32 supplying power and Exxaro continues to reserve its rights in

Div Cover 2.69 2.73 2.58 2.75 3.20

this regard.

NUMBER OF EMPLOYEES: 8 500 Exxaro interim results June 2020 - Thursday, 13 August 2020:

DIRECTORS: Fraser-MoleketiGJ(ld ind ne),

Mbatha L (ne), MntamboVZ(ne), Revenuefor theinterim period increased to R14.078 billion

MoffetMJ(ind ne), MophatlaneLI(ind ne), (2019: R11.961 billion), net operating profit increased to R4.069

MyburghEJ(ind ne), Nkonyeni V (ind ne), billion(2019: R2.377 billion), profit attributable toowners ofthe

Snyders MrPCCH(ind ne), parent decreased to R4.334 billion (2019: R6.499 billion), while

van Rooyen J (Chair, ind ne),

MgojoMDM (CEO), Koppeschaar P A (FD) headlineearningspersharefromcontinuingoperationscameto1

POSTAL ADDRESS:POBox9229, Pretoria,0001 307 cents per share (2019: 1 663 cents per share).

EMAIL: investorrelations@exxaro.com Scan the QR code to Interim dividend

WEBSITE: www.exxaro.com visit our website Notice is hereby given that a gross interim cash dividend,

TELEPHONE: 012-307-5000

FAX: 012-323-3400 number 35, of 643 cents per share, for the six-month period

COMPANY SECRETARY: S E van Loggerenberg ended 30 June 2020was declared, andis payabletoshareholders

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. of ordinary shares. For details of the dividend, please refer to

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd. note 11 of the reviewed condensed group interim financial state-

AUDITORS: PwC Inc. mentsasatandforthesix-monthperiodended30June2020.

BANKERS: Absa Bank Ltd.

127