Page 128 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 128

JSE – EXE Profile’s Stock Exchange Handbook: 2021 – Issue 1

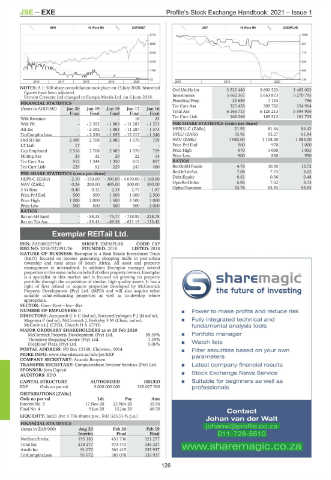

MINI 40 Week MA EUROMET J867 40 Week MA EXEMPLAR

8712 1066

6980 921

5248 775

3516 629

1784 484

52 338

2016 | 2017 | 2018 | 2019 | 2020 | 2018 | 2019 | 2020 |

NOTES: A 1: 500 share consolidation took place on 15 July 2020, historical Ord UntHs Int 3 532 480 3 600 523 3 463 002

figures have been adjusted.

Ferrum Crescent Ltd.changed to Europa Metals Ltd. on 6 June 2018. Investments 5 662 367 5 663 873 5 270 795

FixedAss/Prop 25 689 1 124 796

FINANCIAL STATISTICS

(Amts in AUD’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Tot Curr Ass 325 428 309 782 154 964

Final Final Final Final Final Total Ass 6 166 713 6 126 213 5 594 906

Tot Curr Liab 168 266 169 212 161 705

Wrk Revenue - - - 18 23

Wrk Pft - - 2 392 - 1 883 - 11 287 - 1 573 PER SHARE STATISTICS (cents per share)

Att Inc - - 2 392 - 1 883 - 11 287 - 1 573 HEPLU-C (ZARc) 21.93 81.64 86.42

TotCompIncLoss - - 2 330 - 1 653 - 12 217 - 1 346 DPLU (ZARc) 35.96 92.27 61.84

Ord SH Int 2 499 2 708 2 485 1 570 719 NAV (ZARc) 1 082.00 1 108.00 1 083.00

LT Liab 17 - - - - Price Prd End 960 970 1 000

Cap Employed 2 516 2 708 2 485 1 570 719 Price High 970 1 000 1 055

Mining Ass 24 32 20 22 14 Price Low 900 850 950

Tot Curr Ass 912 1 344 1 350 615 857 RATIOS

Tot Curr Liab 229 92 229 247 460 RetOnSH Funds 4.76 10.35 13.72

PER SHARE STATISTICS (cents per share) RetOnTotAss 7.08 7.73 8.02

HEPS-C (ZARc) - 2.10 - 150.00 - 300.00 - 4 670.00 - 1 160.00 Debt:Equity 0.61 0.56 0.48

NAV (ZARc) 0.24 200.00 405.00 300.00 550.00 OperRetOnInv 6.86 7.62 8.13

3 Yr Beta - 0.40 0.12 2.34 2.77 1.87 OpInc:Turnover 92.76 92.93 93.93

Price Prd End 500 500 1 000 1 000 2 500

Price High 1 000 2 000 1 500 3 500 7 000

Price Low 500 500 500 500 2 000

RATIOS

Ret on SH fund - - 88.33 - 75.77 - 718.92 - 218.78

Ret on Tot Ass - - 85.43 - 69.38 - 621.19 - 133.42

Exemplar REITail Ltd.

EXE

ISIN: ZAE000257549 SHORT: EXEMPLAR CODE: EXP

REG NO: 2018/022591/06 FOUNDED: 2018 LISTED: 2018

NATURE OF BUSINESS: Exemplar is a Real Estate Investment Trust

(REIT) focused on income generating shopping malls in peri-urban

township and rural areas of South Africa. All asset and property

management is internalised. In addition Exemplar manages several

properties in this same niche onbehalf of other property owners.Exemplar TM

is a specialist in this market and is focused on growing its property

portfolio through the acquisition of similar, high quality assets. It has a sharemagic

right of first refusal to acquire properties developed by McCormick

Property Development (Pty) Ltd. (MPD) and will also acquire other

the future of investing

suitable value-enhancing properties as well as co-develop where

appropriate.

SECTOR: Fins—Rest—Inv—Ret

NUMBER OF EMPLOYEES: 0 Power to make profits and reduce risk

DIRECTORS: AzzopardiGVC(ind ne), KatzenellenbogenPJ(ld ind ne),

Maponya P (ind ne), McCormick J, Berkeley F M (Chair, ind ne), Fully integrated technical and

McCormick J (CEO), Church D A (CFO) fundamental analysis tools

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

McCormick Property Development (Pty) Ltd. 59.39% Portfolio manager

Thorntree Shopping Centre (Pty) Ltd. 7.39% Watch lists

Diepkloof Plaza (Pty) Ltd. 5.06%

POSTAL ADDRESS: PO Box 12169, Clubview, 0014 Filter securities based on your own

MORE INFO: www.sharedata.co.za/sdo/jse/EXP parameters

COMPANY SECRETARY: Ananda Booysen

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Latest company financial results

SPONSOR: Java Capital

AUDITORS: BDO Stock Exchange News Service

CAPITAL STRUCTURE AUTHORISED ISSUED Suitable for beginners as well as

EXP Ords no par val 5 000 000 000 325 027 765 professionals

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Interim No 5 17 Nov 20 23 Nov 20 35.96

Final No 4 9 Jun 20 15 Jun 20 48.50

Contact

LIQUIDITY: Jan21 Ave 4 796 shares p.w., R43 325.5(-% p.a.)

Johan van der Walt

FINANCIAL STATISTICS johanw@profile.co.za

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19

Interim Final Final 011-728-5510

NetRent/InvInc 195 183 431 736 321 277

Total Inc 218 277 473 473 336 327 www.sharemagic.co.za

Attrib Inc 91 072 361 415 335 937

TotCompIncLoss 91 072 389 078 335 937

126