Page 104 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 104

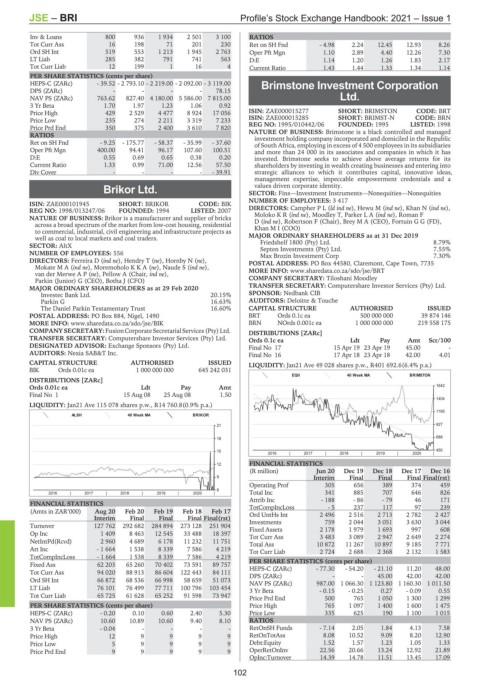

JSE – BRI Profile’s Stock Exchange Handbook: 2021 – Issue 1

Inv & Loans 800 936 1 934 2 501 3 100 RATIOS

Tot Curr Ass 16 198 71 201 230 Ret on SH Fnd - 4.98 2.24 12.45 12.93 8.26

Ord SH Int 519 553 1 213 1 945 2 763 Oper Pft Mgn 1.10 2.89 4.40 12.26 7.30

LT Liab 285 382 791 741 563 D:E 1.14 1.20 1.26 1.83 2.17

Tot Curr Liab 12 199 1 16 4 Current Ratio 1.43 1.44 1.33 1.34 1.14

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 39.52 - 2 793.10 - 2 219.00 - 2 092.00 - 3 119.00 Brimstone Investment Corporation

DPS (ZARc) - - - - 78.15

NAV PS (ZARc) 763.62 827.40 4 180.00 5 586.00 7 815.00 Ltd.

3 Yr Beta 1.70 1.97 1.23 1.06 0.92 BRI

Price High 429 2 529 4 477 8 924 17 056 ISIN: ZAE000015277 SHORT: BRIMSTON CODE: BRT

Price Low 235 274 2 211 3 319 7 233 ISIN: ZAE000015285 SHORT: BRIMST-N CODE: BRN

Price Prd End 350 375 2 400 3 610 7 820 REG NO: 1995/010442/06 FOUNDED: 1995 LISTED: 1998

NATURE OF BUSINESS: Brimstone is a black controlled and managed

RATIOS investment holding company incorporated and domiciled in the Republic

Ret on SH Fnd - 9.25 - 175.77 - 58.37 - 35.99 - 37.60 of South Africa, employing in excess of 4 500 employees in its subsidiaries

Oper Pft Mgn 400.00 94.41 96.17 107.60 100.51 and more than 24 000 in its associates and companies in which it has

D:E 0.55 0.69 0.65 0.38 0.20 invested. Brimstone seeks to achieve above average returns for its

Current Ratio 1.33 0.99 71.00 12.56 57.50 shareholders by investing in wealth creating businesses and entering into

Div Cover - - - - - 39.91 strategic alliances to which it contributes capital, innovative ideas,

management expertise, impeccable empowerment credentials and a

values driven corporate identity.

Brikor Ltd. SECTOR: Fins—Investment Instruments—Nonequities—Nonequities

BRI NUMBER OF EMPLOYEES: 3 417

ISIN: ZAE000101945 SHORT: BRIKOR CODE: BIK

REG NO: 1998/013247/06 FOUNDED: 1994 LISTED: 2007 DIRECTORS: CampherPL(ld ind ne), Hewu M (ind ne), Khan N (ind ne),

NATURE OF BUSINESS: Brikor is a manufacturer and supplier of bricks MolokoKR(ind ne), Moodley T, ParkerLA(ind ne), Roman F

D(ind ne), Robertson F (Chair), Brey M A (CEO), Fortuin G G (FD),

across a broad spectrum of the market from low-cost housing, residential Khan M I (COO)

to commercial, industrial, civil engineering and infrastructure projects as

well as coal to local markets and coal traders. MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

SECTOR: AltX Friedshelf 1800 (Pty) Ltd. 8.79%

Septen Investments (Pty) Ltd.

7.55%

NUMBER OF EMPLOYEES: 556 Max Brozin Investment Corp 7.30%

DIRECTORS: Ferreira D (ind ne), Hendry T (ne), Hornby N (ne), POSTAL ADDRESS: PO Box 44580, Claremont, Cape Town, 7735

MokateMA(ind ne), MoremoholoKKA(ne), Naude S (ind ne),

van der MerweAP(ne), Pellow A (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/BRT

Parkin (Junior) G (CEO), Botha J (CFO) COMPANY SECRETARY: Tiloshani Moodley

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Investec Bank Ltd. 20.15% SPONSOR: Nedbank CIB

Parkin G 16.63% AUDITORS: Deloitte & Touche

The Daniel Parkin Testamentary Trust 16.60% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 884, Nigel, 1490 BRT Ords 0.1c ea 500 000 000 39 874 146

MORE INFO: www.sharedata.co.za/sdo/jse/BIK BRN NOrds 0.001c ea 1 000 000 000 219 558 175

COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd. DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 0.1c ea Ldt Pay Amt Scr/100

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd. Final No 17 15 Apr 19 23 Apr 19 45.00 -

AUDITORS: Nexia SAB&T Inc. Final No 16 17 Apr 18 23 Apr 18 42.00 4.01

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan21 Ave 49 028 shares p.w., R401 692.6(6.4% p.a.)

BIK Ords 0.01c ea 1 000 000 000 645 242 031

EQII 40 Week MA BRIMSTON

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt 1642

Final No 1 15 Aug 08 25 Aug 08 1.50

1404

LIQUIDITY: Jan21 Ave 115 078 shares p.w., R14 760.8(0.9% p.a.)

1165

ALSH 40 Week MA BRIKOR

21 927

18 688

15 450

2016 | 2017 | 2018 | 2019 | 2020 |

12 FINANCIAL STATISTICS

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

9 Interim Final Final Final Final(rst)

Operating Prof 305 656 389 374 459

6 Total Inc 341 885 707 646 826

2016 | 2017 | 2018 | 2019 | 2020 |

Attrib Inc - 188 - 86 - 79 46 171

FINANCIAL STATISTICS TotCompIncLoss - 5 237 117 97 239

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Ord UntHs Int 2 496 2 516 2 713 2 782 2 427

Interim Final Final Final Final(rst)

759

Turnover 127 762 292 682 284 894 273 128 251 904 Investments 2 178 2 044 3 051 3 630 3 044

Fixed Assets

1 693

1 979

608

997

Op Inc 1 409 8 463 12 545 33 488 18 397 Tot Curr Ass 3 483 3 089 2 947 2 649 2 274

NetIntPd(Rcvd) 2 960 4 689 6 178 11 232 11 751 Total Ass 10 872 11 267 10 897 9 185 7 771

Att Inc - 1 664 1 538 8 339 7 586 4 219 Tot Curr Liab 2 724 2 688 2 368 2 132 1 583

TotCompIncLoss - 1 664 1 538 8 339 7 586 4 219

Fixed Ass 62 203 65 260 70 402 73 591 89 757 PER SHARE STATISTICS (cents per share) - 21.10 11.20 48.00

- 54.20

- 77.30

HEPS-C (ZARc)

Tot Curr Ass 94 020 88 913 86 604 122 443 84 111 DPS (ZARc) - - 45.00 42.00 42.00

Ord SH Int 66 872 68 536 66 998 58 659 51 073 NAV PS (ZARc) 987.00 1 066.30 1 123.80 1 160.30 1 011.50

LT Liab 76 101 76 499 77 711 100 796 103 454 3 Yr Beta - 0.15 - 0.25 0.27 - 0.09 0.55

Tot Curr Liab 65 725 61 628 65 252 91 598 73 947

Price Prd End 500 765 1 050 1 300 1 299

PER SHARE STATISTICS (cents per share) Price High 765 1 097 1 400 1 600 1 475

HEPS-C (ZARc) - 0.20 0.10 0.60 2.40 5.30 Price Low 335 625 190 1 100 1 015

NAV PS (ZARc) 10.60 10.89 10.60 9.40 8.10 RATIOS

3 Yr Beta - 0.04 - - - - RetOnSH Funds - 7.14 2.05 1.84 4.13 7.58

Price High 12 9 9 9 9 RetOnTotAss 8.08 10.52 9.09 8.20 12.90

Price Low 5 9 9 9 9 Debt:Equity 1.52 1.57 1.23 1.05 1.33

Price Prd End 9 9 9 9 9 OperRetOnInv 22.56 20.66 13.24 12.92 21.89

OpInc:Turnover 14.39 14.78 11.51 13.45 17.09

102