Page 100 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 100

JSE – BAR Profile’s Stock Exchange Handbook: 2021 – Issue 1

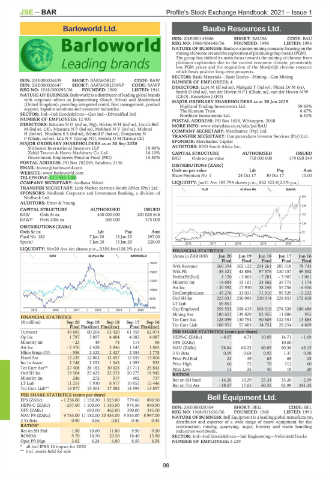

Barloworld Ltd. Bauba Resources Ltd.

BAR BAU

ISIN: ZAE000145686 SHORT: BAUBA CODE: BAU

REG NO: 1986/004649/06 FOUNDED: 1996 LISTED: 1996

NATURE OF BUSINESS: Bauba is a junior mining company focusing on the

miningofchromeoreandtheexplorationofplatinumgroupmetals(PGM).

The group has shifted its main focus towards the mining of chrome from

platinum exploration due to the current economic climate, persistently

low PGM prices and the acquisition of the Moeijelijk chrome resource

which bears positive long-term prospects.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

ISIN: ZAE000026639 SHORT: BARWORLD CODE: BAW NUMBER OF EMPLOYEES: 4

ISIN: ZAE000026647 SHORT: BARWORLD6%P CODE: BAWP DIRECTORS: Luyt M (ld ind ne), Makgala T (ind ne), Phosa Dr M (ne),

REG NO: 1918/000095/06 FOUNDED: 1902 LISTED: 1941 Smith D (ind ne), van der HovenNPJ (Chair, ne), van der Hoven N W

NATURE OF BUSINESS: Barloworld is a distributor of leading global brands (CEO), Knowlden J (FD)

with corporate offices in Johannesburg (South Africa) and Maidenhead MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

(United Kingdom), providing integrated rental, fleet management, product Highland Trading Investments Ltd. 59.93%

support, logistics solutions and consumer industries. The Kumane Trust 6.47%

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Diversified Ind Northlew Investments Ltd. 6.33%

NUMBER OF EMPLOYEES: 12 905 POSTAL ADDRESS: PO Box 1658, Witkoppen, 2068

DIRECTORS: EdozienNO(ind ne, Nig), HickeyHH(ind ne), Lynch-Bell MORE INFO: www.sharedata.co.za/sdo/jse/BAU

M(ind ne, UK), NxasanaNP(ind ne), MokhesiNV(ind ne), Molotsi COMPANY SECRETARY: Merchantec (Pty) Ltd.

H(ind ne), NtsalubaSS(ind ne), Schmid P (ind ne), Dongwana N TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

P (Chair, ind ne), Lila N V (Group FD), Sewela D M (Group CE)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 SPONSOR: Merchantec Capital

Silchester International Investors LLP 19.90% AUDITORS: BDO South Africa Inc.

Zahid Tractor & Heavy Machinery Co. Ltd. 16.10% CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund (PIC) 15.50% BAU Ords no par value 750 000 000 379 020 249

POSTAL ADDRESS: PO Box 782248, Sandton, 2146

EMAIL: invest@barloworld.com DISTRIBUTIONS [ZARc] Ldt Pay Amt

Ords no par value

WEBSITE: www.barloworld.com Share Premium No 1 24 Oct 17 30 Oct 17 10.00

TELEPHONE: 011-445-1000

COMPANY SECRETARY: Andiswa Ndoni LIQUIDITY: Jan21 Ave 185 794 shares p.w., R62 322.8(2.5% p.a.)

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

PLAT 40 Week MA BAUBA

SPONSORS: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd. 291

AUDITORS: Ernst & Young

236

CAPITAL STRUCTURE AUTHORISED ISSUED

BAW Ords 5c ea 400 000 000 201 025 646 181

BAWP Prefs 200c ea 500 000 375 000

126

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt 72

Final No 182 7 Jan 20 13 Jan 20 297.00

Special 7 Jan 20 13 Jan 20 228.00 2016 | 2017 | 2018 | 2019 | 2020 | 17

LIQUIDITY: Nov20 Ave 4m shares p.w., R356.8m(108.3% p.a.) FINANCIAL STATISTICS

GENI 40 Week MA BARWORLD (Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final Final Final Final

18451

Wrk Revenue 260 394 302 122 234 261 205 318 78 743

15851 Wrk Pft - 58 321 43 884 97 576 130 157 49 552

NetIntPd(Rcd) 1 120 - 3 865 - 7 281 - 3 987 - 1 061

Minority Int - 14 684 15 101 33 662 39 773 1 174

13251

Att Inc - 30 592 17 930 38 248 55 756 - 6 406

10650

TotCompIncLoss - 45 276 33 031 71 910 95 529 - 5 232

8050 Ord SH Int 223 031 250 995 230 014 228 851 172 618

LT Liab 58 861 - - - -

5450 Cap Employed 359 553 358 415 308 019 274 328 180 486

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Mining Ass 180 621 139 829 82 955 11 880 955

FINANCIAL STATISTICS

(R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16 Tot Curr Ass 128 099 130 754 90 805 132 351 13 885

Final Final(rst) Final(rst) Final Final(rst) Tot Curr Liab 100 951 57 483 14 751 28 254 4 809

Turnover 49 683 60 206 63 420 61 959 62 074 PER SHARE STATISTICS (cents per share)

Op Inc 1 797 3 897 4 404 4 082 4 087 HEPS-C (ZARc) - 8.07 4.73 10.09 14.71 - 1.69

Minority Int - 23 49 74 114 96 DPS (ZARc) - - - 10.00 -

Att Inc - 2 476 2 428 3 846 1 643 1 883 NAV (ZARc) 58.84 66.22 60.69 60.38 46.15

Hline Erngs-CO - 536 2 322 2 427 2 053 1 778 3 Yr Beta 0.09 0.68 0.92 1.37 0.98

Fixed Ass 12 239 12 062 12 657 12 659 13 806 Price Prd End 23 49 63 65 25

Inv in Assoc 2 148 2 253 1 343 1 093 923 Price High 66 72 78 112 60

Tot Curr Ass** 27 408 28 182 30 028 27 711 25 843 Price Low 11 35 40 19 20

Ord SH Int 19 504 23 623 22 233 20 275 18 942 RATIOS

Minority Int 246 272 517 602 737 Ret on SH fund - 16.26 10.29 25.24 35.26 - 2.99

LT Liab 11 251 7 930 8 917 10 852 12 446 Ret on Tot Ass - 18.67 17.65 60.35 92.98 241.35

Tot Curr Liab** 16 877 15 563 17 592 14 595 13 897

PER SHARE STATISTICS (cents per share) Bell Equipment Ltd.

EPS (ZARc) - 1 236.00 1 150.20 1 823.80 779.60 890.50

HEPS-C (ZARc) - 267.60 1 100.00 1 150.90 974.50 840.90 ISIN: ZAE000028304 SHORT: BELL CODE: BEL

BEL

DPS (ZARc) - 690.00 462.00 390.00 345.00 REG NO: 1968/013656/06 FOUNDED: 1968 LISTED: 1995

NAV PS (ZARc) 9 783.00 11 182.00 10 453.00 9 533.00 8 997.00 NATURE OF BUSINESS: Bell Equipment is a leading global manufacturer,

3 Yr Beta 0.90 0.66 0.81 0.46 0.45 distributor and exporter of a wide range of heavy equipment for the

RATIOS* construction, mining, quarrying, sugar, forestry and waste handling

Ret on SH Fnd - 1.50 10.60 11.80 9.50 9.20 industries worldwide.

RONOA 9.70 18.70 20.50 18.40 15.90 SECTOR: Ind—Ind Goods&Srvcs—Ind Engineering—Vehicles&Trucks

Oper Pft Mgn 3.62 6.28 6.80 6.59 6.58 NUMBER OF EMPLOYEES: 3 229

* all incl IFRS 16 impact for 2020

** incl. assets held for sale

98