Page 215 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 215

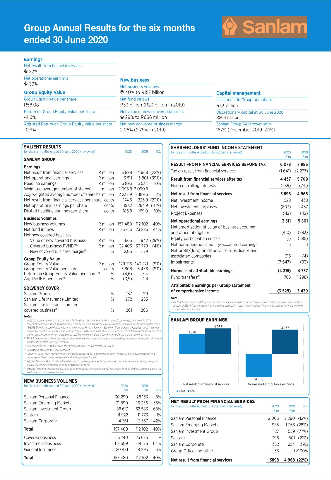

Group Annual Results for the six months

ended 30 June 2020

Earnings

Net result from fi nancial services

22%

Net operational earnings New business

39% Net business volumes

Group Equity Value 40% to R157 billion Capital management

Group Equity Value per share Net fund infl ows Investment in Group operations

R58,08 R33 billion (R23 billion in 2019) R1,3 billion

Return on Group Equity Value per share Net value of new convered business Discretionary capital at 30 June 2020

-4,6% 29% to R666 million R264 million

Adjusted Return on Group Equity Value per share Net new convered business margin Sanlam Group SAM cover ratio

-0,9% 2,06% (2,79% in 2019) 187% (December 2019: 211%)

SALIENT RESULTS SHAREHOLDERS’ FUND INCOME STATEMENT

for the six months ended 30 June 2020 (reviewed) 2020 2019 % for the six months ended 30 June 2020 (reviewed) 2020 2019

R’m R’m

SANLAM GROUP

Earnings RESULT FROM FINANCIAL SERVICES BEFORE TAX 6 078 7 986

Net result from fi nancial services R million 3 898 4 968 (22%) Tax on result from fi nancial services (1 641) (2 277)

Net operational earnings R million 3 511 5 801 (39%) Result from fi nancial services after tax 4 437 5 709

Headline earnings R million 3 893 3 534 10% Non-controlling interests (539) (741)

Weighted average number of shares million 2 095.8 2 090,8 –

(1)

Adj. weighted average number of shares (1) million 2 233,9 2 189,6 2% Net result from fi nancial services 3 898 4 968

Net result from fi nancial services per share cents 174,5 226,9 (23%) Net investment income 528 438

Net operational earnings per share cents 157,2 264,9 (41%) Net investment surpluses (803) 437

Diluted headline earnings per share cents 185,8 169,0 10% Project Expenses (112) (42)

Business volumes Net operational earnings 3 511 5 801

New business volumes R million 157 480 112 102 40%

Net fund infl ows R million 33 413 23 283 44% Net amortisation of value of business acquired

Net new covered business and other intangibles (1) (410) (383)

Value of new covered business R million 666 942 (29%) Equity participation costs (1) (595)

Covered business PVNBP (2) R million 32 403 33 779 (4%) Net non-operational equity-accounted earnings 16 11

(3)

New covered business margin % 2,06 2,79 Net profi t/(loss) on disposal or subsidiaries and

Group Equity Value associated companies 216 (4)

Group Equity Value R million 129 315 143 271 (9%) Impairments (7 647) (93)

Group Equity Value per share cents 5 808 6 436 (9%) Normalised attributable earnings (4 315) 4 737

Return on Group Equity Value per share (4) % (4,6) 5,4

(1)

Adj. RoGEV per share % (0,9) 4,6 Fund transfers 786 (1 298)

(5)

Attributable earnings per Group statement

SOLVENCY COVER of comprehensive income (3 529) 3 439

Sanlam Group % 187 211

Sanlam Life Insurance Limited % 272 253 Note

(1) The B-BBEE transaction in 2019 gave rise to a non-recurring share-based payment charge of R1 686 million. The above market-related

Sanlam Life Insurance Limited discount of R594 million was recognised as an equity participation cost in the shareholders’ fund income statement, with the remainder

covered business % 201 206 recognised in fund transfers

(6)

Notes

(1) Weighted average number of shares excludes Sanlam shares held directly or indirectly through consolidated investment funds in SANLAM GROUP EARNINGS

policyholder portfolios, as well as Sanlam shares held by the Group’s broad-based black economic empowerment special purposes vehicle

(B-BBEE SPV) that is consolidated in terms of International Financial Reporting Standards. These shares are treated as shares in issue for 4 968 4 737

purposes of adjusted weighted average number of shares in issue, which is the base to determine net result from fi nancial services per share 3 878

and net operational earnings per share. Diluted headline earnings per share is based on the weighted average number of shares

(2) PVNBP = present value of new business premiums and is equal to the present value of new recurring premiums, at the relevant risk discount

rate for each business, plus single premiums.

(3) New covered business margin = value of new covered business as a percentage of PVNBP.

(4) Comparative fi gures as at 31 December 2019.

(5) Growth in Group Equity Value per share (with dividends paid, capital movements and cost of treasury shares acquired reversed) as a

percentage of Group Equity Value per share at the beginning of the year.

(6) Adjusted Return on Group Equity Value = Return on Group Equity Value excluding investment market and currency volatility, changes in

interest rates and other factors outside of management’s control.

(7) Excludes investments in subsidiaries and associated companies, discretionary capital, cash accumulated for dividend payments and the net

asset value of non-covered operations.

NEW BUSINESS VOLUMES (4 315)

for the six months ended 30 June 2020 (reviewed) 2020 2019 Net result from fi nancial services Normalised attributable earnings

R’m R’m % 2020 2019

Sanlam Personal Finance 30 290 28 153 8%

Sanlam Emerging Markets 21 890 16 236 35% NET RESULT FROM FINANCIAL SERVICES 2020 2019

for the six months ended 30 June 2020 (reviewed)

Sanlam Investment Group 88 617 52 583 68% R’m R’m %

Santam 11 922 11 773 1%

Sanlam Corporate 4 761 3 357 42% Sanlam Personal Finance 2 005 2 290 (12%)

Sanlam Emerging Markets 985 1 363 (28%)

Total 157 480 112 102 40%

Sanlam Investment Group 127 559 (77%)

Covered business 23 740 23 633 – Santam 396 501 (21%)

Investment business 113 309 69 176 64% Sanlam Corporate 352 254 39%

General Insurance 20 431 19 293 6% Group Offi ce and other 33 1 >100%

Total 157 480 112 102 40%

Net result from fi nancial services 3898 4 968 (22%)

JSE R&E book IR2020 v20201020.indd 1 22.10.2020 15:27:24