Page 212 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 212

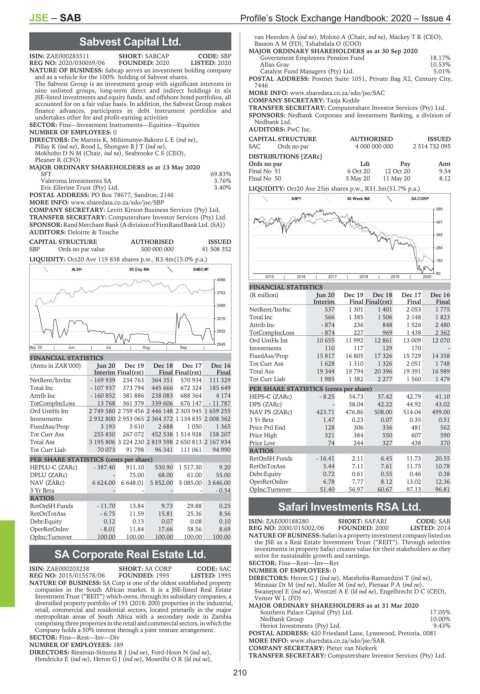

JSE – SAB Profile’s Stock Exchange Handbook: 2020 – Issue 4

van Heerden A (ind ne), Moloto A (Chair, ind ne), Mackey T R (CEO),

Sabvest Capital Ltd. Basson A M (FD), Tshabalala O (COO)

SAB MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

ISIN: ZAE000283511 SHORT: SABCAP CODE: SBP Government Employees Pension Fund 18.17%

REG NO: 2020/030059/06 FOUNDED: 2020 LISTED: 2020 Allan Gray 10.53%

NATURE OF BUSINESS: Sabcap serves an investment holding company Catalyst Fund Managers (Pty) Ltd. 5.01%

and as a vehicle for the 100% holding of Sabvest shares. POSTAL ADDRESS: Postnet Suite 1051, Private Bag X2, Century City,

The Sabvest Group is an investment group with significant interests in 7446

nine unlisted groups, long-term direct and indirect holdings in six MORE INFO: www.sharedata.co.za/sdo/jse/SAC

JSE-listed investments and equity funds, and offshore bond portfolios, all COMPANY SECRETARY: Tasja Kodde

accounted for on a fair value basis. In addition, the Sabvest Group makes

finance advances, participates in debt instrument portfolios and TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

undertakes other fee and profit-earning activities SPONSORS: Nedbank Corporate and Investment Banking, a division of

SECTOR: Fins—Investment Instruments—Equities—Equities Nedbank Ltd.

NUMBER OF EMPLOYEES: 0 AUDITORS: PwC Inc.

DIRECTORS: De Matteis K, Mthimunye-BakoroLE(ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Pillay K (ind ne), Rood L, ShongweBJT(ind ne), SAC Ords no par 4 000 000 000 2 514 732 095

MokhoboDNM (Chair, ind ne), Seabrooke C S (CEO),

Pleaner R (CFO) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 13 May 2020 Ords no par Ldt Pay Amt

SFT 69.83% Final No 51 6 Oct 20 12 Oct 20 9.54

Valeroma Investments SA 3.76% Final No 50 5 May 20 11 May 20 8.12

Eric Ellerine Trust (Pty) Ltd. 3.40% LIQUIDITY: Oct20 Ave 25m shares p.w., R51.3m(51.7% p.a.)

POSTAL ADDRESS: PO Box 78677, Sandton, 2146

SAPY 40 Week MA SA CORP

MORE INFO: www.sharedata.co.za/sdo/jse/SBP

COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd. 589

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

487

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: Deloitte & Touche

385

CAPITAL STRUCTURE AUTHORISED ISSUED

SBP Ords no par value 500 000 000 41 508 352 284

LIQUIDITY: Oct20 Ave 119 838 shares p.w., R3.4m(15.0% p.a.) 182

ALSH 80 Day MA SABCAP

80

2015 | 2016 | 2017 | 2018 | 2019 | 2020

4066

FINANCIAL STATISTICS

3783

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final(rst) Final Final

3499

NetRent/InvInc 537 1 301 1 401 2 053 1 775

Total Inc 566 1 385 1 506 2 148 1 823

3216

Attrib Inc - 874 236 848 1 526 2 480

2932 TotCompIncLoss - 874 227 969 1 438 2 362

Ord UntHs Int 10 655 11 992 12 861 13 009 12 070

2649

May 20 | Jun | Jul | Aug | Sep | Investments 110 117 129 170 -

FINANCIAL STATISTICS FixedAss/Prop 15 817 16 805 17 326 15 729 14 358

(Amts in ZAR’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Tot Curr Ass 1 628 1 310 1 326 2 051 1 748

Interim Final(rst) Final Final(rst) Final Total Ass 19 344 19 794 20 396 19 391 16 989

NetRent/InvInc - 169 939 234 763 364 351 570 934 111 329 Tot Curr Liab 1 985 1 382 2 277 1 560 1 479

Total Inc - 107 937 373 794 445 666 672 324 185 649 PER SHARE STATISTICS (cents per share)

Attrib Inc - 160 852 381 886 238 083 688 364 4 174 HEPS-C (ZARc) - 8.25 34.73 37.42 42.79 41.10

TotCompIncLoss 13 768 361 379 339 606 676 147 - 11 787 DPS (ZARc) - 38.04 42.22 44.92 43.02

Ord UntHs Int 2 749 580 2 759 456 2 446 148 2 303 945 1 659 255 NAV PS (ZARc) 423.71 476.86 508.00 514.04 499.00

Investments 2 932 800 2 953 065 2 364 372 1 134 835 2 008 362 3 Yr Beta 1.47 0.23 0.07 0.35 0.51

FixedAss/Prop 3 193 3 610 2 688 1 050 1 365 Price Prd End 128 306 336 481 562

Tot Curr Ass 255 850 267 072 452 538 1 514 928 158 207 Price High 321 384 550 607 590

Total Ass 3 195 806 3 224 230 2 819 598 2 650 813 2 167 934 Price Low 74 244 327 438 370

Tot Curr Liab 70 073 91 798 96 341 111 061 94 990 RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds - 16.41 2.11 6.45 11.73 20.55

HEPLU-C (ZARc) - 387.40 911.10 530.90 1 517.30 9.20 RetOnTotAss 5.44 7.11 7.61 11.75 10.78

DPLU (ZARc) - 75.00 68.00 61.00 55.00 Debt:Equity 0.72 0.61 0.55 0.46 0.38

NAV (ZARc) 6 624.00 6 648.01 5 852.00 5 085.00 3 646.00 OperRetOnInv 6.78 7.77 8.12 13.02 12.36

3 Yr Beta - - - - - 0.54 OpInc:Turnover 51.40 56.97 60.67 97.13 96.81

RATIOS

RetOnSH Funds - 11.70 13.84 9.73 29.88 0.25 Safari Investments RSA Ltd.

RetOnTotAss - 6.75 11.59 15.81 25.36 8.56

SAF

Debt:Equity 0.12 0.13 0.07 0.08 0.10 ISIN: ZAE000188280 SHORT: SAFARI CODE: SAR

OperRetOnInv - 8.01 11.84 17.66 58.56 8.69 REG NO: 2000/015002/06 FOUNDED: 2000 LISTED: 2014

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 NATUREOF BUSINESS:Safariisaproperty investmentcompanylistedon

the JSE as a Real Estate Investment Trust (“REIT”). Through selective

investments in property Safari creates value for their stakeholders as they

SA Corporate Real Estate Ltd. strive for sustainable growth and earnings.

SAC SECTOR: Fins—Rest—Inv—Ret

ISIN: ZAE000203238 SHORT: SA CORP CODE: SAC NUMBER OF EMPLOYEES: 0

REG NO: 2015/015578/06 FOUNDED: 1995 LISTED: 1995 DIRECTORS: HeronGJ(ind ne), Matshoba-Ramuedzisi T (ind ne),

NATURE OF BUSINESS: SA Corp is one of the oldest established property Minnaar Dr M (ind ne), Muller M (ind ne), PienaarPA(ind ne),

companies in the South African market. It is a JSE-listed Real Estate Swanepoel E (ind ne), WentzelAE(ld ind ne), Engelbrecht D C (CEO),

Investment Trust (“REIT”) which owns, through its subsidiary companies, a Venter W L (FD)

diversified property portfolio of 193 (2018: 200) properties in the industrial, MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

retail, commercial and residential sectors, located primarily in the major Southern Palace Capital (Pty) Ltd. 17.05%

metropolitan areas of South Africa with a secondary node in Zambia Nedbank Group 10.00%

comprisingthreepropertiesintheretailandcommercialsectors,inwhichthe Heriot Investments (Pty) Ltd. 9.43%

Company holds a 50% interest through a joint venture arrangement. POSTAL ADDRESS: 420 Friesland Lane, Lynnwood, Pretoria, 0081

SECTOR: Fins—Rest—Inv—Div MORE INFO: www.sharedata.co.za/sdo/jse/SAR

NUMBER OF EMPLOYEES: 189 COMPANY SECRETARY: Pieter van Niekerk

DIRECTORS: Biesman-SimonsRJ(ind ne), Ford-Hoon N (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Hendricks E (ind ne), HeronGJ(ind ne), MosetlhiOR(ld ind ne),

210