Page 191 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 191

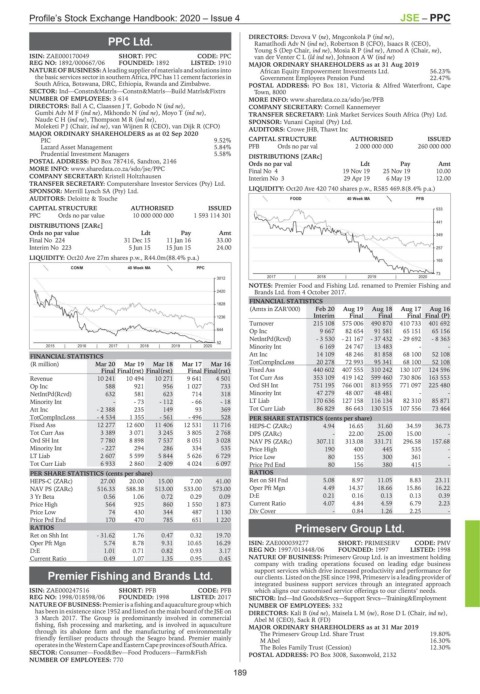

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – PPC

DIRECTORS: Dzvova V (ne), Mngconkola P (ind ne),

PPC Ltd. Ramatlhodi Adv N (ind ne), Robertson B (CFO), Isaacs R (CEO),

Young S (Dep Chair, ind ne), MosiaRP(ind ne), Amod A (Chair, ne),

PPC

ISIN: ZAE000170049 SHORT: PPC CODE: PPC van der VenterCL(ld ind ne), JohnsonAW(ind ne)

REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019

NATUREOF BUSINESS:Aleading supplier of materialsandsolutionsinto African Equity Empowerment Investments Ltd. 56.23%

the basic services sector in southern Africa, PPC has 11 cement factories in Government Employees Pension Fund 22.47%

South Africa, Botswana, DRC, Ethiopia, Rwanda and Zimbabwe. POSTAL ADDRESS: PO Box 181, Victoria & Alfred Waterfront, Cape

SECTOR: Ind—Constn&Matrls—Constn&Matrls—Build Matrls&Fixtrs Town, 8000

NUMBER OF EMPLOYEES: 3 614 MORE INFO: www.sharedata.co.za/sdo/jse/PFB

DIRECTORS: Ball A C, Claassen J T, Gobodo N (ind ne), COMPANY SECRETARY: Cornell Kannemeyer

Gumbi AdvMF(ind ne), Mkhondo N (ind ne), Moyo T (ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

NaudeCH(ind ne), ThompsonMR(ind ne), SPONSOR: Vunani Capital (Pty) Ltd.

Moleketi P J (Chair, ind ne), van Wijnen R (CEO), van Dijk R (CFO) AUDITORS: Crowe JHB, Thawt Inc

MAJOR ORDINARY SHAREHOLDERS as at 02 Sep 2020

PIC 9.52% CAPITAL STRUCTURE AUTHORISED ISSUED

Lazard Asset Management 5.84% PFB Ords no par val 2 000 000 000 260 000 000

Prudential Investment Managers 5.58% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 787416, Sandton, 2146 Ords no par val Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/PPC Final No 4 19 Nov 19 25 Nov 19 10.00

COMPANY SECRETARY: Kristell Holtzhausen Interim No 3 29 Apr 19 6 May 19 12.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Merrill Lynch SA (Pty) Ltd. LIQUIDITY: Oct20 Ave 420 740 shares p.w., R585 469.8(8.4% p.a.)

AUDITORS: Deloitte & Touche FOOD 40 Week MA PFB

CAPITAL STRUCTURE AUTHORISED ISSUED 533

PPC Ords no par value 10 000 000 000 1 593 114 301

441

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 349

Final No 224 31 Dec 15 11 Jan 16 33.00

Interim No 223 5 Jun 15 15 Jun 15 24.00 257

LIQUIDITY: Oct20 Ave 27m shares p.w., R44.0m(88.4% p.a.)

165

CONM 40 Week MA PPC

73

3012 2017 | 2018 | 2019 | 2020

NOTES: Premier Food and Fishing Ltd. renamed to Premier Fishing and

2420 Brands Ltd. from 4 October 2017.

FINANCIAL STATISTICS

1828

(Amts in ZAR’000) Feb 20 Aug 19 Aug 18 Aug 17 Aug 16

1236 Interim Final Final Final Final (P)

Turnover 215 108 575 006 490 870 410 733 401 692

644

Op Inc 9 667 82 654 91 581 65 151 65 156

NetIntPd(Rcvd) - 3 530 - 21 167 - 37 432 - 29 692 - 8 363

52

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Minority Int 6 169 24 747 13 483 - -

FINANCIAL STATISTICS Att Inc 14 109 48 246 81 858 68 100 52 108

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 TotCompIncLoss 20 278 72 993 95 341 68 100 52 108

Final Final(rst) Final(rst) Final Final(rst) Fixed Ass 440 602 407 555 310 242 130 107 124 596

Revenue 10 241 10 494 10 271 9 641 4 501 Tot Curr Ass 353 109 419 142 599 460 730 806 163 553

Op Inc 588 921 956 1 027 733 Ord SH Int 751 195 766 001 813 955 771 097 225 480

NetIntPd(Rcvd) 632 581 623 714 318 Minority Int 47 279 48 007 48 481 - -

Minority Int - - 73 - 112 - 66 - 18 LT Liab 170 636 127 158 116 134 82 310 85 871

Att Inc - 2 388 235 149 93 369 Tot Curr Liab 86 829 86 643 130 515 107 556 73 464

TotCompIncLoss - 4 534 1 355 - 561 - 496 528 PER SHARE STATISTICS (cents per share)

Fixed Ass 12 277 12 600 11 406 12 531 11 716 HEPS-C (ZARc) 4.94 16.65 31.60 34.59 36.73

Tot Curr Ass 3 389 3 071 3 245 3 805 2 768 DPS (ZARc) - 22.00 25.00 15.00 -

Ord SH Int 7 780 8 898 7 537 8 051 3 028 NAV PS (ZARc) 307.11 313.08 331.71 296.58 157.68

Minority Int - 227 294 286 334 535 Price High 190 400 445 535 -

LT Liab 2 607 5 599 5 844 5 626 6 729 Price Low 80 155 300 361 -

Tot Curr Liab 6 933 2 860 2 409 4 024 6 097 Price Prd End 80 156 380 415 -

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 27.00 20.00 15.00 7.00 41.00 Ret on SH Fnd 5.08 8.97 11.05 8.83 23.11

NAV PS (ZARc) 516.33 588.38 513.00 533.00 573.00 Oper Pft Mgn 4.49 14.37 18.66 15.86 16.22

3 Yr Beta 0.56 1.06 0.72 0.29 0.09 D:E 0.21 0.16 0.13 0.13 0.39

Price High 564 925 860 1 550 1 873 Current Ratio 4.07 4.84 4.59 6.79 2.23

Price Low 74 430 344 487 1 130 Div Cover - 0.84 1.26 2.25 -

Price Prd End 170 470 785 651 1 220

RATIOS Primeserv Group Ltd.

Ret on Shh Int - 31.62 1.76 0.47 0.32 19.70

PRI

Oper Pft Mgn 5.74 8.78 9.31 10.65 16.29 ISIN: ZAE000039277 SHORT: PRIMESERV CODE: PMV

D:E 1.01 0.71 0.82 0.93 3.17 REG NO: 1997/013448/06 FOUNDED: 1997 LISTED: 1998

Current Ratio 0.49 1.07 1.35 0.95 0.45 NATURE OF BUSINESS: Primeserv Group Ltd. is an investment holding

company with trading operations focused on leading edge business

support services which drive increased productivity and performance for

Premier Fishing and Brands Ltd. our clients. Listed on the JSE since 1998, Primeserv is a leading provider of

integrated business support services through an integrated approach

PRE

ISIN: ZAE000247516 SHORT: PFB CODE: PFB which aligns our customised service offerings to our clients’ needs.

REG NO: 1998/018598/06 FOUNDED: 1998 LISTED: 2017 SECTOR: Ind—Ind Goods&Srvcs—Support Srvcs—Training&Employment

NATURE OF BUSINESS:Premier is a fishing and aquaculture group which NUMBER OF EMPLOYEES: 332

has been in existence since 1952 and listed on the main board of the JSE on DIRECTORS: Kali B (ind ne), MaiselaLM(ne), Rose D L (Chair, ind ne),

3 March 2017. The Group is predominantly involved in commercial Abel M (CEO), Sack R (FD)

fishing, fish processing and marketing, and is involved in aquaculture MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

through its abalone farm and the manufacturing of environmentally The Primeserv Group Ltd. Share Trust 19.80%

friendly fertiliser products through the Seagro brand. Premier mainly M Abel 16.30%

operatesintheWesternCapeandEasternCapeprovincesofSouthAfrica. The Boles Family Trust (Cession) 12.30%

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish POSTAL ADDRESS: PO Box 3008, Saxonwold, 2132

NUMBER OF EMPLOYEES: 770

189