Page 188 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 188

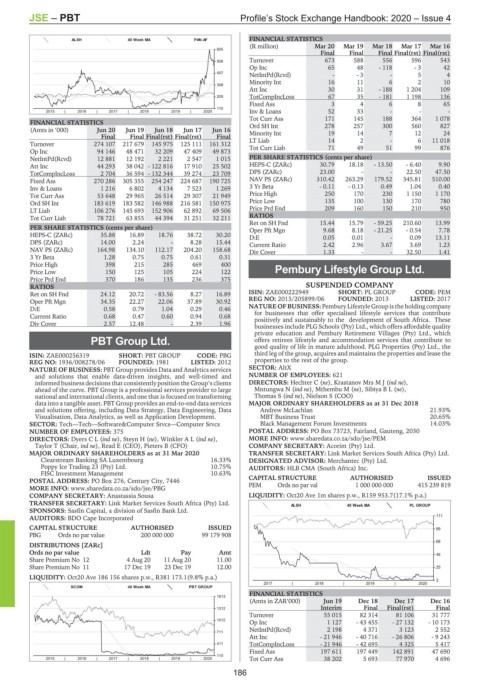

JSE – PBT Profile’s Stock Exchange Handbook: 2020 – Issue 4

ALSH 40 Week MA PAN-AF FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

605

Final Final Final Final(rst) Final(rst)

506 Turnover 673 588 556 596 543

Op Inc 65 48 - 118 - 3 42

407

NetIntPd(Rcvd) - - 3 - 5 4

Minority Int 16 11 6 2 10

308

Att Inc 30 31 - 188 1 204 109

209 TotCompIncLoss 67 35 - 181 1 198 136

Fixed Ass 3 4 6 8 65

110

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Inv & Loans 52 33 - - -

Tot Curr Ass 171 145 188 364 1 078

FINANCIAL STATISTICS Ord SH Int 278 257 300 560 827

(Amts in ‘000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Minority Int 19 14 7 12 24

Final Final Final(rst) Final(rst) Final

Turnover 274 107 217 679 145 975 125 111 161 312 LT Liab 14 49 2 51 - 99 6 11 018

876

71

Tot Curr Liab

Op Inc 94 146 48 471 32 209 47 409 49 873

NetIntPd(Rcvd) 12 881 12 192 2 221 2 547 1 015 PER SHARE STATISTICS (cents per share)

Att Inc 44 293 38 042 - 122 816 17 910 25 502 HEPS-C (ZARc) 30.79 18.18 - 13.50 - 6.40 9.90

TotCompIncLoss 2 704 36 594 - 132 344 39 274 23 709 DPS (ZARc) 23.00 - - 22.50 47.50

Fixed Ass 270 286 305 355 254 247 224 687 190 725 NAV PS (ZARc) 310.42 263.29 179.52 345.81 510.00

Inv & Loans 1 216 6 802 4 134 7 523 1 269 3 Yr Beta - 0.11 - 0.13 0.49 1.04 0.40

Tot Curr Ass 53 648 29 965 26 514 29 307 21 949 Price High 250 170 230 1 150 1 170

Ord SH Int 183 619 183 582 146 988 216 581 150 975 Price Low 135 100 130 170 780

LT Liab 106 276 145 693 152 906 62 892 69 506 Price Prd End 209 160 150 210 950

Tot Curr Liab 78 721 63 855 44 394 31 251 32 211 RATIOS

Ret on SH Fnd 15.44 15.79 - 59.25 210.60 13.99

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 9.68 8.18 - 21.25 - 0.54 7.78

HEPS-C (ZARc) 35.88 16.89 18.76 38.72 30.20 D:E 0.05 0.01 - 0.09 13.11

DPS (ZARc) 14.00 2.24 - 8.28 15.44 Current Ratio 2.42 2.96 3.67 3.69 1.23

NAV PS (ZARc) 164.98 134.10 112.17 204.20 158.68 Div Cover 1.33 - - 32.50 1.41

3 Yr Beta 1.28 0.75 0.75 0.61 0.31

Price High 398 215 285 469 400

Price Low 150 125 105 224 122 Pembury Lifestyle Group Ltd.

Price Prd End 370 186 135 236 375 PEM

RATIOS SUSPENDED COMPANY

Ret on SH Fnd 24.12 20.72 - 83.56 8.27 16.89 ISIN: ZAE000222949 SHORT: PL GROUP CODE: PEM

Oper Pft Mgn 34.35 22.27 22.06 37.89 30.92 REG NO: 2013/205899/06 FOUNDED: 2013 LISTED: 2017

D:E 0.58 0.79 1.04 0.29 0.46 NATURE OF BUSINESS:Pembury Lifestyle Group is the holding company

for businesses that offer specialised lifestyle services that contribute

Current Ratio 0.68 0.47 0.60 0.94 0.68 positively and sustainably to the development of South Africa. These

Div Cover 2.57 12.48 - 2.39 1.96

businesses include PLG Schools (Pty) Ltd., which offers affordable quality

private education and Pembury Retirement Villages (Pty) Ltd., which

PBT Group Ltd. offers retirees lifestyle and accommodation services that contribute to

good quality of life in mature adulthood. PLG Properties (Pty) Ltd., the

PBT

ISIN: ZAE000256319 SHORT: PBT GROUP CODE: PBG third leg of the group, acquires and maintains the properties and lease the

REG NO: 1936/008278/06 FOUNDED: 1981 LISTED: 2012 properties to the rest of the group.

NATURE OF BUSINESS: PBT Group provides Data and Analytics services SECTOR: AltX

and solutions that enable data-driven insights, and well-timed and NUMBER OF EMPLOYEES: 621

informed business decisions that consistently position the Group’s clients DIRECTORS: Hechter C (ne), Krastanov MrsMJ(ind ne),

ahead of the curve. PBT Group is a professional services provider to large Mntungwa N (ind ne), Mthembu M (ne), SibiyaBL(ne),

national and international clients, and one that is focused on transforming Thomas S (ind ne), Nielson S (COO)

data into a tangible asset. PBT Group provides an end-to-end data services MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

and solutions offering, including Data Strategy, Data Engineering, Data Andrew McLachlan 21.93%

Visualisation, Data Analytics, as well as Application Development. MBT Business Trust 20.65%

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs Black Management Forum Investments 14.03%

NUMBER OF EMPLOYEES: 375 POSTAL ADDRESS: PO Box 73723, Fairland, Gauteng, 2030

DIRECTORS: DyersCL(ind ne), Steyn H (ne), WinklerAL(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/PEM

Taylor T (Chair, ind ne), Read E (CEO), Pieters B (CFO) COMPANY SECRETARY: Acorim (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Clearstream Banking SA Luxembourg 16.33% DESIGNATED ADVISOR: Merchantec (Pty) Ltd.

Poppy Ice Trading 23 (Pty) Ltd. 10.75% AUDITORS: HLB CMA (South Africa) Inc.

FISC Investment Management 10.63%

POSTAL ADDRESS: PO Box 276, Century City, 7446 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/PBG PEM Ords no par val 1 000 000 000 415 239 819

COMPANY SECRETARY: Anastassia Sousa LIQUIDITY: Oct20 Ave 1m shares p.w., R159 953.7(17.1% p.a.)

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

ALSH 40 Week MA PL GROUP

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

111

AUDITORS: BDO Cape Incorporated

CAPITAL STRUCTURE AUTHORISED ISSUED 89

PBG Ords no par value 200 000 000 99 179 908

68

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 46

Share Premium No 12 4 Aug 20 11 Aug 20 11.00

Share Premium No 11 17 Dec 19 23 Dec 19 12.00 25

LIQUIDITY: Oct20 Ave 186 156 shares p.w., R381 173.1(9.8% p.a.)

3

2017 | 2018 | 2019 | 2020

SCOM 40 Week MA PBT GROUP

FINANCIAL STATISTICS

1613

(Amts in ZAR’000) Jun 19 Dec 18 Dec 17 Dec 16

1312 Interim Final Final(rst) Final

Turnover 55 015 82 314 81 106 31 777

1012

Op Inc 1 127 - 43 455 - 27 132 - 10 173

NetIntPd(Rcvd) 2 198 4 371 3 123 2 552

711

Att Inc - 21 946 - 40 716 - 26 806 - 9 243

411 TotCompIncLoss - 21 946 - 42 695 4 325 5 417

Fixed Ass 197 611 197 449 142 891 47 690

110

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Tot Curr Ass 38 202 5 693 77 970 4 696

186