Page 180 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 180

JSE – NIC Profile’s Stock Exchange Handbook: 2020 – Issue 4

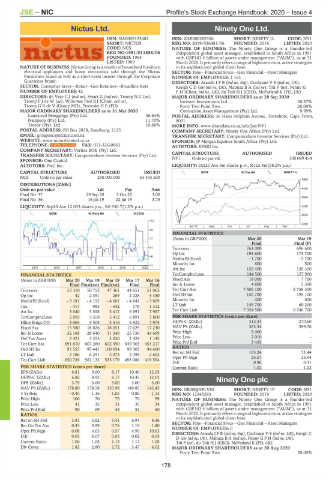

Nictus Ltd. Ninety One Ltd.

NIC NIN

ISIN: NA0009123481 ISIN: ZAE000282356 SHORT: NINETY 1L CODE: NY1

SHORT: NICTUS REG NO: 2019/526481/06 FOUNDED: 2019 LISTED: 2020

CODE: NCS NATURE OF BUSINESS: The Ninety One Group is a founder-led

REG NO:1981/011858/06 independent global asset manager, established in South Africa in 1991

FOUNDED: 1964 with GBP103.4 billion of assets under management (“AUM”), as at 31

LISTED: 1969 March 2020. It primarily offers a range of highconviction, active strategies

NATURE OF BUSINESS: Nictus Group is a retailer of household furniture, to its sophisticated global client base.

electrical appliances and home electronics sold through the Nictus SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

Furnishers brand as well as a short-term insurer through the Corporate NUMBER OF EMPLOYEES: 1 165

Guarantee brand. DIRECTORS: ArandaIFB(ind ne, Esp), CochraneVS(ind ne, UK),

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets KeoghCD(snr ind ne, UK), MabuzaBA(ind ne), Titi F (ne), Penny G

NUMBER OF EMPLOYEES: 42 P H (Chair, ind ne, UK), du Toit H J (CEO), McFarland K (FD, UK)

DIRECTORS: de VryeCJ(ind ne), Swart G (ind ne), TrompNC(ne), MAJOR ORDINARY SHAREHOLDERS as at 28 Sep 2020

TrompPJdeW(ne), Willemse Prof B J (Chair, ind ne), Investec Investments Ltd. 26.87%

TrompGRdeV (Group MD), Prozesky H E (FD) Forty Two Point Two 20.00%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 Coronation Asset Management (Pty) Ltd. 9.99%

Landswyd Beleggings (Pty) Ltd. 46.64% POSTAL ADDRESS: 36 Hans Strijdom Avenue, Foreshore, Cape Town,

Namprop (Pty) Ltd. 11.70% 8001

Trocor (Pty) Ltd. 10.66% MORE INFO: www.sharedata.co.za/sdo/jse/NY1

POSTAL ADDRESS: PO Box 2878, Randburg, 2125 COMPANY SECRETARY: Ninety One Africa (Pty) Ltd.

EMAIL: groupsec@nictus.com.na TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WEBSITE: www.nictuslimited.co.za SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

TELEPHONE: 011-787-9019 FAX: 011-326-0863 AUDITORS: KPMG Inc.

COMPANY SECRETARY: Veritas BOE (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: One Capital NY1 Ords no par val. - 300 089 454

AUDITORS: PwC Inc. LIQUIDITY: Oct20 Ave 3m shares p.w., R123.4m(58.2% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED GENF 80 Day MA NINETY 1L

NCS Ords no par value 250 000 000 53 443 500

4900

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 4420

Final No 37 29 Sep 20 5 Oct 20 3.00

Final No 36 16 Jul 19 22 Jul 19 3.75 3940

LIQUIDITY: Sep20 Ave 12 035 shares p.w., R6 930.7(1.2% p.a.) 3459

GERE 40 Week MA NICTUS

2979

107

2499

| Apr 20 | May | Jun | Jul | Aug | Sep |

92

FINANCIAL STATISTICS

77 (Amts in GBP’000) Mar 20 Mar 19

Final Final (P)

61 Turnover 761 000 696 600

Op Inc 194 600 173 700

46

NetIntPd(Rcvd) - 1 700 - 5 700

Minority Int 600 500

31

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Att Inc 155 400 139 300

FINANCIAL STATISTICS TotCompIncLoss 144 500 127 900

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 Fixed Ass 18 000 7 700

Final Final(rst) Final(rst) Final Final Inv & Loans 4 800 5 300

Turnover 53 310 50 752 47 361 44 651 51 062 Tot Curr Ass 7 506 100 8 758 300

Op Inc 42 2 351 269 2 228 5 430 Ord SH Int 150 700 195 100

NetIntPd(Rcvd) - 3 181 - 4 192 - 4 601 - 4 841 - 3 869 Minority Int 400 600

Tax - 417 985 - 542 178 1 312 LT Liab 145 700 60 200

Att Inc 3 640 5 558 5 412 6 891 7 987 Tot Curr Liab 7 354 500 8 546 700

TotCompIncLoss 2 095 5 558 5 412 6 891 7 800 PER SHARE STATISTICS (cents per share)

Hline Erngs-CO 3 664 5 508 5 416 6 922 7 974 HEPS-C (ZARc) 315.34 270.60

Fixed Ass 15 580 18 026 18 051 17 629 17 230 NAV PS (ZARc) 363.34 399.76

Inv & Loans 32 168 28 640 11 340 25 730 44 609 Price High 5 000 -

Def Tax Asset 2 421 3 253 3 020 1 424 1 145 Price Low 2 010 -

Tot Curr Ass 691 610 607 260 602 390 549 903 453 217 Price Prd End 3 435 -

Ord SH Int 95 555 95 441 100 054 99 303 94 400 RATIOS

LT Liab 3 186 6 291 5 073 2 398 2 602 Ret on SH Fnd 103.24 71.44

24.94

25.57

Oper Pft Mgn

Tot Curr Liab 650 739 561 133 535 179 493 086 419 554

D:E 0.96 0.31

PER SHARE STATISTICS (cents per share) Current Ratio 1.02 1.02

EPS (ZARc) 6.81 9.00 8.17 10.40 12.05

HEPS-C (ZARc) 6.86 8.92 8.17 10.45 12.03 Ninety One plc

DPS (ZARc) 3.75 3.00 3.00 3.00 3.00

NIN

NAV PS (ZARc) 178.80 178.58 150.98 149.85 142.45 ISIN: GB00BJHPLV88 SHORT: NINETY 1P CODE: N91

3 Yr Beta - 0.45 1.16 - 1.05 - 0.86 - 1.13 REG NO: 12245293 FOUNDED: 2019 LISTED: 2020

Price High 100 70 75 70 99 NATURE OF BUSINESS: The Ninety One Group is a founder-led

Price Low 41 35 31 35 34 independent global asset manager, established in South Africa in 1991

Price Prd End 90 69 45 52 60 with GBP103.4 billion of assets under management (“AUM”), as at 31

March 2020. It primarily offers a range of highconviction, active strategies

RATIOS

to its sophisticated global client base.

Ret on SH Fnd 3.81 5.82 5.41 6.94 8.46 SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

Ret On Tot Ass 0.43 0.99 0.76 1.19 1.80

Oper Pft Mgn 0.08 4.63 0.57 4.99 10.63 NUMBER OF EMPLOYEES: 0

DIRECTORS: Aranda I F B (ind ne, Esp), Cochrane V S (ind ne, UK), Keogh C

D:E 0.03 0.07 0.05 0.02 0.03 D(snr ind ne, UK), Mabuza B A (ind ne), Penny G P H (ind ne, UK),

Current Ratio 1.06 1.08 1.13 1.12 1.08 Titi F (ne), du Toit H J (CEO), McFarland K (FD, UK)

Div Cover 1.82 2.80 2.72 3.47 4.02 MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2020

Forty Two Point Two 20.00%

178