Page 179 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 179

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – NEW

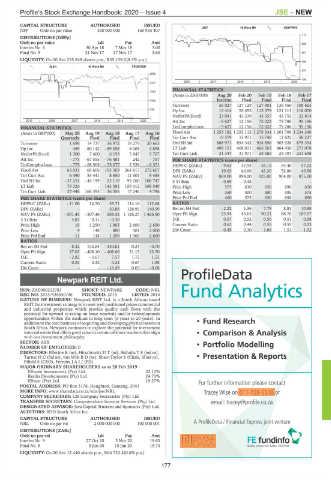

CAPITAL STRUCTURE AUTHORISED ISSUED

NFP Ords no par value 300 000 000 160 935 407 J867 40 Week MA NEWPARK

714

DISTRIBUTIONS [GBPp]

Ords no par value Ldt Pay Amt 608

Interim No 6 30 Apr 18 7 May 18 3.00

Final No 5 21 Nov 17 27 Nov 17 3.60 501

LIQUIDITY: Oct20 Ave 255 848 shares p.w., R35 139.2(8.3% p.a.)

394

ALSH 40 Week MA FRONTIER

287

2650

180

2016 | 2017 | 2018 | 2019 | 2020

2121

FINANCIAL STATISTICS

1593

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

1064 Interim Final Final Final Final

Turnover 56 027 127 129 127 901 136 450 109 663

536

Op Inc 13 414 55 495 115 379 121 113 118 070

NetIntPd(Rcvd) 23 041 43 339 43 357 43 755 22 874

7

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Att Inc - 9 627 12 156 72 022 79 786 95 196

FINANCIAL STATISTICS TotCompIncLoss - 9 627 12 156 72 022 79 786 95 196

(Amts in GBP’000) May 20 Aug 19 Aug 18 Aug 17 Aug 16 Fixed Ass 1 253 182 1 253 112 1 278 334 1 261 766 1 234 246

Quarterly Final Final Final Final Tot Curr Ass 19 579 13 971 15 748 12 822 58 227

Turnover 1 698 14 737 16 972 19 279 20 663 Ord SH Int 868 971 894 342 924 856 903 928 875 354

Op Inc 459 - 60 142 - 69 358 6 005 4 898 LT Liab 498 151 468 011 466 563 464 450 273 078

NetIntPd(Rcvd) 1 300 7 400 6 193 5 847 5 707 Tot Curr Liab 31 347 31 971 28 682 23 397 251 648

Att Inc - 775 - 67 555 - 76 481 242 - 757 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 775 - 68 508 - 75 077 2 526 - 6 371 HEPS-C (ZARc) - 9.63 37.93 55.12 54.40 57.22

Fixed Ass 63 031 68 606 193 303 264 817 272 607 DPS (ZARc) 19.63 40.06 43.30 52.80 49.56

Tot Curr Ass 6 490 53 441 8 650 11 601 9 485 NAV PS (ZARc) 869.00 894.00 925.00 904.00 875.00

Ord SH Int - 37 251 - 44 199 23 119 99 760 108 747 3 Yr Beta - 0.59 - 0.48 - - -

LT Liab 79 324 - 143 581 159 412 168 549 Price High 575 630 650 690 650

Tot Curr Liab 27 448 166 395 36 356 17 246 4 796 Price Low 350 400 500 595 575

PER SHARE STATISTICS (cents per share) Price Prd End 400 575 630 650 650

HEPS-C (ZARc) - 11.00 14.70 55.71 114.16 112.68 RATIOS

DPS (ZARc) - - 50.88 128.95 140.99 Ret on SH Fnd - 2.22 1.36 7.79 8.83 10.88

NAV PS (ZARc) - 501.43 - 507.46 268.52 1 126.27 1 426.50 Oper Pft Mgn 23.94 43.65 90.21 88.76 107.67

3 Yr Beta 4.87 0.11 - 0.30 - - D:E 0.57 0.52 0.50 0.51 0.58

Price High 19 1 250 1 905 2 600 2 650 Current Ratio 0.62 0.44 0.55 0.55 0.23

Price Low 4 148 800 501 2 000 Div Cover - 0.49 0.30 1.66 1.51 1.92

Price Prd End 11 148 1 250 1 900 2 600

RATIOS

Ret on SH Fnd 8.32 152.84 - 330.81 0.24 - 0.70

Oper Pft Mgn 27.03 - 408.10 - 408.66 31.15 23.70

D:E - 2.82 - 3.67 7.57 1.72 1.55

Current Ratio 0.24 0.32 0.24 0.67 1.98

Div Cover - - - 16.49 0.03 - 0.08

Newpark REIT Ltd.

NEW

ISIN: ZAE000212783 SHORT: NEWPARK CODE: NRL

REG NO: 2015/436550/06 FOUNDED: 2015 LISTED: 2016

NATURE OF BUSINESS: Newpark REIT Ltd. is a South African based

REIT. Its investment strategy is to seek well positioned prime commercial

and industrial properties which provide quality cash flows with the

potential for upward re-rating on lease renewals and/or redevelopment

opportunities within the medium to long term (5 years to 20 years). In Fund Research

addition to the core business of acquiring and developing physical assets in

South Africa, Newpark continues to explore the potential for investment

into real estate that offers good value in certain offshore markets that align Comparison & Analysis

with our investment philosophy.

SECTOR: AltX Portfolio Modelling

NUMBER OF EMPLOYEES: 0

DIRECTORS: Ellerine K (ne), HirschowitzDT(ne), SishubaTS(ind ne),

TurnerHC(ind ne), van WykBD(ne), Shaw-Taylor S (Chair, ld ind ne), Presentation & Reports

Fifield S (CEO), FerreiraJAI( (FD)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Ellwain Investments (Pty) Ltd. 32.12%

Renlia Developments (Pty) Ltd. 24.73%

Ellvest (Pty) Ltd. 19.27%

POSTAL ADDRESS: PO Box 3178, Houghton, Gauteng, 2041 For further information please contact

MORE INFO: www.sharedata.co.za/sdo/jse/NRL Tracey Wise on 011-728-5510 or

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. email: tracey@profile.co.za

DESIGNATED ADVISOR: Java Capital Trustees and Sponsors (Pty) Ltd.

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

NRL Ords no par val 2 000 000 000 100 000 001 A ProfileData / Financial Express joint venture

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Interim No 9 27 Oct 20 2 Nov 20 19.63

Final No 8 9 Jun 20 15 Jun 20 15.74

LIQUIDITY: Oct20 Ave 12 440 shares p.w., R64 722.4(0.6% p.a.)

177